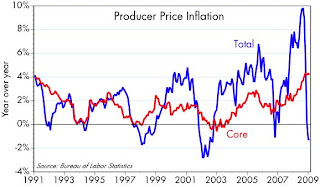

Take out food and energy prices, and you find that producer prices have been rising at a 3-4% rate all throughout this economic crisis. Lots of headline-making prices have plunged of course, with oil being the big standout. But oil prices have now stopped falling, and commodity prices in general are stabilizing if not rising. That means the two lines in this chart should start converging going forward, with the blue line (year over year changes in the headline PPI) moving higher. Inflation at the producer level is definitely not dead.

Take out food and energy prices, and you find that producer prices have been rising at a 3-4% rate all throughout this economic crisis. Lots of headline-making prices have plunged of course, with oil being the big standout. But oil prices have now stopped falling, and commodity prices in general are stabilizing if not rising. That means the two lines in this chart should start converging going forward, with the blue line (year over year changes in the headline PPI) moving higher. Inflation at the producer level is definitely not dead.This is extremely important to the general economic outlook. Much of the market's fear has come from concern that plunging demand worldwide would set up a generalized deflation that central banks would be powerless to stop. Call it a variant on the "liquidity trap," or an offshoot of Phillips Curve thinking. In short, the weaker the economy gets, the more convinced the market becomes that inflation is impossible and deflation is the threat. But now we're seeing that, despite demand hitting a major airpocket all over the world, lots of prices are still rising. That means monetary policy is not powerless, deflation risks are much lower than most people realize, and inflation risk in general is being underestimated.

And that in turn means that way too much money is trying to pile into risk-free securities (e.g., T-bills and T-bonds) that are paying very little in the way of interest. TIPS are a much better alternative to Treasuries if you are concerned about preserving principal and avoiding defaults. As for default risk, that has gone down in line with decreased deflation risk (because deflation is a debtor's worst nightmare), so corporate bonds and emerging market bonds look more attractive.

Full disclosure: I am long TIP, HYG and EMD as of this writing.

1 comment:

Could rising prices but lower sales be happening, ...stagflation?

And Scott, I still do not fully understand how $200 Billion in bad loans went to $ trillions in losses.

I'd love to read a well crafted Pundit explanation of that.

Post a Comment