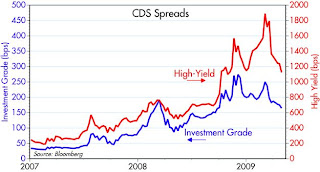

Here's a nice recap of the state of credit spreads, as quoted on the iBoxx indices. These indices are the basis for the credit default swap spread on a basket of 125 investment grade entities and 100 non-investment grade entities, and thus they represent a good, liquid proxy for generic credit spreads on corporate bonds. As the charts show, spreads on investment grade as well as high-yield bonds have tightened significantly, though all spreads are still much higher than normal. One thing that stands out is the huge gap between IG and HY spreads (second chart): junk bonds are paying on average almost 10 percentage points more than high quality bonds, almost 5 times what might be considered "normal." The rally in corporate debt has been meaningful, but the potential is there for a whole lot more. At current levels, junk spreads are still anticipating a record-breaking rise in default rates. However, the market's default fears are being called into question daily, as we see more and more signs of an economy that is bottoming instead of sinking. The Fed's quantitative easing policy is also contributing to support the valuation of corporate bonds, since it significantly reduces the likelihood of deflation, which in turn is the worst nightmare for heavily indebted borrowers.

Here's a nice recap of the state of credit spreads, as quoted on the iBoxx indices. These indices are the basis for the credit default swap spread on a basket of 125 investment grade entities and 100 non-investment grade entities, and thus they represent a good, liquid proxy for generic credit spreads on corporate bonds. As the charts show, spreads on investment grade as well as high-yield bonds have tightened significantly, though all spreads are still much higher than normal. One thing that stands out is the huge gap between IG and HY spreads (second chart): junk bonds are paying on average almost 10 percentage points more than high quality bonds, almost 5 times what might be considered "normal." The rally in corporate debt has been meaningful, but the potential is there for a whole lot more. At current levels, junk spreads are still anticipating a record-breaking rise in default rates. However, the market's default fears are being called into question daily, as we see more and more signs of an economy that is bottoming instead of sinking. The Fed's quantitative easing policy is also contributing to support the valuation of corporate bonds, since it significantly reduces the likelihood of deflation, which in turn is the worst nightmare for heavily indebted borrowers.Full disclosure: I am long HYG, an exchange-traded fund designed to track the price and yield performance of the High-Yield iBoxx Index, at the time of this writing.

6 comments:

Scott,

I think we are all falling, once again, for the siren song of inflation (i.e. money growth). Doug Noland has some excellent comments this week. He points out that: "the more immediate (and always seductive) consequences of loosened financial conditions tend to be reduced risk premiums, higher asset prices, and a boost to economic 'output'."

He makes the case that there is no free lunch, and that the true costs of these policy extravaganzes don't show up until later. He thinks we are now entering a period in which the "unfolding Government Finance Bubble" is even bigger and more precarious than the mortgage finance bubble. Among many other points, he makes one that seems irrefutable: "I can’t even begin to contemplate how this process might nurture an effective allocation of financial and real resources."

The bottom line is that, yes, we may see improving "financial conditions" for a period of time, but there is going to be hell to pay at some future time. We are sowing the seeds for a much bigger crisis down the road.

Tom, what you are saying may well end up being right--inflationary monetary policy may bring us a world of troubles in the future. But in the meantime it makes the existing stock of high-yield bonds quite attractive, since it will very likely result in default rates that are much lower than the market currently expects.

The government is dealing with major troubles in unemployment, housing, autos, and state budget deficits. Scott, I respect your observation that signs of bottoming and potential inflation from monetary looseness may be emerging. My concern is that the economy is not ready for a black swan even a small one. Flu, terrorism, Pakistan trouble all could tip this economy. Given the economic vulnerability, do you think being long stocks or bonds is worth the risk?

That is exactly the right question to be asking. The answer depends on your assessment of the likelihood of these risks occurring, combined with your assessment of the amount of risk that has been discounted in current market prices. In my opinion, equities are still priced for a very gloomy economy and more bad news. The rise in equity prices of late is reflects more a declining risk of a depression, rather than the rising risk of a recovery. The risks you cite are front page news, and investors are still shell-shocked. I don't think this market is even close to being overly optimistic.

I am an eternal optimist when it comes to the ability of the US economy to overcome problems, so I am willing to take the risk and be long equities.

Hi Scott, not sure if you notice a comment on an old post, but here goes.

The argument for high yield debt is that they are currently priced for record breaking defaults, which (in your view) is becoming less likely every day.

How does that apply to high yield municipals? I wonder if they might have an additional advantage of greater likelihood of government support ("can't let municipal market fail"). And the likelihood of higher tax rates.

Randy

Muni bonds were one area of the bond market I never spent much time with, and I don't pretend to have any expertise in munis. I can only offer the observation that high yield munis might be attractive for the same reason all high-yield debt is attractive these days: easy money and rising inflation are a wonderful tonic for heavily indebted entities. Cash is easier to come by, nominal spending is likely to rise by more than expected, and cash flows in general are likely to exceed expectations.

Post a Comment