Thursday, February 18, 2010

The Fed is behind the tightening curve

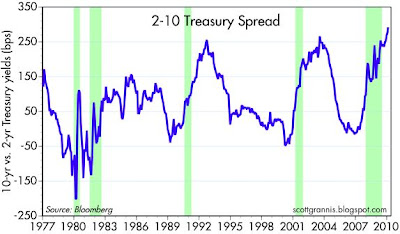

These two charts focus on the yield on 2- and 10-year Treasury yields from 1977 through today. The top chart shows the yields, while the bottom chart shows the difference in the yields, which is a measure of the steepness of the yield curve. If you compare the two charts, you will see that a steep yield curve generally corresponds to periods in which short-term rates are low, and that in turn is generally a sign of easy monetary policy. Steep curves typically flatten as short-term rates rise relative to, and more than, long-term rates. When the yield curve is inverted, short-term rates are higher than long-term rates; this is generally caused by very tight monetary policy, and this is what has preceded every post-war recession.

Today the yield curve is steeper than at any other time in history. This is the bond market's way of saying that short-term rates are exceedingly low, so low that they will have to rise by a LOT in coming years. The Fed has been keeping rates artificially low for quite some time now, and they will have to correct for this by raising rates by a lot in the future. The only thing we don't know is when they will begin raising rates.

This last chart shows the market's current expectations of what the Treasury curve will look like 1, 2, and 5 years from now. The bottom line is the current Treasury yield curve. I note that the market expects all Treasury yields to be significantly higher in 5 years than they are now. Note also that the market expects the curve to be slightly inverted 5 years from now, which further suggests that there is very little risk of recession for the next 5 years.

Subscribe to:

Post Comments (Atom)

4 comments:

The yield curve may also reflect another reality: Tons of investment capital waiting for a home, and parked short-term in T-bills, the non-brainer default option.

I contend a global glut of capital is behind the long-term decline in interest rates, and will be with us for generations Savings rates in Asia and Europe are high, and huge pools of capital are formed in the US through mutual funds, money funds, insurance companies, private equity etc.

Passive investing--and passive is the current word, as it can be done online with a push of a button--will necessarily show disappointing yields from now on. Too much capital chasing too few deals. The safe option--T-bill and notes--will yield close to nothing.

On the other hands, lots of capital is good for the economy. No worthy start-up idea will go unfunded--plenty of VC money out there--and operating businesses should be able to get capital for growth, once this down cycle plays out.

For passive investors, I suggest the relatively "insincere" technique of "pre-herd" investing. Capital will pour, fad-like, into any sector that promises returns. Typically, this will result in over-investment, and bust. Get there first, and get out first.

Investing on the fundamentals? Well, I wish I could say yes. But the Dow in still stuck below 1999 levels, and could be for another few years. Remember, the Dow hit 1,000 in 1967 and then again in 1982--a 15 year wait.

That suggests there are long periods in which fundamental investing is essentially a wash--unless you think you can outpick the market.

But get used to low interest artes for the rest of our lives. Even negative, after inflation. Every bear market in equities should be attended to by sub-zero interest rates, as investors take flight to safety.

Real estate may fare well in a low interest rate environment.

The yield curve may be reflecting even another reality, the amount of supply seen coming into the market causes prices to fall and yields to rise...a simple supply/demand story.

That's why regardless of what happens, we will see another recession in short order.

If the Fed raises rates, interest rates in the 10 and 30 yrs will skyrocket and upend the housing market as well as curtail business investment = Recession

If the Fed keeps rates low, we may have inflation on the horizon, but companies won't be able to pass the costs to consumers without taking a hit to their profits...Stagflation.

Every way you look at it, it points to a recession/stagnation in my view.

Every time people think that the economy is going to recover, interest rates will rise to the point where they choke the recovery...why? because we have so much supply out there that if people began selling rates would spike.

Rodrigo: if it were a simple supply-demand story, why is the price of risk extremely high (zero yields on T-bills) but the price of corporate debt historically low (credit spreads are still very wide)? Why are equity prices unchanged since 1988 despite a doubling of after-tax profits since then? Why is the VIX still relatively high?

I think there is a lot more to the story than just supply and demand.

As for interest rates: the market absolutely knows that the Fed is going to raise rates. The market is already priced for a huge increase in interest rates over the next 5 years. Mortgage rates are still very close to all-time lows; they have plenty of room to rise before they kill the housing market.

One more thing to consider: households have more floating rate assets (e.g., bank CDs) than floating rate debt, so higher interest rates are a net positive for the household sector.

I'm looking at the cost of corporate debt through LQD and that tells me that it is back to where it was in 2006.

While it is still below corporate bond values in 2003. I think it signifies a much better growth profile.

---"Why are equity prices unchanged since 1988 despite a doubling of after-tax profits since then?"---- Not sure I get this, but the value of the S&P 500 was at 277 in 1988 and reached a high 1552 in 2000. Lots of demand for investments from the private sector (in the 90s) as the credit binge started to get going.

"--- Why is the VIX still relatively high?"--- as far as this is concerned, I admit that the Vix is still relatively high when compared to the 2003-2006 cyclical bull, but when looked at in the context since 1987, it's actually in the bottom quartile"

I agree with Benjamin. I think interest rates are going to be low for a while to come. The weak consumer won't be able to pay for price hikes from companies and they will get margins squeezed.

While it may be a period of higher profits and healthier margins for companies due to decreased labor costs (they make up the bulk of the costs), there won't be any growth for a while. Companies will employ as little labor as possible (high productivity) and will be lean for years. The consumer doesn't have spending power like before. It won't be the growth that we saw in the past, it be pretty stagnant for some time to come.

Don't look now, but home prices are beginning to double dip.

Post a Comment