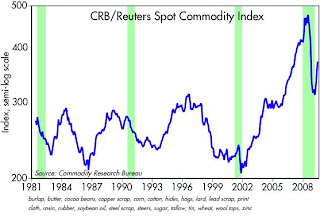

This measure of spot commodity prices is up 25% from the lows of last December. I still see lots of people downplaying the significance of rising commodity prices, arguing that China and India are mindlessly stockpiling the stuff, and speculators are driving prices higher, so higher prices don't really reflect any improvement in the global economy. Well, take a look at the fine print at the bottom of this chart, which details the 22 different commodities that comprise this index. Do you really think the Chinese and the world's speculators are stockpiling butter, cocoa, corn, soybean oil, sugar, and tallow? I don't think so. I think this index is sending two big messages: 1) the global economy is rebounding strongly after last year's collapse, and 2) monetary policy is overly accommodative, as it is helping to fuel the rebound.

This measure of spot commodity prices is up 25% from the lows of last December. I still see lots of people downplaying the significance of rising commodity prices, arguing that China and India are mindlessly stockpiling the stuff, and speculators are driving prices higher, so higher prices don't really reflect any improvement in the global economy. Well, take a look at the fine print at the bottom of this chart, which details the 22 different commodities that comprise this index. Do you really think the Chinese and the world's speculators are stockpiling butter, cocoa, corn, soybean oil, sugar, and tallow? I don't think so. I think this index is sending two big messages: 1) the global economy is rebounding strongly after last year's collapse, and 2) monetary policy is overly accommodative, as it is helping to fuel the rebound.Keep your eye on commodity prices. They trade in real-time, and they consolidate all the production and consumption decisions of the billions of people in the world. You couldn't ask for a better coincident indicator of what's going on out there. This is undeniably good news. The doomsayers are watching the wrong stuff. Yes, mortgage defaults are going to be rising, and yes, commercial defaults are going to be rising. But high default rates are already priced into bonds—the market has effectively realized those losses already. That's yesterday's news. Commodities are today's news, and commodity prices are rising across the board. Deflation is history. Depression is not happening. This is not going to be a double-dip recession, it's a global recovery.

15 comments:

Hope you are right and this isn't simply people hedging against inflation.

My point here is that the things contained in this commodity index are not the sorts of things that speculators can buy to speculate with. You can't stockpile massive amounts of sugar and butter, etc. And this index uses spot prices, not futures prices. This is just everyday ordinary stuff, not a playground for commodity speculators.

You mean you don't have a basement full of tallow?

Just hoping that higher commodity prices don't impede the recovery. After all, higher crude prices mean less discretionary funds to full the recovery.

Just as is the case with higher interest rates, higher commodity prices are the result of a stronger economy. They would have to rise a lot more to begin to be a drag on the economy. In real terms commodity prices are still pretty low, with the exception of oil prices. But even then, oil prices in real terms are less today than they were during the boom times of the early 1980s.

AOL and Sears are now selling "Good News" too. Good news for them means bad news for your pocket book but hey, who's counting!

Either this is the time to go long or its the beginning of a sell signal...

"Good News Now addresses the fundamental human need for fulfillment and joy," said Don Hamblen, Sears' chief marketing officer, in a statement. "We recognized there was so much negative news out there and people needed a positive break, so we developed a site with heart-warming stories on kindness and good deeds -- that's Good News Now."

See all the happiness at the link below...

http://www.gnn.com/

Scott,

I am not sure how you can be so confident with this chart indicating bright skies ahead when you consider how much weaker the dollar is versus other currencies since December of last year.

With this weakness, of course the price of commodities is going to rise. I guess the question would be is the dollar getting weaker because people are chasing risk again or is the dollar getting weaker because investors are starting to second guess the dollar as a reserve currency with our rising deficits and increased government spending.

Thanks for the blog..I enjoy it.

Scott,

Don't you think this has something to do with the trillions of dollars (and other currencies) poured into the global economy by central banks? Higher prices do not imply more transactions, or more goods being produced. Even if that is happening, we may well find that much of the new activity comes from US or Chinese government spending and ultra low interest rates. If so, this will be a recovery to "play," perhaps, but it will end badly, just like the 2003-2007 economy.

