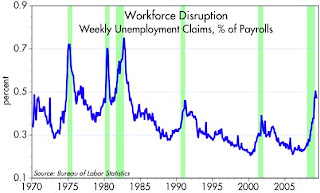

This is probably the best chart for demonstrating that we have seen the worst of the jobs deterioration. The unemployment rate jumped to 9.4% in May, but that might well prove to be the high. The pace of layoffs has dropped; the pace of job losses has dropped: the pace of unemployment claims has dropped; claims as a percent of the workforce has dropped. We've clearly passed through an inflection point.

25 comments:

Scott,

The fact we've passed through an inflection point in rate of unemployment is fine, but do also think it means real growth will ever come with this administrations big govt policies? True free-market entrepreneurial jobs as a result of health care, energy, auto, banking, and perhaps EFCA will be choked-off, yes? Even though we may have reached a top in the surface of unemployment, IF you peel off the layers, I feel the quality of jobs will drag the quantity of mediocre govt jobs. Anyway, I heard Kudlow mention your name as a great blogger Friday, congrats. I am Adam from Psychology of the Call blog.

Excellent blog by the way! Keep it up, this country needs intelligent economic voices outside of mainstream media.

TC

Would you be willing to make public wagers on this prediction? You would agree that it is a definite outlier for expert opinions on the trajectory of the unemployment rate, right?

Your chart is a bit misleading by showing covered employment rather than the total U-3 unemployment rate that you are talking about in the post itself. It makes a huge visual difference when comparing now to the early 80s.

Thank you for the great data and interpretation. I agree with Fenner about the your quality analysis. With the threat of state bankruptcies, the fed monetizing the debt, and smart money being on the sidelines from market action. What would you look for to suggest that the uptrend in unemployment may not hold-other than the next report.

21,000,000 Amreicans work for Federal, State, and Local Governments.....currently budgets routinely are set to be cut by 20%.

Federal tax receipts were down 44% through April....California is swimming in the same icy waters....and most every other state is not too far behind.

Prior to the downturn.... government spending totalled $6.5 Trillion dollars.....yes......$6.5 Trillion in a GDP not much more than twice that....when things were booming.

Big govt is OK when tax recepits are flowing from revenues and profits created from a Ponzi like credit bubble....now that the bubble has popped and tens of trillions of legacy debt remain.....we are just starting to see private and corporate bankruptcies skyrocket....as this comment is written the rate is 6000 per day.

In the next few weeks....state and local budgets will be addressed....already we are seeing hundreds of thousands of government jobs slated to be cut nationally...BEFORE budget revisions are addressed.

Couple that with the inevitable spending cutbacks and the private sector is about to get a massive body blow.

With a $1.8 TRILLION Federal Deficit and what is likely approaching $700 Billion state and local deficits......if you collectively took practially all of the savings of EVERY American....it would barely cover this years shortfall.....NEXT year is likely to be a lot worse.

As you sit there and look out at the ocean....that rising water you see may be a wave unlike any you have ever seen before.

Try quantitatively easing a $2+ Trillion dollar shortfall without productivity behind you and watch how interest fly through the stratosphere when all run for the hills.

Scott,

Dang! I was hoping the end-of-the-world types like dkearns72 and alstry wouldn't find your blog!

Some important items to take away from May's unemployment report, courtesy of Brian Wesbury and Robert Stein at First Trust:

1. Not only did job losses slow to 345,000 (the smallest drop since August 2008, significantly better than the expected -520K, and WAY below the -749K in January), March and April were revised to reflect +82,000 jobs. Positive revisions are usually associated with economic expansion, not recession.

2. Hotel jobs increased for the first time since before the recession began and restaurant/bar payrolls increased the most since December 2007. These are signs that consumer behavior is returning to normal.

3. Not only did health and education jobs continue to increase (+44K), they did so by the most in six months.

4. "The jobs report strongly supports our call that the economy bottomed in May and is now in the early stages of a V-shaped recovery. Businesses are shedding jobs at a much slower pace than earlier this year and we would not be surprised to see payrolls start to increase by the end of the summer. The speed of the turnaround cannot be ignored."

I was too young to remember the nastier recessions in the 70's and 80's and I graduated college as the 1990-91 unpleasantness was winding down. I was just wondering if it's normal for people to be THIS down coming out of a recession?

P.S. If the Challenger, Gray & Christmas report you referenced in your June 3 post is to be believed, you might want to consider dkearns72's wager offer!

