This blog has consistently employed a supply-side approach to fiscal policy (e.g., improving the incentives to work and take risk tends to lead to a stronger and more prosperous economy, as does reducing regulatory burdens) and a classic approach to monetary policy (e.g., inflation occurs when the supply of money exceeds the demand for it). In this post I focus on monetary policy, reiterating and amplifying observations that I have made over the past decade or so.

It's easy to measure the supply of money, and the Fed provides those statistics weekly. The M2 measure of money is broadly favored, and it is the one I have consistently used. More recently I have emphasized two components of M2—savings deposits and demand deposits—which together comprise about 75% of the $18.4 trillion M2. I have argued that these two measures are a good proxy for the demand for money, even as they are also measures of the supply of money. Both components represent money that has been set aside my consumers and businesses as a form of saving, security and/or comfort—essentially a hedge against risk. They are distinct from checking accounts and currency in circulation, since those are held primarily for convenience (e.g., to make monthly payments and to make miscellaneous purchases) rather as a risk-free store of money.

With the interest paid on savings deposits and demand deposits now hovering just above zero, it's easy to see why these deposits are a good proxy for money demand. Since they yield practically nothing, people hold them simply because they want a store of value that is easily accessible and relatively risk-free. For most of our history, these deposits paid an attractive rate of interest that was greater than the prevailing rate of inflation (i.e., real interest rates were positive). Those conditions (high interest rates) served to muddy the monetary waters, since it's tough to know whether people held these deposits as investments or merely as a store of value. Now, with interest rates at or near zero it's easy: they respond directly to people's demand for money and safety.

As I predicted back in 2009 and 2010, when the M2 measure of money was growing faster than ever before, the then-rapid growth of money would not be inflationary, because rapid M2 growth was being driven by strong growth of savings and demand deposits. The Fed was accommodating a huge increase in the demand for money; the Fed was NOT "printing money" with abandon as so many thought. (That includes yours truly, since I worried about rising inflation in late 2008 and early 2009. I later realized I was wrong.) The proof of the monetary pudding, as it were, was to be found in the fact that inflation has been low and relatively stable for a long time. Indeed, the world has worried more about deflation in the past decade than it has about rising inflation, despite rapid growth in the money supply.

How do you get low and even falling inflation when the supply of money is expanding rapidly, as it did in late 2008 and early 2009? It can only happen if the demand for money is growing as fast or faster than the supply of money. If a farmer is selling more apples every day it's because the demand for apples is also increasing every day; otherwise he would find himself with a glut of apples and would soon have to cut the price of his apples. A lower price would be required to bring demand back into line with supply.

What follows are some charts which focus on money supply and money demand. The story they are telling is similar to what it was a decade ago: incredibly rapid money growth is occurring because the demand for money is incredibly strong. The Fed is not printing money and so, for the time being at least, there is little risk of inflation.

Chart #1

Chart #1 shows the composition of the M2 measure of the money supply. Bank savings deposits make up by far the biggest portion, and they currently total almost $11.6 trillion. Currency is the next largest portion, currently totaling $1.9 trillion. One could argue that currency in circulation in a good measure of money demand, because nobody holds onto currency unless it serves them a purpose. It's complicated, however, because foreigners hold the vast majority of US currency. Do some math, and you will see that if $1.9 trillion of currency (mostly $100 bills) were held by only US residents, then each of us would be holding almost $6,000 in cash on average. Don't know about you, but my family rarely has more than $1000 in cash lying around or stashed under the mattress. Currency tells us a lot more about foreigners' demand for money than it does about the demand for money of US residents. Interestingly, currency has surged at a 23% annual rate since last February, which suggests the whole world is scared of Covid—which is not surprising since Covid is a problem everywhere. In any event, the Fed supplies currency only on demand, and in exchange for bank reserves, so the supply of currency and the demand for it are always in balance.

