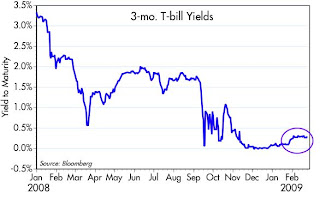

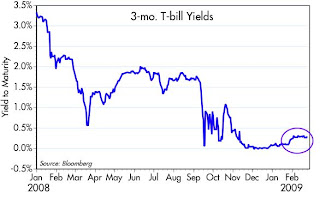

Part of the reason for the decline in the TED spread (see previous post) is the rise in T-bill yields. While the rise is still quite modest, it is nevertheless significant that yields on the world's safest security are no longer zero. Any tendency for Treasury yields to rise from their year-end lows is a good sign that fear is subsiding and markets are gradually regaining a degree of confidence in the future. It's also a sign that defaltion risks are declining, and that means we are not necessarily in the grips of a self-reinforcing cycle of weak demand and falling prices.

Part of the reason for the decline in the TED spread (see previous post) is the rise in T-bill yields. While the rise is still quite modest, it is nevertheless significant that yields on the world's safest security are no longer zero. Any tendency for Treasury yields to rise from their year-end lows is a good sign that fear is subsiding and markets are gradually regaining a degree of confidence in the future. It's also a sign that defaltion risks are declining, and that means we are not necessarily in the grips of a self-reinforcing cycle of weak demand and falling prices.

Tuesday, February 24, 2009

Good news recap (3)

Part of the reason for the decline in the TED spread (see previous post) is the rise in T-bill yields. While the rise is still quite modest, it is nevertheless significant that yields on the world's safest security are no longer zero. Any tendency for Treasury yields to rise from their year-end lows is a good sign that fear is subsiding and markets are gradually regaining a degree of confidence in the future. It's also a sign that defaltion risks are declining, and that means we are not necessarily in the grips of a self-reinforcing cycle of weak demand and falling prices.

Part of the reason for the decline in the TED spread (see previous post) is the rise in T-bill yields. While the rise is still quite modest, it is nevertheless significant that yields on the world's safest security are no longer zero. Any tendency for Treasury yields to rise from their year-end lows is a good sign that fear is subsiding and markets are gradually regaining a degree of confidence in the future. It's also a sign that defaltion risks are declining, and that means we are not necessarily in the grips of a self-reinforcing cycle of weak demand and falling prices.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment