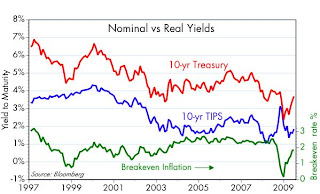

The major trend in the Treasury bond market this year has been a reversal of the deflationary expectations which dominated sentiment at the end of last year. As this chart shows, inflation expectations have risen but are still lower than they were going into this crisis. The market still believes that pervasive economic weakness will keep inflation suppressed.

Forward-looking inflation expectations, meanwhile, have adjusted by more than is reflected in this chart. The Fed's favorite indicator of inflation expectations is the 5-year, 5-year forward inflation rate. That has now returned to 2.4%, which is just about where it was for several years leading up to last summer's financial meltdown. Putting these two observations together, it would appear that the market is expecting the next several years to be tough sledding, with things (inflation and growth) finally returning to normal in, say, 3-5 years from now.

7 comments:

Hawaii slashing state wages 15%

Idaho cutting school funds....

“These are some of the worst numbers we have ever seen,” said Scott D. Pattison, executive director of the National Association of State Budget Officers, adding that the federal stimulus money that began flowing this spring was the only thing preventing widespread paralysis, particularly in the areas of education and health care. “If we didn’t have those funds, I think we’d have an incredible number of states just really unsure of how they were going to get a new budget out.”

Scott:

Inflation with imploding incomes....How bad of a Depression do you think this is going to be???

Market just rolled over. Closed at the lows. 200 day SMA came and went. I know you do not read too much into this indicator but if you are going to present it on the upside its worth noting it has gone belly up to the downside...

It's worth noting, as I said before, but whether this means anything more than a temporary selloff I'm not sure. I don't see any deterioration in the fundamentals that would suggest this is a serious downturn.

Soup Kitchens running out of food as lines get longer.

http://www.guardian.co.uk/business/2009/jun/21/surge-in-demand-us-soup-kitchens

People foregoing medicine and delaying medical treatment because the can't afford copays.

http://www.boston.com/news/local/massachusetts/articles/2009/06/21/costs_are_keeping_patients_from_care/

GS paying out record bonuses this quarter.......

HOW LONG DO YOU THINK IT WILL BE BEFORE RIOTING BREAKS OUT AND THERE WILL BE THOUSANDS OF PEOPLE IN FRONT OF OUR HOMES BEGGING FOR FOOD AND SHELTER?????

alstry,

It will take as long it takes you to convince people they should all panic and start rioting. And based on your blogoshpere reach, we have plenty of time to ponder this scenario...

On June 5th, you concluded your blog entry with the proviso that you were long TIPS. No change, then?

No change. I plan to be long TIPS for a long time, or until I see signs that the Fed is serious about tightening.

Post a Comment