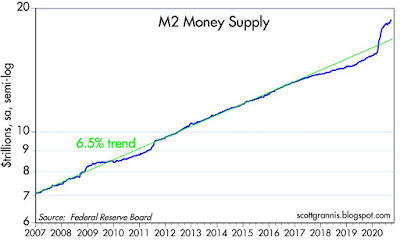

Chart #2

Chart #2 shows the level of the M2 money supply compared to the long-term trend rate of M2 growth (green), which has averaged about 6.5% per year for the past 20 years. M2 exploded starting last March, as the Fed pulled out all the stops and the federal government began mailing big checks to tens of millions of displaced workers and struggling businesses. M2 has now increased by about $3.2 trillion over the past seven months. Growth in savings and demand deposits account for about 80% of the increase in M2.

Here's the underlying and underreported story: federal debt has increased by almost the same amount ($3.4 trillion) as M2 has since last March. The Fed bought substantially all of the Covid-era federal debt (notes and bonds) issued by the federal government and paid for them with bank reserves. The banking system experienced an equivalent surge in deposits, which they used to buy the treasuries the Fed then bought from them. The banking system effectively "invested" their deposit surge in bank reserves. By buying over $3 trillion of treasuries, the Fed effectively converted (transmogrified, as I like to say) notes and bonds into short-term, risk free assets, since bank reserves are essentially T-bill substitutes which the banks find to be an attractive way to invest their deposit inflows. Bottom line, the increase in the money supply was driven by an equivalent increase in the demand for money and money equivalents. That's not inflationary.

Chart #3 shows the 3-mo. annualized growth rate of savings and demand deposits, which was truly explosive from early March until just a few months ago. Note how this component of M2 also experienced rapid growth around the time of the Eurozone crisis in 2011, when money fled to the security offered by US banks. Note also how the growth of savings and demand deposits slowed in the wake of the Nov. '16 elections: money held in safe form flowed back into the economy as confidence increased and the economy prospered. If we're fortunate, the economy will sooner or later lose its fear of Covid and money will once again leave deposit accounts and go back into the economy, there to fuel rising consumption and an expanding economy.

It's important to note here that the growth rate of M2 has almost completely returned to what it was prior to the Covid crisis: in the past three months M2 has increased at about a 10% annualized rate, and in the three months prior to last March, M2 increased at about a 6% annualized rate. What that means is that demand for money is no longer rising by much. Thus the Fed has little reason and little need to continue to convert notes and bonds into T-bill equivalents. Simply put, there doesn't seem to be a need for much more "monetary stimulus" as it is incorrectly referred to (actually, it's just an accommodation of increased money demand).

Chart #3

Chart #3 shows the 3-mo. annualized growth rate of savings and demand deposits, which was truly explosive from early March until just a few months ago. Note how this component of M2 also experienced rapid growth around the time of the Eurozone crisis in 2011, when money fled to the security offered by US banks. Note also how the growth of savings and demand deposits slowed in the wake of the Nov. '16 elections: money held in safe form flowed back into the economy as confidence increased and the economy prospered. If we're fortunate, the economy will sooner or later lose its fear of Covid and money will once again leave deposit accounts and go back into the economy, there to fuel rising consumption and an expanding economy.

It's important to note here that the growth rate of M2 has almost completely returned to what it was prior to the Covid crisis: in the past three months M2 has increased at about a 10% annualized rate, and in the three months prior to last March, M2 increased at about a 6% annualized rate. What that means is that demand for money is no longer rising by much. Thus the Fed has little reason and little need to continue to convert notes and bonds into T-bill equivalents. Simply put, there doesn't seem to be a need for much more "monetary stimulus" as it is incorrectly referred to (actually, it's just an accommodation of increased money demand).

Chart #4

Chart #4 compares the level of nominal GDP to the level of M2. Both have increased by about the same order of magnitude over the past 60 years. Until this year, that is. What's happening is that the economy has effectively and suddenly increased its desire to hold money rather than to spend it. This is a natural reaction to the great uncertainty and fear that the Covid crisis has caused. But as that tendency reverses—as the demand for money declines—there is plenty enough money out there to fuel a big increase in real and nominal GDP.

Chart #5

Chart #5 divides the level of M2 by the level of nominal GDP. I've labeled the result "money demand." I like to think of this as being a proxy for the amount of cash and cash equivalents the public wants to hold, expressed as a percentage of average annual income. Prior to the Covid crisis, as a country we were comfortable holding a cash and cash-equivalent reserve equal to about 70% of our annual income; now it's almost 90%. Money demand was relative stable for many decades, but it has increased dramatically in the wake of the Great Recession and now during the Covid panic. However, money demand is already beginning to decline. I've estimated the value of the ratio for the third quarter, assuming 10% annualized growth in M2 and a 30% annualized growth of nominal GDP. It will probably decline a lot more in the months and the years to come as confidence returns and the economy grows.