Scott,

Could you comment on this article in the WSJ (Giving Corrporate credit its due). A graph from the WSJ article is shown in the blog post below. The graph shows historic correllation between unemployment and corporate spreads, and based on prior correllation predicts unemployment peaking at over 20%.

http://jimolness.blogspot.com/2009/04/credit-spread-model-predicts-massive.html

fenner: I do think we'll see real growth, in spite of the administration's anti-growth policies. Labor productivity is still positive, and the economy has gone through a big adjustment, wherein resources have been shifted from spending on housing to spending on things which which most likely have more value added. I expect the main impact of the administration's policies will be to retard the economy in its effort to regain its former growth path. Instead of 3% trend growth a year we'll see maybe 2% trend growth. That doesn't sound like a lot but over time it becomes significant. The early part of the recovery, which I think is starting, could see growth of 3-4%.

And thanks for the compliment!

dkearns72: When I say that the storm has passed, I am not necessarily saying that the unemployment rate has peaked. That is a lagging indicator in any event. It is composed of several variable, one of which is the number of people looking for jobs. That can increase as the outlook improves, but it shows up as an increase in the unemployment rate--so it is also at times a misleading indicator. In fact, the big boost to the rate in May occurred because of a big increase in those looking for jobs.

The important thing to me is that a) weekly unemployment claims are no longer rising and seem to be declining, and b) the number of people getting laid off is decreasing. This occurs against a backdrop of a global recovery (higher shipping rates, higher container shipments, rising commodity prices, etc.) and as such is significant.

I think it means that confidence is beginning to build, and that can unleash pent-up demand and investment. It is a virtuous cycle that is just beginning.

The chart is only meant to show the number of layoffs as a percent of the number of people working. "Workforce disruption" I call it. In prior recessions the percentage of layoffs was much higher.

ronrasch: weekly unemployment claims are a key thing to watch. If they continue to trend down, then I would expect layoffs to trend down as well.

alstry: I sure hope we see big cutbacks in government spending, since that would obviate massive tax increases. I think it is entirely plausible that government job losses could coincide with a pickup in hiring in the private sector. Lots of people might stop working for the government and start working for the private sector. That would be a very good thing.

Chad: Thanks for posting the stuff from Brian. He and I see things pretty much the same way. I've been through a few recessions in my professional life, and it seems they all end the same way: with massive denial. The great majority of people don't realize the recession has ended until well after the fact.

And thanks for reminding me of the CG&C data, since they have been reliable in the past and they are showing a huge improvement, which further confirms the message of the May payroll report.

bobo: I would be the last person to downplay the significance of credit spreads. I think they are extremely important, and my optimism has been based significantly on the decline in swap spreads which began last October. I've got lots of posts on swap spreads as a leading indicator.

As for the article you mention, I think the specific spreads they refer to were driven artificially high by the panic selling and the almost total lack of liquidity in the bond market. As such, I think those spreads were probably exagerrating how bad things will be going forward. Things are looking much more reasonable today.

Scott,

Right now we are running about a $2Trillion dollar Federal Deficit and a half a Trillion dollar State and Local deficit.

If we balance the budget as you advocate and I applaud.....how many million private sector jobs do you think will be cut, in addition to the millions of government jobs, as a result of the spending cutback?????

Then what area of the economy do you think has the capacity to hire between 8 and 12 million workers.....in addition to the six million already recently unemployed.....since we only need so many windmills.....there really is only one area left....who do you suggest we blow up?

Here is an interesting analysis comparing now versus the "d" era.

http://www.voxeu.org/index.php?q=node/3421

If you look out globally instead focusing on just the US, it appears by many measures that we are either tracking similarly to or worse than during the depression.

The main difference has been the thrust of liquidiity this time around. The question is probably whether that works or not. I tend to think this is a credit crisis and not one of liquidity. Before this crisis policy makers were talking about the liquidity glut. Now apparently that must not have been the case.

In addtion, I do not believe the commodities picture provides the proof of support Scott shares over and over again. I think you are seeing a one sided trade by countries snapping up resources for other than growth policies. While the short term impact may be positive, the longer term outlook does nothing to pull economies out their slumps. If fact the sharp rise could hurt.

China bought US assets at ridiculously low rates until everything went BOOM. It now seems they are shifting from US assets to commodities. Is that a good thing?

Alstry does have a point re State Governments shedding loads of jobs and Scott may be right about the Private sector picking up some of the slack, but what that failes to consider is that most of the jobs will come in the low skill, low pay, services type jobs.

This is not what you want to base your economy on but this is all the US has to offer at this point. I think we can all acknowledge that the age of your local Starbucks employee or cashier at Target has increased significantly.

We are only getting started in this malaise. It will be far reaching, last much longer, and force more significant change than anyone cares to digest.

"Finance is the art of passing money from hand to hand until it finally disappears."

- Robert W. Sarnoff

The article you link to is interesting, but sheds very little light on the future. As the authors note, policy responses this time around have been very different. I would further note that there is nothing there about commodity prices or credit spreads, both of which have been good leading indicators in the past and now say that things are getting substantially better.

