Thursday, November 12, 2009

Federal budget update

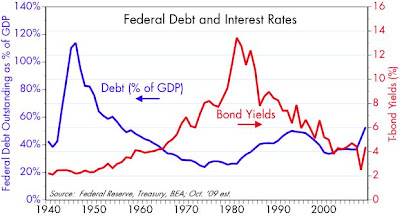

October budget data released today show a modest improvement in federal government finances, thanks mainly to the fact that spending in October of this year was about $90 billion less than it was in October of last year, when the frenetic bailouts and TARP legislation were launched. Still, spending growth is likely to continue to outpace revenue growth, with the result that the federal debt will continue to rise in relation to the economy. As this next chart shows, there does not appear to be any solid relationship between debt outstanding and long-term Treasury yields. Indeed, the relationship appears for the most part to be counter intuitive, with bond yields moving inversely to the size of the debt. Within reasonable limits (which we are still within), there is no reason for large deficits to impact interest rates, mainly because the latter are driven by inflation. Inflation, in turn, is ultimately controlled by the Fed, whose purchases this past year of $1 trillion or so of Treasuries and MBS threatens to push inflation higher in coming years.

Subscribe to:

Post Comments (Atom)

8 comments:

Mr. Grannis:

The divergence of revenue and expenditures seems to be answered by State and Local Governments by merely raising taxes. The Fed’s are hinting at or trying to enact higher taxes (VAT, Socialized Medicine, Cap and Trade, expiration of Bush across the board tax cuts, etc. etc.).

The reduction of the Size and Scope of Government appears completely off the table.

If memory serves me, State, Local, and Federal Taxes increased during the Great Depression which depressed consumption and depressed Private Capital Formation which is a major driver of long term Private Sector job creation.

This sure looks like a replay of a major error of the Great Depression that keep the economy in a constant recession with high unemployment.

You've discovered the reason the market tanked in early March. People saw all the parallels to the Great Depression, and then some. My optimism is based on my belief that the country is not ready to go down the path to ever-greater government control of the economy.

Or are the taxation trends mentioned above contributing to high and persistent unemployment. Making unemployment as a Lagging Indicator false this time around. That unemployment as a Lagging Indicator becomes a statistical outlier this time around.

That as the economy anemically rebounds, unemployment doesn’t fall 18 months after the recover begins. In other words, unemployment didn’t function as Lagging Indicator during the Great Depression. Rather, unemployment during the Depression was an indicator of taxation being out of equilibrium as depicted in the Laffer Curve.

Maybe this can be solved now that the President has found the root of the problem:

"As I’ve said from the start of this crisis, hiring often takes time to catch up to economic growth. And given the magnitude of the economic turmoil that we’ve experienced, employers are reluctant to hire.

Small businesses and large firms are demanding more of their employees, they're increasing their hours, and adding temporary workers — but these companies have not yet been willing to take the steps necessary to hire again."

Next up: Speaker Pelosi proposing prison sentences for employers not willing to do their part in solving the unemployment crisis...

Scott,

I have an amazing chart looking at the 2 and 10 year spread vs budget balance as a percent of GDP. It shows a very strong correlation. How do I post that

Scott,

check out this graph

http://swapsandflops.blogspot.com/

Thanks

The budget deficit is driven in large part by the business cycle, and the shape of the yield curve tends to lead the business cycle, so it is not surprising that the deficit tracks the yield curve. But I'm not sure that is an argument for a far steeper curve than we have now.

The inflection point in the chart, where interest rates begin to decline seems to coincide with the Reagan era that included lowering marginal tax rates, reducing regulation and stabilizing the dollar. The pathway to those high interest rates whas the opposite approach . High Taxes, strangulation regulation and an inflationary dollar.Think Nixon and Carter

We are beginning to see both our past and future with this crowd of economic geniuses in Washington.

Post a Comment