What happens when the demand for bank deposits declines? Let's say the public decides over the next year to withdraw $1 trillion of the $3 trillion they added to bank deposits this year. As the money is withdrawn, banks will no longer need $1 trillion of the bank reserves they "bought" this year. Banks can simply sell their reserves back to the Fed in exchange for notes and bonds. They can then sell the notes and bonds in exchange for cash which they can then distribute to those who are withdrawing their money. In the process, the demand for notes and bonds will decline, and that would likely translate into higher interest rates. Which is exactly what we would expect to happen as the economy recovers and returns to more normal conditions. If the Fed is on top of this development, they will happily sell notes and bonds and retire bank reserves, and the money supply will shrink in line with a reduction in money demand. But if the Fed insists on keeping plenty of reserves in the banking system, they would risk creating a surplus of money and that would be inflationary.

One soon reaches the conclusion that the Fed has been reacting to changes in the demand for money rather than stimulating anything. I and others have said this many times in the past. The Fed would have us believe they re setting the tone and the level of interest, when in reality they are simply accommodating the mood of the market. Whatever the case, it is clear that interest rates are extremely low not because the Fed has said so, but because the market's demand for short-term, cash-equivalent assets (e.g., T-bills and bank reserves) is enormous. The market is willing to pay such a high price for them that their yield has been pushed down to near zero. Thus, the prevalence of near-zero or even negative interest rates can mean only one thing: risk aversion remains very strong these days. The market is not exuberant or irrational. The Fed has not stimulated anything.

Chart #6

Chart #6 is my favorite way of seeing whether the Fed is behaving correctly. The blue line is the inflation-adjusted Fed funds rate (i.e., the Fed's target rate minus the year over year change in the Core Personal Consumption Deflator), and the red line is the real yield on 5-yr TIPS, which in turn is essentially the market's expectation of what the real funds rate will average over the next 5 years. When the blue line is below the red line, the Fed is behaving well and the economy is healthy, because the market is expecting the real funds rate to rise in the future. But when the blue line is above the red line this means the Fed is so "tight" that the economy is likely to weaken and the Fed will eventually need to lower the real funds rate in response. Today it looks like the Fed is just about right.

The charts that follow are interesting in their own right, and help me to understand what's going on in the economy:

Chart #7 compares the price of gold to the price of 5-yr TIPS (using the inverse of their real yield as a proxy for their price). It's remarkable that the prices of these two completely different assets should be so closely correlated over so many years. I can only conclude that the market views both assets as "safe havens." Both provide insurance against nasty events: gold protects you from disasters of all sorts, and TIPS are guaranteed to protect you against a rise in inflation. Both prices appear to have peaked, which suggests that the demand for money and safety has peaked. That confirms the message of M2.

Chart #8

Initial claims for unemployment were disappointingly unchanged last week, but continuing claims continued their strong downtrend, as seen in Chart #8. From a peak of 25 million in early May, they are now down to 11 million. That means that at least 14 million people who lost their jobs have now gone back to work. In other words, 60% of the jobs lost have been recovered, which further suggests an ongoing decline in the rate of unemployment. That counts as a V-shaped recovery in may book. It's tragic, however, that there are still so many unemployed, and that their ranks are filled with the most vulnerable. The only solution for so much misery is to OPEN THE ECONOMY ASAP. Failing that, the government should somehow compensate the workers who have fallen on hard times directly as a result of terribly misguided public policy choices.

Chart #9

Car sales, shown in Chart #9, have almost completely reversed their Covid plunge. Another V-shaped recovery.

Chart #10

Chart #11

Chart #12

Charts #11 and #12 show that air travel is decidedly NOT enjoying a V-shaped recovery. For the past three months, gains in passenger traffic have been very small. Overall traffic today is still down some 66% versus year-ago levels. A sobering statistic. Fear of flying will be with us for a long time, it would appear.