You seem too willing to assume that some of the things that are happening and might happen will not be "good things." Are all emerging economies making the mistake of buying commodities for no purpose other than to stockpile them? Will the private sector only create jobs that are low-paying and non-productive? I'm a congenital optimist and I believe that the changes that come as a result of the wrenching adjustment we have been through will be positive. The profit motive is still alive and well, and millions of motivated people can make a difference for the better, despite the misguided policies of the Obama administration.

The article you link to is interesting, but sheds very little light on the future. As the authors note, policy responses this time around have been very different. I would further note that there is nothing there about commodity prices or credit spreads, both of which have been good leading indicators in the past and now say that things are getting substantially better.

You seem too willing to assume that some of the things that are happening and might happen will not be "good things." Are all emerging economies making the mistake of buying commodities for no purpose other than to stockpile them? Will the private sector only create jobs that are low-paying and non-productive? I'm a congenital optimist and I believe that the changes that come as a result of the wrenching adjustment we have been through will be positive. The profit motive is still alive and well, and millions of motivated people can make a difference for the better, despite the misguided policies of the Obama administration.

Scott,

I believe the creative destruction let to occur is good but that the scale of misguided intervention and moral hazard grossly retards this natural process and that we will pay for it in many ways. Optimist or not, trying to rationalize down the scale, complexity, and trajectory does not make them go away.

Over the past 30 or so years, neither political party has shown the will to put our fiscal house in order. The numbers are bigger and more meaningless than ever. To assume someone will deliver us from this mayhem is insanity, not optimism. Here is a lovely chart of the US government spending as a % of GDP (State/Fed). Nearly 50% of our GDP is made of .Gov works and this crisis has only made the public turn further towards governmental intervention.

http://www.usgovernmentspending.com/downchart_gs.php?year=1930_2009&view=1&expand=&units=p&fy=fy10&chart=F0-fed_F0-statelocal&stack=1&size=m&title=Total%20Spending%20As%20A%20Percentage%20Of%20GDP&state=US&col=c

The US has seen its best days and that even if we cannot “see” how the eventual transition will occur, let there be no doubt it is occurring. That does not mean we will not create high skill jobs or contribute to the global community, but if you look at what our priorities are (war, socialism, favoritism, fiscal foolishness), it is hard not to see that this country is heading down an unsustainable path sooner rather than later. Like it or not, conservative or liberal, we are bankrupting the foundations of this nation, one day at a time.

The profit motives are definitely intact but expect the trail of riches to follow the path of Bog .Gov. This is the best game in town right now and the asset management industry knows it. Eventually Main Street will figure it out too.

Here is a great example in the press today of chase the government checkbook.

"effrey Immelt, Welch’s successor at GE, is positioning his Fairfield, Connecticut-based company to take advantage of the current once-in-a-generation “reset” of the government’s role in the economy, he told investors at the April 22 annual meeting in Orlando, Florida.

GE is hoping to serve customers who receive money from the $787 billion federal stimulus plan, signed by Obama Feb. 17, with sales of meters to make electrical distribution more efficient, wind turbines and electronic medical record systems.

Hybrid Locomotives

The company also is applying for Department of Energy stimulus funds to help build a battery factory near Albany, New York. The sodium-based chemical technology in the batteries, which GE spent $150 million to develop, will be used in hybrid locomotives and represents a new business for the world’s biggest maker of the equipment. "

Public Library,

You should read Doug Noland's Credit Bubble Bulletin from this past Saturday. Go to the end to read his comments, past all the "news" that he lists.

Here's a couple sentences that give part of his gist: "I used to find it rather perplexing that our nation’s largest bond fund managers were among inflationism’s most vocal proponents. I was naïve; it now seems all so obvious. Of course, market operators prefer to have the Fed and Washington there reliably backstopping the markets. An activist central bank pegging interest rates and manipulating the cost (hence, the flow) of finance creates wonderful opportunities for the savviest traders playing the money game most adeptly. The expansion of Bubbles creates great opportunities and then, for the enlightened, the bursting of these Bubbles provides only greater profits."

I would expand his comments to indicate that the savviest operators know how to play the "government in the economy" game, regardless of the mechanism. Whether it's government payments to "green" investors or bubbles blown by the Fed.

I am not so sure that the "profit motive is alive and well." The "well" part is in doubt because too many entrepreneurs are now focused on the government's next move.

Tom,

Thanks for the heads up. It was a great read. I firmly believe we are heading towards the next great calamity due in part to the size and nature of the interventions over the past 15 years. Add to that continued fiscal foolishness and you have a spicy recipe for disaster. I do not need sophisticated models to understand this, commonsense will do.

PL

Article here: http://www.prudentbear.com/index.php/creditbubblebulletinview?art_id=10238

Post a Comment