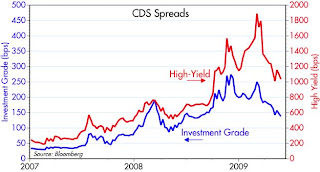

Here's an update of a chart I posted about a month ago. Spreads on Credit Default Swaps (a proxy for spreads on generic corporate bonds) have continued to narrow, although they still remain unusually high. With monetary policy still very accommodative (and verging on inflationary), and with lots of economic and financial fundamentals showing improvements, I expect we will see continued narrowing in these spreads. A pickup in inflation and a pickup (however modest) in the economy should go a long way to keeping default rates within reasonable limits. That makes the current double-digit yields on junk bond very attractive.

Here's an update of a chart I posted about a month ago. Spreads on Credit Default Swaps (a proxy for spreads on generic corporate bonds) have continued to narrow, although they still remain unusually high. With monetary policy still very accommodative (and verging on inflationary), and with lots of economic and financial fundamentals showing improvements, I expect we will see continued narrowing in these spreads. A pickup in inflation and a pickup (however modest) in the economy should go a long way to keeping default rates within reasonable limits. That makes the current double-digit yields on junk bond very attractive.Full disclosure: I am long HYG at the time of this writing.

No comments:

Post a Comment