We now have inflation data through July, including the CPI and the all-important PCE deflators. Here are some updated charts and commentary. This situation is developing and I plan to watch these numbers closely.

Chart #1

Energy is by far the most volatile component of the CPI. Chart #1 shows the ex-energy version of the CPI, which rose by about 2% per year for almost 20 years. It's now risen significantly above that trend line, and this suggests that the rising inflation we've seen this year is not likely to be temporary. The whole price level has been lifted by an excess supply of money, and the Fed has no plans to raise short-term rates or to withdraw excess reserves from the banking system for a very long time.

Chart #2

Chart #2 shows two versions of the CPI using a 6-mo. annualized rate of change—which is more representative of the current behavior of pricing. We haven't seen inflation like this for a very long time.

Chart #3

Chart #3 shows the consequence of rising inflation for bond investors. The real yield on 10-yr Treasuries is now deeply in negative territory. This represents a significant loss of purchasing power for anyone holding Treasuries. Caveat emptor. How much longer will bond investors tolerate a government-guaranteed loss of purchasing power? How much longer will people keep tons of money on deposit in the banking system, when it pays no interest and is losing at least 4-5% of its purchasing power every year?

Chart #4

Chart #4 shows versions of the CPI year over year back to 1982, just after inflation peaked. We may well be revisiting the painfully high levels of inflation which first surfaced in the late 1970s.

Chart #5

Chart #5 shows the 3-mo. annualized change in the Core CPI. Yikes.

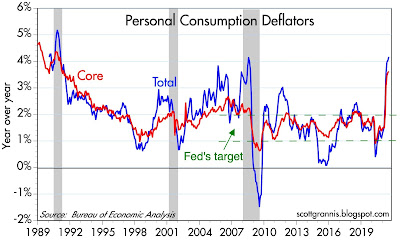

Chart #6

Chart #6 shows inflation as measured by the Personal Consumption Deflator, the Fed's (and most economists') favorite inflation statistic, given that it reflects a broad basket of goods and services and is periodically updated to reflect changing tastes and markets. There's no denying that we have seen a meaningful increase in a broad range of prices. Only overly accommodative monetary policy can support such price action. If monetary policy were not so loose, a surge in durable goods prices would likely act to depress other prices (because people would not have an unlimited supply of cash).

Chart #7

Chart #8

UPDATE: Thanks to reader Peter Barnes for bringing up the subject of money velocity. I've written a response and I want to add a chart to this post to illustrate my argument.

Chart #9

Chart #9 shows the demand for money (M2/GDP) which is simply the inverse of the velocity of M2 (GDP/M2). I think it's more logical to think of this in terms of people's willingness to hold on to M2 money, which predominately consists of retail bank deposits of various sorts). I think the chart shows that there is a clear tendency for money demand to rise during recessions (gray bars) and during periods of great turmoil, such as 2008-9 and the second quarter of last year. When people are scared and faced with uncertainties, it is natural to want to accumulate cash as a form of protection against the unknown. But for the past year things have been getting slowly better, and in fact the demand for money has declined by about 5% since June '20 by my calculations and estimates of current conditions. If the demand for money declines but the supply of money holds steady or increases, that is the classic prescription for a higher price level (i.e., inflation). And in fact that is what we have seen over the past year.

Viewed in velocity terms, what has happened over the past year is that people have been trying spend their money instead of accumulating more money. Dollars are being passed around faster and faster, and that supports a growing economy and/or rising prices.

If the demand for money were to fall back to pre-Covid levels, that would be the equivalent of unleashing a flood of $4-5 trillion into the economy (the M2 money supply is currently just under $21 trillion). And that would almost surely result in a bigger economy and much higher prices.

11 comments:

Certainly housing cost inflation is deadly serious and a topic that remains off the radar for most macroeconomists. The solution is simple: end property zoning and other government control of private property.

Wage inflation? Have to wait and see on that one. It's been a long time since the American labor force had much leverage (unlike property owners). Q2 unit labor costs were nearly flat.

Business owners up and down the West Coast and certain other markets have it tough. Their workforce needs to make enough to pay the rent, and the rents are skyrocketing. Not a pretty picture.

In any event, institutional investors are buying 10-year Treasuries that yield 1.3% or so.

Inflation remains dead in large parts of the global economy.

My crystal ball seems to get foggy....

Cost push and inelastic supply curves, just in time supply chain shortages. Demand pull - direct stimulus payments, child tax credits, increased food stamp budgets and extra federal unemployment insurance to consumers. Money supply... Inflationary pressures from all directions.

