Thursday, February 25, 2010

Financial conditions -- another V-shaped recovery

I'm getting a lot of pushback of late for my unrelenting optimism in the face of some disappointing market stats and economic releases. So I thought it appropriate to review at least some of my reasons for thinking that things are indeed getting better despite the occasional setback.

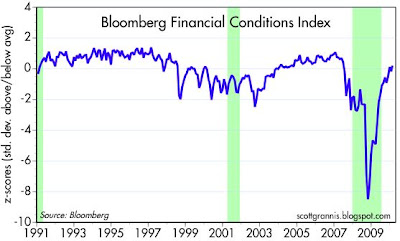

I last commented on this chart in early December. It's Bloomberg's index of financial conditions, a composite of key financial fundamentals such as credit spreads, implied volatility, interest rates, and P/E ratios. The y-axis of the chart is measured in z-scores: the number of standard deviations above and below the average of the 1992-June 2008 period.

The peak of the financial crisis in late 2008 was literally off the charts from an historical perspective, shown here as a 9 standard deviation event (the actual low for the index was -12.6, which occurred on Oct. 10 '08). This was a market that for all intents and purposes was priced to Armageddon: a deep depression accompanied by paralyzing deflation and lasting for years. In just over a year we now find ourselves back to something that resembles normalcy, and more than 9 months into a recovery.

What a difference a year makes! It's hard to underestimate the importance of this: the reality we are living today far surpasses even the most optimistic forecasts of a year ago.

Notwithstanding the power struggles in Washington which seem to have left us in legislative limbo (thank goodness for the respite), financial markets have undergone a significant healing process in the past year, and we have seen plenty of signs of recovery, this chart being an important one.

Meanwhile, I don't see any of the typical signs that presage economic downturns. Swap spreads have been trading at "normal" levels for months now, and credit spreads are significantly tighter and much more stable than they were a year ago. Very tight monetary policy has been the leading cause of every post-war recession, but we certainly don't have that problem today. All of the key measures of monetary conditions suggest monetary policy is accommodative: the yield curve is very steep, real yields are relatively low, the dollar is relatively weak, and gold prices are up hugely. If anything goes wrong in the near future, it will not be for a lack of money.

Fiscal policy has been turbulent this past year, but we have yet to see policies, such as a significant increase in tax burdens, a serious outbreak of trade wars, or a major increase in regulatory burdens, that have in the past contributed to a meaningful economic slowdown. There are of course concerns in all these areas, but if anything, the likelihood of a nasty turn in fiscal policy has decreased over the past year, thanks to very visible and growing opposition to the direction Obama has been trying to take us. Why else would Obama take such pains to emphasize that he is "an ardent believer in the free market?"

I have an enduring belief that when left largely alone and fed a diet of financial normalcy, the U.S. economy is quite capable of growing, even in the face of fiscal adversity.

As the chart above shows, financial markets have healed. Asset markets have healed as well, with home prices stabilizing and commodity prices recapturing much of their 2008 losses. We've got tens of millions of entrepreneurs out there, all of whom want to make more money than they made last year. We've got 130 million people working 5% more productively in the nine months ended last December. Corporate profits after tax likely rose over 20% last year. Business investment is up at a 15% since last April. U.S. corporations raised over $450 billion by selling new bonds in the past 12 months. The ISM manufacturing index has surged to levels that are fully consistent with 4+% growth. The stock market is up over 60% from its recent lows. Homebuilders' stocks are up fully 126% from their March lows, even though residential construction has collapsed to a mere 2.5% of GDP. Exports have jumped at a 27% annual rate since last April. Despite the Fed's massive liquidity injections, the dollar today is worth almost the same, relative to other major currencies, as in mid-2007, before the recent crisis was on anyone's radar screen.

The list of positives could go on, but suffice it to say that to be pessimistic today you have to ignore an awful lot of good news.

Subscribe to:

Post Comments (Atom)

10 comments:

From your lips to God's ears.

Scott,

On Monday, Medicare cuts reimbursements by 21%. How do you think that is going to impact the revenues and financial ability of our many highly leveraged hospitals to operate?

Do you think this will have a material impact on the economy as health care is about 20% of GDP.

It remains to be seen whether Congress will allow this cut to take effect. I doubt it will.

Scott,

You are probably right. The have done it before.... and spending and spending more has never been a problem for Congress...even if it was with money the never had or ever likely to see.

I guess the path to inflation is the destiny of our nation.

The credit machine is not functioning and for self-sustained economic growth, a rebound of bank loans is necessary.

Watch loans and leases in credit banks - awful !!!

Watch the housing market - awful !

Watch the labour market - awful.

Housing market is supported by HAMP, $8k First Buyer Tax..., job market supported by "taxpayers" jobs - a lot of government jobs, temporary help service, extended local job programs...

Sorry-but thats not US as we know before - it´s socialism !

The banks about 65% of the way recognizing their cumulative losses

in this great deleveraging....(cumulative losses being from 2007

to 2012). Plus the tangible common equity is now twice what it was at the end of 2008.

i admire your unflagging optimism. but i think it is nevertheless blinkered. you don't discount enough the fact that many of the positives are the result of "command" policies. it is unknow if in fact these will work in the long run.

I do not believe that the government can "command" growth through income redistribution policies such as have been used this past year. I don't see any contribution to growth from last year's stimulus, most of which has yet to be spent and most of which was "spent" on transfer payments. I continue to believe that the economy is growing in spite of, not because of, government policies.

Some pretty smart guys have launched a critique of the Bloomberg FCI and replaced it with their own, which they believe shows some significant "drag" for 2010.. Enjoy

http://research.chicagobooth.edu/igm/events/docs/2010usmpfreport.pdf

Lantern: Thanks for pointing this out.

Post a Comment