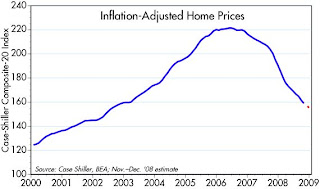

The Case Shiller home price index fell just over 2% from September to October, which is somewhat faster than the 18% annualized pace that we've seen for the past year. Projecting more of the same through year-end, real home prices according to this index will have fallen about 30% from their highs. That goes a long way to solving the housing affordability and attractiveness problem.

The Case Shiller home price index fell just over 2% from September to October, which is somewhat faster than the 18% annualized pace that we've seen for the past year. Projecting more of the same through year-end, real home prices according to this index will have fallen about 30% from their highs. That goes a long way to solving the housing affordability and attractiveness problem.Real home prices are now back to where they were in 2002, which was just before the housing bubble started to take off. Since 2002, real disposable personal income is up just over 15%, and now mortgage rates are the lowest they have been in our lifetimes, and substantially lower than they were in 2002. So homes are clearly more affordable today than they were six years ago. As long as the economy doesn't fall down a black hole (and last time I checked, the freeways in Los Angeles were as jammed as ever), the combination of these forces (lower prices, lower borrowing costs, and rising incomes) should put a floor under housing prices before too long. And that would dramatically reduce the threat to our financial system.

No comments:

Post a Comment