Covid comments

Catching Covid is not a death sentence, as Trump has showed us: "Don't be afraid of Covid. Don't let it dominate your life." Very wise words from our Commander in Chief, who is unafraid to bow to the prevailing orthodoxy of fear. In that regard, Heather Mac Donald has a very good quote (HT Mark Perry):

"Reopening is still the right policy. Mandatory outdoor mask-wearing is merely a way for government to turn citizens into walking billboards of fear, sending the false message that danger is everywhere. Infection rarely leads to death. Most of the infected recover. Given his governmental duties, the surprise is that Trump—as president, another kind of front-line worker—has not gotten sick before now."

Don't miss the Great Barrington Declaration, an open letter signed by more than 7,000 mental & public health scientists and medical practitioners. In it they argue strongly for opening the economy, especially schools, while protecting the vulnerable (i.e., mostly the elderly and infirm). Here is a functioning link for the Great Barrington Declaration.

UPDATE: A MUST WATCH VIDEO by Dr Reiner Fullmich. An intelligent, well-argued brief for why there was never a Covid “pandemic.” It’s always been just a bad flu, as I and many others have been arguing since last April. Lockdowns have had no impact. Tests, as even the NY Times has admitted, cannot reliably detect Covid infections, and the vast majority of positive results are false positives. It’s a “case-demic” not a pandemic. Governments everywhere have systematically trampled the constitutional rights and liberties of their people without any justification. Watch it and weep for the miseries unnecessarily inflicted upon millions of innocent people and businesses.

28 comments:

But if the Fed insists on keeping plenty of reserves in the banking system, they would risk creating a surplus of money and that would be inflationary

Hello Scott. im always a big fan of your work. And I like your positive thought.

above a sentence i copy from your post today. i die to get more about it.

where and how can we estimate (which ratio, which indicator, which chart... ?) the insistance of the FED ? Ive found a ratio of 10% for bank reserve. do you use this ratio to keep an eye about the strategy followed by FED ?

In the past three months alone, ex petrol USA trade deficit increased by 200 billion! In about a year it could be a trillion.

This is net local demand used by external supply.

One has to keep this in mind when trying to understand the local economy and the impact of inflation.

It's a massive leakage of demand.

"everything is supply side" economists should consider the impact of external supply and capital flows on the local economy. It's 2020.

"Catching Covid is not a death sentence, as Trump has showed us" - Scott Grannis

Trump, for now, seems to be recovering thanks to Regeneron:

https://www.technologyreview.com/2020/10/07/1009664/trumps-antibody-treatment-was-tested-using-cells-from-an-abortion/

"developed with the use of a cell line originally derived from abortion tissue".

Thank God for scientists and not having the supreme court filled with religious extremists that would have prevented this scientific outcome.

Here's Trump on Regeneron:

https://bit.ly/36NQHNU

Roy, re trade deficits. For a supply-sider, or any classical economist for that matter, trade deficits are meaningless. The net flows of capital, goods, and services across international borders are the result of hundreds of millions of individual decisions. No one is calling the shots on whether the US should buy more goods and services from the rest of the world, and if it does, how that is paid for. Maybe the trade deficit is the result of tons of foreigners deciding that they want to buy US assets (bonds, deposits, stocks, real estate) instead of US goods and services. If they buy more of our assets than our goods and services, that results in a trade deficit. So what?

The trade deficit is one economic statistic that should never have been invented, because it only serves to motivate ignorant politicians who think it should somehow be "fixed." And that goes for Trump too; from day one I have criticized his fixation on our trade deficit. His only defense is that there are bad economic actors like China that might seek to exploit our dependence on them for critical goods, and that is something we should avoid.

Scott,

Yes, it's obvious you disregard capital inflows. That's exactly my point.

" Maybe the trade deficit is the result of tons of foreigners deciding that they want to buy US assets (bonds, deposits, stocks, real estate) instead of US goods and services. If they buy more of our assets than our goods and services, that results in a trade deficit. So what?"

In some markets, there is no "decision". It's not some free market balancing. Various large and significant markets have intrinsic imbalances that limit demand as percentage of their total economies.

Germany is the country with the largest current account surplus in the world. Why does it matter? Because they achieved this by intentionally implementing local regulation that limit households/consumers income (as percentage of the economy). This means a lack of demand for the global market, and and imbalance that has to be resolved somehow. It has to be paid for (I'm looking at you, Spanish and American households...)