Following up on the other comments--Scott, I hear you on the risk of inflation, but you yourself have discussed the velocity of money and its role in the money supply. Velocity remains at historic lows. The Fed and the government can flood the economy with money, but if consumers don't use it to spend, where is the (excessive) demand that fuel higher inflation permanently? Thanks. Peter B.

Peter: the velocity of money is indeed a crucial variable (velocity of money = GDP/M2). However, I prefer to look at the inverse of velocity, which is the demand for money (demand for money = M2/GDP) since I think it makes it easier to understand what is going on. The velocity of money is near an all-time low, and the demand for money is near an all-time high.

My thesis has long been that the demand for money, which typically increases in times of economic and social turmoil, is very unlikely to increase further, unless some other catastrophe befalls us. Instead it is likely already in decline, given the relatively rapid normalization of employment, demand, and economic growth. If the current level of M2 increases or even just holds steady, falling money demand will lead to a higher price level, because people will want to spend rather than hold on to all the money they have accumulated. And in fact, I'm pretty sure this is what has happened over the past year.

I'll add a chart of money demand to this post to make it clear.

The 'money demand' or the inverse of 'money velocity' discussion is interesting and begs the following question: do productive people really want or need all this excess money?

The excess savings resulting from the short term public debt to money swap has been concentrated in the high net worth individuals' bank accounts (this is not mentioned for the inequality aspect, it's just for the analysis). If productive people's demand for money for productive purposes is on the rise why is the demand for commercial and industrial loans so anemic? i realize there are 'base' effects from last year when corporations massively drew their credit lines to bolster cash and it may take some time (like the inflation readings) to see more enduring trends but corporations have used most of the excess savings to pay back the credit lines and to reinstate significant share buyback activity, not for productive investment purposes. Productive animal spirits, where are you?

https://fred.stlouisfed.org/series/H8B1023NCBCMG

"Productive animal spirits, where are you?"

1. for consumers/household sector, buying a home is the biggest financial decision most make. The new homes built/capita has been declining for about 30 years, which coincides with the decline in durable goods.

2. People in general, and consumers specifically tend to have "animal spirits" when they perceive not only current good times, but that they will retain their wealth and good times are in future expectations. With the job market being impacted so much by durable goods- which have been sick for decades, you are not going to see lots of loans for "physical plant, equipment, buildings/residences, etc.

I think the inflation rate is transitory because the economy is too punk to support a lot of demand. The price level isn't transitory. I think the data are already starting to show this.

If the government continues to pass multi-trillion spending increases, then we'll have long-lasting inflation.

Case Schiller hockey stick and approaching housing bubble YOY change.

https://1.bp.blogspot.com/-YsXRQwtp0ec/YQAFRuGOJ3I/AAAAAAAA6VY/58aXRwvQvM8yzA9XWk0ducWwxUOY-3P7QCLcBGAsYHQ/s1020/CSYoYMay2021.PNG

https://www.calculatedriskblog.com/2021/08/schedule-for-week-of-august-29-2021.html

"If the government continues to pass multi-trillion spending increases, then we'll have long-lasting inflation."

That may be, in fact, a paradoxical situation. There has to be a point-of-no-return whereby the inflation genie will leave the bottle but large-and-advanced-economies countries are discovering the absence of significant constraints in this ultra-low interest rate world often combined with the theoretical ability to print money and to proceed to pseudo-monetary financing. Typically, in the real world, the cost of debt goes up as leverage goes up, especially if a restructuring is one of the scenarios. What's going on here?

If you're into an analogy about the Treasury-Fed complex tampering with money supply, the complex is finding out that the Rubicon is very wide and it's not clear when the Rubicon will be crossed. But in this modern day world, we may find out that the Rubicon is much deeper than previously thought and we're finding out without real constraints (or alternatives) and that's why monetary velocity may fall in an unprecedented way, no matter how much money supply is freely and easily provided for so-called liquidity purposes.

File under: What did they think was going to happen?

A government runs trillion dollar deficits using fiat currency backed by fairy dust and colorful unicorn droppings. The same elected officials of that government then voluntarily shut down their own economy while temporarily sending out more and more free fairy dust/unicorn dropping based dollars to all of their constituents (read: Bottom 90% of US households).

Meanwhile, the property owners (a.k.a. Investor Class, Top 10% of US households, Quasi elites, etc) decline to sell their own products and services at the fixed currency price expected by the people and their government. Anyone who wants to dance at this big party must first pay the fiddler. Voila! Inflation...if that makes sense?

Apple (AAPL) now has a $2.5 trillion market cap.

In a world of supply shortages and pandemic.

The statistics are misleading and underreport inflation. Inflation psychology suffers from worse misinformation than masks and vaccines do. You are late to the party. There are reasons that gold is almost $2k/oz. But better late than never.

Post a Comment