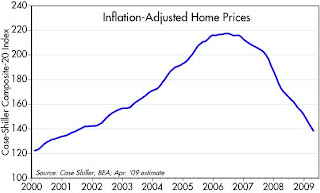

The December data for the Case Shiller housing price index fell at a somewhat faster rate than in previous months, but the message remains clear: housing prices are rapidly adjusting downwards. I posted comments on the seriously lagging nature of this index before, and this chart contains the same assumptions I've used in the past to try and get a picture of where housing prices might actually be today. In short, I'm guessing that real housing prices by this measure have fallen a little over 35% from their high; in real terms, they are about where they were during the 2001 recession.

The faster prices reach levels that clear the market—and anecdotally they appear to have done this in at least a few markets around the country, most notably in California—the quicker this recession will be over. One key to restoring confidence will be the perception that prices and the economy are not going down a black hole, that there is some solid support developing. The bottom shouldn't be too far away. After all, the vast majority of people are still working, there is more money out there than ever before, and mortgage rates are just about as low as they have ever been for the majority of borrowers (i.e., those looking for mortgages that fall within conforming limits).

7 comments:

Scott,

On an unrelated note, I wonder if you have an thoughts on mark-to-market accounting. Brian Wesbury, William Isaac, Bob McTeer and a few others seem to be the only ones arguing that the rules need to be changed.

I'm very sympathetic to the argument that MTM accounting has exacerbated the problems faced by banks today. Subprime securities are exceedingly difficult to understand and model (i.e., they lack transparency), so it is not difficult to believe that a distressed market (lots of forced sellers, a dearth of willing buyers) can misvalue them. If they are underpriced, that triggers downgrades and more forced selling, and you get a vicious circle effect.

Whether the government of FASB should suspend or modify MTM rules, or whether it is a simple matter of the government allowing banks some "regulatory forebearance" I'm not sure which is best. But why not give it a try? It can't cost nearly as much as throwing hundreds of billions of dollars at the problem with complex solutions that are likely to have many unintended consequences.

I think it is also signficant that every time there has been even a whisper about changing m-t-m rules, or changing them under another name, as in the original TARP program, the market has surged

Then why not change the mark to market rules on homes and allow people who want to re-finance at a lower rate do so regardless of the value of the home as perceived by relative comps?

What is good for the banks must be good for the home owner, no?

Probably because the people on the other side of the trade (banks) want a solid assessment of the underlying value of the asset they are financing which is determined by actual market forces...

As soon as you change the rules that govern the value of assets, the entire system will collapse. The banks are already playing a game of hide and seek with their losses. If the banks were to disclose the true reality of the situation, the more quickly we could get a handle on it, execute a plan, and move forward.

Again, all comes back to a lack of leadership and accountability and it is very sad.

Bernard, there is no "other side of the trade". Many banks and financial companies are marking to market securities that they have no intention to sell. They are holding them on their balance sheet, receiving payments on principal and interest (just listen to State Street), and yet they are being forced to mark down their securities based on other people's trades. It is insane. And MTM is not some pillar of the modern financial system. It is only about 10 years old. If banks knew how volatile MTM accounting could be, they would have desiginated the securities as held-to-maturity (another accounting term), meaning the securities stay marked at the purchase price as long as they are cash flowing properly. It is beyond idiotic that Obama has not suspended MTM. It costs taxpayers nothing. Markets will rip up and provide a much needed boost of confidence and optimism.

Bernard,

Ditto what Dan says plus:

The accounting rules for financial institutions were changed -- in 2007. We had the same rules from 1938 to 2007 without these kinds of problems. The issue is financial insitutions having to take write-offs and balance sheet hits on assets that are still producing cash flow just because current market value is down. If we had the same accounting rules during the Latin American debt crisis and the S&L crisis during the 80s and 90s, every major financial institution in the country would have been bankrupt.

There are no mark-to-market rules on homes. If you are paying your mortgage, the bank doesn't care if the value of your home has declined below the amount of your mortgage. If the same rules applied to homeowners, the bank would force you to pony up the difference between your mortgage value and the depressed value of your home. I don't know of anyone who has a mortgage which operates that way.

Excellent points, thanks for contributing to the discussion.

Post a Comment