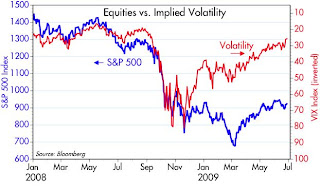

Here's yet another installment in a long-running series. The main thesis is that fear—with the VIX index being a good proxy for the market's level of fear, uncertainty and doubt—played a big role in the economy's collapse last year. Fear, counterparty risk, deleveraging, cash hoarding, declining money velocity, safe haven refuges: all were part of the same story. So as fear declines (shown in this chart as a rising red line) and confidence returns, the economy ought to be able to recover a lot of the ground it lost.

Here's yet another installment in a long-running series. The main thesis is that fear—with the VIX index being a good proxy for the market's level of fear, uncertainty and doubt—played a big role in the economy's collapse last year. Fear, counterparty risk, deleveraging, cash hoarding, declining money velocity, safe haven refuges: all were part of the same story. So as fear declines (shown in this chart as a rising red line) and confidence returns, the economy ought to be able to recover a lot of the ground it lost.Some of the lost ground may not be recoverable, however, and that would be the portion attributable to misguided policy actions of the Bush administration (e.g., the Paulson/Geither bailouts), and the Obama administration (e.g., the $800 billion stimulus package, the Chrysler takeover, the trillion-dollar-deficits budget, and more recently the cap and trade bill, all of which were rammed through with the mantra "there's no time to look at the details, just vote yes"). These policy actions all share two dreadful features: they dramatically expand the scope and power of government, and they promise a significant increase in future tax burdens. And that, in turn, means that the future growth prospects of the U.S. economy have been diminished. Profits will be less than they otherwise might have been, and living standards will be less than they otherwise might have been.

But those are long-range considerations. For now, the main issue is getting the economy back on a recovery track. I think a recovery is underway, and it is being fueled by a restoration of confidence and the return of liquidity to the markets. There are still legions of skeptics out there, however, and we will undoubtedly be barraged for many months by bad news, as more companies and banks fail and as more and more underwater homewowners default on their obligations. Still, the fact that the VIX index, as well as other key and leading indicators such as swap spreads, are returning to "normal" tells me that there is still room for improvement in the economic fundamentals and in the pricing of risky assets. So I think we will see equity prices continuing to drift higher in coming months.

Full disclosure: I am long IVV (S&P 500 ETF) at the time of this writing.

9 comments:

WILL FEAR RETURN????

Struggling cities cancel Fourth of July fireworks

Nearly 50 cash-strapped cities nationwide are forgoing fireworks festivities.....

Reporting from Euclid, Ohio -- Mayor Bill Cervenik has spent a lifetime celebrating the Fourth of July curled up on a blanket in this city's Memorial Park beneath bursts of fireworks across a darkened Ohio sky.

People have long considered the fireworks a treasure of this Cleveland suburb, where flags fly year-round in neighborhoods of bungalows and stores post signs for passersby to "support our troops."

But the fireworks and singing along to "The Star-Spangled Banner" on a warm summer night -- and the police and firefighters needed to manage the 30,000 people who turn out -- don't come cheap.

So this year, Euclid will have no fireworks. "I'm 55 years old and I can't remember not going to one of these," Cervenik said.

As the economic crisis has dragged on, city leaders around the country say fireworks are a luxury they can no longer afford. Big and small, urban and rural, the skies will remain dark over at least four dozen communities nationwide come July 4.

"It came down to this: Did we want to spend $150,000 on something that would be over in a few hours?" Cervenik said. "Or did we want to use that money to keep city workers employed?"

The news has sparked outrage and protests among residents who long to preserve an American tradition that dates to 1777. They say that fireworks displays are more than a nod to nostalgia: They allow communities to come together, set aside their woes and build up town pride -- even if only for a few hours.

"Good times, bad times, there's always been fireworks," said Robert Baker, who heads the Fourth of July festival committee in Abington, Mass.

Baker, a shipping foreman with a shoe manufacturer, has been out of work for a year. The festival was quashed this month amid city budget fights.

"This is one more blow in a year of blow after blow," Baker said.

In San Jose, slumping tourism and dwindling sales tax receipts shut down the city's America Festival and its evening display over a half-mile stretch of Highway 87.

"We're faced with balancing an $84-million budget shortfall," said mayoral spokeswoman Michelle McGurk. "We don't have the money to support a lot of things we'd like to."

Some cities would rather feed their residents than entertain them. In the Los Angeles suburb of Montebello, where unemployment hovers at 12%, the City Council unanimously voted to use its $39,000 fireworks budget on donations to local food banks.

"The last food bank line I saw had more than 1,000 people in it," said Mayor Rosemarie Vasquez. "We figured that, instead of burning the money in the air, why not give it to people who need it."

In Lowell, Mass., Mayor Edward Caulfield canceled the city's annual show to help save one city job. He had already cut 48.

http://www.latimes.com/news/nationworld/nation/la-na-fire......

Jobs are being cut in city after city after city across America....before it is said and done, we are likely to see millions upon millions lose jobs......

Millions more houses could come to market in an environment of already high inventory and low prices.....

At this point, only time will tell whether fear subsides or increases.....

Scott, wondering if you are still long HYG?? Your current thoughts on high yield debt would be greatly appreciated. Thx.

Still long HYG, still thinking that easy money plus even a very modest recovery equals good news for all debtors, given current pricing which is still fearful of huge default rates.

I guess this means we can now begin our gradual descent ;)

Scott,

Does the increase in capital standards for US bank holding companies reduce the power of the money multiplier to translate greater bank reserves to new risk assets? If so, is the unprecedented rise in bank reserves perhaps less of a worry if the power of the money multiplier has been reduced.

Thanks,

Dale

Inflation is always and everywhere a monetary phenomenon. It is amazing how people rty to explain this away.

Eventually, like 2001-2003, the Fed will make it so painful to hold cash that the market (bubble) will respond accordingly.

Giddy up cowboys cuz this here is the wildest ride in the wilderness.

Dale: Increased capital standards would limit the money multiplier, but the expansion of bank reserves exceeds this limiting factor by orders of magnitude. On a related subject, it seems to me that the deleveraging phenomenon--both voluntary and forced--is being largely ignored. That is probably at least as important as increased capital standards in limiting money expansion. You can't force the system to borrow if it doesn't want to.

Regardless, the net effect of all the factors influencing lending and money creation can be observed in 1) the value of the dollar, 2) gold prices, 3) commodity prices, 4) the slope of the yield curve, and 5) credit spreads. On balance I think these indicators tell us that monetary policy is accommodative, and that there is no shortage of money supply relative to the demand for it.

Fear RISING, Prices CRASHING!....

The number of California hotels involved in a foreclosure action or in default has risen 125 percent in the past 60 days.

Thirty-one hotels have been foreclosed upon, the Irvine-based Atlas Hospitality Group reported Friday.

There are 175 hotel properties in default on their notes right now.

Those properties already lost to foreclosure have largely been in the counties of San Bernardino, Riverside and San Diego.

With 19.6 percent of the total, San Bernardino County leads the state in foreclosed hotels. Riverside County was next with 16.1 percent. San Diego came in third with nearly 13 percent of the foreclosed market share.

Alan Reay, president of Atlas Hospitality Group, said Atlas saw signs the hotel industry may be affected by the housing crisis in California about 18 months ago, and has compiled data over the past year on troubled hotel properties.

Initially, foreclosure action was taken against independent hotels, the hotel brokerage and consulting firm noted. Most were boutique motels in secondary markets.

“Only in the last 60 days have we seen a massive run-up,'' Reay said. “I think hoteliers are getting to the point of not seeing light at the end of the tunnel, and they're starting to throw in the towel.”

http://www.mydesert.com/apps/pbcs.dll/article?AID=/20090627/BUSINESS01/906260348&template=printart

Scott,

Thanks. Very interesting. I was wondering because reserves have doubled YoY (to $1.77 trillion, according to the Fed's H.3 release) while some banks are looking at a 20% to 100% increase in capital (tier 1, TCE ratio, or other calculations). These forces act against one another in direct proportion at the upper end of the spectrum while reserve expansion has more power at the lower marginal capital ratio.

Agree on high yield. Your former colleagues are handling some of that for me in the 401(k) while I have some pretty junky paper and bond insurers in the PA.

Dale

Post a Comment