The bond market seems absolutely convinced that inflation is dead. Yields on short- and intermediate maturity Treasuries are at or very near all-time lows, and long-maturity yields are deep into all-time low levels. The spread between most TIPS and Treasuries (the market's implied inflation rate) has never been lower; outright deflation for the next few years is fully priced in at this point, presumably because of the collapse of energy, commodities, and real estate. Yet the firm "inflation is dead" stance of the bond market stands in sharp contrast to the gold market, where the precious metal trades close to $800/oz., far above its $255 low in 2001 when deflation pressures were clearly evident.

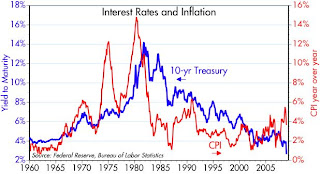

The bond market seems absolutely convinced that inflation is dead. Yields on short- and intermediate maturity Treasuries are at or very near all-time lows, and long-maturity yields are deep into all-time low levels. The spread between most TIPS and Treasuries (the market's implied inflation rate) has never been lower; outright deflation for the next few years is fully priced in at this point, presumably because of the collapse of energy, commodities, and real estate. Yet the firm "inflation is dead" stance of the bond market stands in sharp contrast to the gold market, where the precious metal trades close to $800/oz., far above its $255 low in 2001 when deflation pressures were clearly evident.So which market should you trust? Gold has a pretty good track record of forecasting inflation, as I have pointed out before. In contrast, this chart shows that the bond market has not done a very good job of forecasting inflation over the years. The y-axes are offset by 2 percentage points, so that when the two lines are on top of each other then bond yields are 2 points higher than inflation; this is roughly the long-term average spread of yields over inflation. During the inflationary 1970s, the bond market chronically underestimated inflation (and so did the Fed). During the 1980s and 1990s, the bond market chronically overestimated inflation. The action of the past few years looks a lot more like the 70s than anything else. Conclusion: the bond market is likely underestimating inflation risk today. And let's not forget that the Fed is absolutely committed to ensuring that deflation doesn't happen. The Fed has never been so anxious to see inflation.

4 comments:

Hello Scott,

Thank you for sharing your insights. I used to own one of the leveraged municipal bond etfs (PMX). I sold it over a year ago, but it’s still on my monitor, and I noticed the last few days some dramatic things happening to it. I believe Wamco had some experience with these types of instruments and would love to hear your thoughts on it.

Basically, it’s a municipal bond etf, leveraged by issuing adjustable rate preferred shares (ARPS) in addition to the common shares. The funds also leverage by creating inverse floaters out of long bonds it owns. Two things have happened – the auctions for the preferred shares have collapsed, leaving preferred owners stuck with shares they expected to be able to redeem at anytime for near par. Also, the prices of the base muni bonds has fallen to the point that the equity in the preferred shares is covered by less than 200% in assets (also means leverage from the preferreds is more than 50%). So for many of these funds the fund is forced by regulatory and bylaw rules to suspend the dividend.

As a result, yesterday the PMX fund was selling at a 18% discount from NAV. It seems to me anytime you can buy something at an 18% discount, it’s interesting. I’ve tried to consider what can go wrong, but I admit there is too many moving parts that I don’t understand well enough to make a good judgement. The most obvious “bad” thing that could happen is that interest rates on muni bonds could rise near term and with the high leverage the NAV would take a big hit. As for the ARPS, it seems the likely course of action will be for the fund to redeem the shares reducing leverage to the point they can pay common dividends again. Assuming that the shares are redeemed at market value reflected in the NAV, this shouldn’t affect NAV?

Do you think there is any value for the risk here? I’d be interested in hearing your thoughts even if just from an academic and general interest value.

Regards

Hi Scott,

For what it's worth, I believe the inflation of the 70s/early-80s was driven by the massive demographic wave of baby boomers moving into their 20s (relative to the much smaller number of people in their productive 40s/50s). During their 20s, Americans are getting decent jobs for the first time and beginning to form families and buying starter homes. Thus, they begin to accelerate borrowing against their future participation in the American Dream (consuming resources); yet, they are still not very productive in the workforce.

I believe that such demographic ratios determine a natural level of inflation (as well as NAIRU). At the current time, the ratio of echo boomers in their 20 relative to the number of baby boomers in their 40s/early-50s (productive years) is roughly one-to-one. This ratio has been increasing in recent years, so I was not surprised to see some increased inflationary pressure, but based on the realtively equal size of the baby boom and echo generations, the natural rate of inflation won't ever get close to the highs of the 70s.

Of course, if the Fed goes crazy and doesn't retract this massive quantitative easing in a timely fashion, the monetary excesses will swamp out the natural rate of inflation (I think gold is reflecting this risk).

I also worry about the unprecedented expenditures underway (and rising rapidly) for medicare/medicaid being deflationary. We are going to have increasing numbers of retired people around who are in their lower productivity years, and as it stands, we are poised to take massive sums of money (spending/investing power) away from productive age cohorts to prolong the life spans of unproductive cohorts. This massive deflationary force was not even directly discussed during the election; however, it seems to me the Democrat desire to move us to single payer healthcare is a stealth path to healthcare rationing -- probably the only solution to this out of control train given no politician will get elected telling the large block of retired and nearly retired voters they won't get the healtchare to which they feel entitled.

I think you know more about this subject than I do, so I can't be of much help. I have been trying to spend some time researching the general theme which you bring up, which is that there are some closed end bond funds that are trading at distressed prices and at huge discounts to NAV. I think your intuition is right, that there are some incredible opportunities there. The problem is lack of information; it's hard to find out just what is in these portfolios and what their major risks are.

But I would not find it hard to believe that the market has overreacted to perceived risks, and that there is great value here for the taking.

I know there are some funds that are backed by bank loans that are trading at prices which assume that virtually ever single loan will default, or that recovery rates on massive defaults will be only a fraction of what they have been historically.

Mark, over the years I have had several people try to sell me on the idea that demographics drives inflationary cycles, but I have never been convinced. I think inflation is absolutely under the control of the Fed.

The issues of healthcare and retirement are clearly major problems that are slowly approaching. But again I don't seen spending related to these as having any impact on inflation. The Dems do seem to want single payer healthcare and it is easy to predict that this will ultimately result in chronic problems, not to mention rationing. If they succeed, the economy will be saddled with an inefficient healthcare system and that will retard the rise of living standards.

Ultimately, the government is going to have to renege on its retirement promises by raising the retirement age, means-testing benefits, and changing the indexing formula for social security payments.

Post a Comment