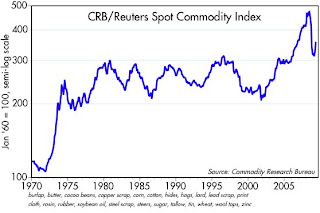

Gold prices have been rising ever since the Fed started easing in early 2001. There have been ups and downs along the way, but the uptrend has remained largely intact for almost 8 years. Gold fell last year, as commodities did, but by only half as much as the decline experienced by most commodities. Gold turned up in November last year, about a month before commodities started to recover. Gold is now approaching its all-time of $1000; will commodities return to their previous highs? Will Fed ease have given us another commodity price bubble?

Gold prices have been rising ever since the Fed started easing in early 2001. There have been ups and downs along the way, but the uptrend has remained largely intact for almost 8 years. Gold fell last year, as commodities did, but by only half as much as the decline experienced by most commodities. Gold turned up in November last year, about a month before commodities started to recover. Gold is now approaching its all-time of $1000; will commodities return to their previous highs? Will Fed ease have given us another commodity price bubble?Commodities have turned up meaningfully from their year-end lows, in direct definance of the theory that says that when economies are operating way below their potential (i.e., when "economic slack" is significant) then prices of everything tend to fall. It's popular to explain away the rise in commodity prices by asserting that China and India are mindlessly stockpiling commodities, and so this is just a temporary phenomenon. But when just about every single industrial commodity price is up, then I would argue that there must be some fundamental factors at work. Two things come quickly to mind: a rebound in global economic activity (bolstered by the big rise in shipping rates, the big upturn in outgoing container shipments, the big rise in global equity markets, the big drop in credit spreads), and very accommodative monetary policy (as seen in the extremely low level of nominal interest rates in all major economies and the very expansive growth in money supply measures).

Zeroing in on the energy sector, crude oil prices are up about 85% from their December lows. Gasoline at the pump is up about 50% from the end of last year, and considering that its price lags that of crude, gasoline is probably going up another 20% over the next month, which in turn would bring regular gasoline back to around $3 per gallon at the pump. That's not enough to qualify as "expensive" in my view (I keep thinking that gas needs to be over $4 a gallon to really grab people's attention), nor to cause a consumer revolt or any major push to buy more fuel-efficient cars, but it is enough to put inflation back on the table. For TIPS fans, I would note that the rise in gasoline prices will contribute a little over 4 percentage points to the CPI for the January-August period, and that in turn would probably drive the total CPI adjustment for this year higher than the TIPS market is hoping for.

If there are indeed two major forces pushing commodity prices higher (e.g., renewed economic growth and expansive monetary policy), then it is difficult at this point to say that the rise in commodity prices is the start of another bubble. (Bubbles being defined as prices that are pushed to unsustainable levels by speculative demand.) It's difficult if not impossible to say how much of the current rise in commodity prices is inflation/easy money speculation and how much is due to strong demand coming from a resurgent global economy.

The continued rise in gold prices tells me that there is definitely an element of monetary-driven inflation at work. As I mentioned in my earlier posts this week, I think we have now passed a "tipping point." Fed policy has shifted from correctly accommodating a massive increase in money demand, to now oversupplying the world with dollars. This shift is not the result of anything the Fed has done; it is the result of a change in the world's demand for dollars and for liquidity. The worst part of the financial crisis has clearly passed, and so the world's demand for money is now declining; money velocity was declining but it is now increasing. The Fed needs to withdraw money from the system; if it doesn't, then the gold market will prove once again to be prescient, and an abundance of cheap dollars will cause inflation to rise and commodities will once against enter bubble territory.

I believe Bernanke when he says that he is deeply committed to low inflation and a strong dollar. But for now I think the Fed is incapable of taking bold steps to tighten liquidity conditions. Unemployment is too high, and the political environment is too skewed towards "making sure" (Obama's favorite phrase) that the economy gets back on track whatever the cost. So that leaves me thinking that gold is right: inflation is going to be increasing, and commodity prices are going to continue to rise.

Rising inflation and commodity bubbles are not good for the economy in the long run, because at some point the Fed will have to tighten the monetary screws and that will likely give us yet another recession. But for now, I think it pays to bet on rising real and nominal cash flows, and rising prices for "things." That means staying long equities, long TIPS, and short T-bonds. I would also be long commodities if it weren't for my real estate holdings.

Full disclosure: I am long equities, long TIPS, and long TBT as of the time of this writing.

7 comments:

$3 gas might still be enough to resume the calls of "drill here, drill now!" And this time the Left won't be able to pin it on "Bush's oil buddies." Perhaps our Community-Organizer-In-Chief will start to feel some heat.

Good point! Let's hope he begins to feel heat from every direction!

Scott,

Please explain your comment "For TIPS fans, ..., and that in turn would probably drive the total CPI adjustment for this year higher than the TIPS market is hoping for."

Would a higher CPI adjustment necessarily lead to a change in TIPS pricing or simply a higher income stream?

Also, is a higher CPI adjustment more than the market is hoping for, or is it more than the market was expecting?

Thanks for a sensible and upbeat (when appropriate) view of the world.

Here is a prediction: at some point during Obama's first (hopefully only) term, gas prices will be a problem for him and he will raid the SPR in a desperate attempt to rein in prices at the pump. I don't know what price, $3 or $4, will do it, but I am 90% sure it will happen.

Scott: Does your reference to real estate holdings indicate that you believe real estate to be a good hedge against future inflation? I personally think it is especially given the incredibly cheap prices if one buys now. What are your thoughts and what type real estate are you invested in?

Craig: A higher-than-expected inflation reading could drive TIPS prices higher (but not necessarily), and it would also give TIPS owners a higher yield.

Bill: I do think real estate is a good inflation hedge, especially now that prices have fallen so much. It's also nice that you can buy real estate at relatively low prices and finance the purchases at rates that are essentially the lowest we have seen in many decades.

Post a Comment