In fairness, many of the commodities on that list are tradable as futures, and it's quite possible for the tail (futures) to wag the dog (spot), as we saw last year with cotton (this was well covered by the WSJ) and several other commodities.

I don't necessarily disagree with your argument, but it's perhaps less black and white, and more grey.

As ever, thanks for posting.

Alex: Nice try, but no cigar. The dollar today is almost unchanged relative to its year-end position. For most of this year it has actually been stronger than it is today, so the theory that commodity prices are up because the dollar is down is simply inoperative.

Tom: I agree with you that easy money has contributed to the rise in commodities. But I don't think it's the whole story. I see too many other signs of recovery to say this is just a money illusion. And it may end badly, but that end could be years from now.

MW: Some of the commodities in this index do have futures contracts tied to them. But they are not easily stored, so I don't agree that futures speculators are behind the rise in the index. Let's say speculators bid up the price of futures contracts relative to the spot price (which is determined by day to day market forces). In order for the higher futures prices to pull spot prices higher, speculators and/or producers would have to sell futures contracts and buy the commodity (or not sell their own production). On balance, the world would have to accumulate the commodity, i.e., it would need to be stored. I don't think there are many commodities that lend themselves to this.

And when I see all commodities behaving the same way, I tend to look for a simple common denominator. In this case it seems to me that demand is returning for just about everything.

I just came across a very interesting piece by a NBER committe member.

http://content.ksg.harvard.edu/blog/jeff_frankels_weblog/2009/06/08/the-labor-market-has-not-yet-signaled-a-turning-point/

"Speaking entirely for myself, I like to look at the rate of change of total hours worked in the economy. Total hours worked is equal to the total number of workers employed multiplied by the average length of the workweek for the average worker. The length of the workweek tends to respond at turning points faster than does the number of jobs."

"Unfortunately, as reported by Forbes, pursuing this logic leads to second thoughts about whether the most recent BLS announcement was really good news after all. The length of the average work week fell to its lowest since 1964!

The graph below shows that, not only did total hours worked decline in May, but the rate of decline (0.7%) was very much in line with the rate of contraction that workers have experienced since September. Hours worked suggests that the hope-inspiring May moderation in the job loss series may have been a monthly aberration. If firms were really gearing up to start hiring workers once again, why would they now be cutting back as strongly as ever on the hours that they ask their existing employees to work? If one factors in falling wages, to compute total weekly earnings, the picture looks still worse. My bottom line: the labor market does not quite yet suggest that the economy has hit bottom."

Deleveraging spiral.

http://researchahead.blogspot.com/2009/06/consumer-deleveraging-spiral-still.html

We all have our favorite things to look at. The hours worked argument is not compelling for me for a variety of reasons. It applies only to those who earn hourly wages, and that's not everyone. And the data come from a relatively small sample of businesses. The establishment data typically lags when the economy turns up, because it doesn't capture the new businesses that have been created in the downturn. But I would admit to preferring to see stronger work week data. Meanwhile, today's unemployment report continued the improving trend that has been in place for the past nine weeks.

Pulling forward future demand. "Cash for Clunkers" is a sterling example. There is no arguing that the goverments around the world have created the "shoots" we see with capital and guarantees but that really doesn;t answer the forward looking question of how are we going to pay for it all...

"As we've been saying, it's not the change in the trajectory of the global economy, but the cost of engineering it, that clouds the outlook. One example: the cash-for-clunkers program that drove German auto sales higher may cost German taxpayers at least $3.5 billion, even after the sales tax and foregone unemployment cost benefits. Such programs simply pull forward future demand, and displace other non-auto purchases. The world has never relied before on a coordinated avalanche of fiscal and monetary stimulus, and financial guarantees. I find investment commentary that hails the arrival of better data without acknowledging its potential costs to be incomplete."

http://zerohedge.blogspot.com/2009/06/opportunity-cost-of-green-shoots.html

Post a Comment