You are basically saying, that if a foreign market decides (I would say, is forced to) to spend its 1 trillion USD on US government debt, it's the same as if this foreign market's consumers would have spent 1 trillion USD on American made goods and services.

This is not a theoretical question, it's what is happening now.

You would likewise state, that if Jeff Bezos decided to use 100 billion to purchase US government debt, it's exactly the same as if he would have spent 100 billion, on purchasing goods and services produced and provided in the USA.

This is the main issue with economic inequality. And no, it's not the 1%, it's the 0.01%. The 0.01% would not put any extra marginal dollar (billion, 100 billion, a trillion...) into the real economy, thus impacting demand, and the economy as a whole.

There's always some inequality, as should be, but there comes a point that the numbers make a difference.

Just to be clear, the Trump tariffs are ignorant and futile. It's easy to see why they can't and won't work. What they should do, is tax capital inflows.

Wearing a mask is a "better safe than sorry" measure that prevents the spread of a disease that is still poorly understood. Of course, covid has already killed more than 218,000 Americans. This is a conservative measure: if we measure deaths by excess mortality, the number is well above 300,000. But deaths are only one of the harmful effects of covid and may not even be the most serious. Recently, there has been evidence that covid does long-term damage to the heart, lungs, and brain even among people who only suffer a mild form of the disease. These effects are not confined to the elderly but affect people in the prime of life.

https://www.cnbc.com/2020/10/07/long-covid-sufferers-struggle-to-return-to-work.html

It may ultimately prove the case that lockdowns and mask-wearing are not the best way of dealing with this disease. But since we don't understand its effects yet, people who advise letting down our guard are just hoping for good luck. We should be taking all measures to prevent the spread of the disease that are not unduly burdensome.

And wearing a mask is not unduly burdensome. When I see someone wearing a mask, I don't see a "billboard of fear." Rather, I see a good citizen who is willing to endure a minor inconvenience in order to lower the risk of a major evil. It's the people who refuse to wear masks who disturb me because through their negligence they are communicating that they don't care about the health of their fellows.

I'm sick of the mask debate. They are patently impractical to stop the spread of viruses in the ordinary business of human life.

I'm disappointed to see it dividing otherwise intelligent people.

If, in fact, anything needed to be done which is almost certainly an emphatic "no," it is the hospital and healthcare system that should have been re-organized, not the social fabric and infrastructure of human society.

Ian, at one point I thought excess deaths was a good proxy. Now I doubt the usefulness as an indicator of Covid deaths. The reason is that there are likely non-trivial excess deaths from the negative effects of Covid fear. Delayed health care for other diseases; excess drinking and drugs; depression; etc. Given how different countries count deaths from Covid differently, and the politics of it, and the complications described above - I'm skeptical we can have any useful / reliable comparative statistics.

One thing I'm pretty sure of is that there is no reason to think things would have been meaningfully different with an Obama administration, or Harris/Biden.

"No one is calling the shots on whether the US should buy more goods and services from the rest of the world,"

This is the usual economist claptrap that ignores the prerequisites for "free" trade (better called "fair").

Friedman: "It's just obvious you can't have free immigration and a welfare state,"

More complete: "can't have open borders to immigrant workers or capital to build factories in low wage labor markets" - same concept.

To argue in the extreme: what if your trading partner has slave labor? - many have "de-facto slave labor" by paying very little.

NB- I have been doing international business for decades and lived abroad for several years doing business.

I have seen what low wage labor markets are like. Because US workers have had to compete with that, the lower 50% of wage earners have gotten hosed for 30+years.

Another great post from Scott Grannis.

I think I disagree with Scott Grannis on monetary policy, but I certainly enjoy reading his perspective.

My understanding is the Federal Reserve, when conducting QE, buys Treasuries from the 21 primary dealers.

The 21 primary dealers assemble clumps of Treasuries to sell to the Federal Reserve, by buying Treasuries in global capital markets.

The primary dealers then sell their Treasuries to the Federal Reserve, and then make a deposit, counted as a "reserve," in a commercial bank.

I think this is a Fed-initiated or directed result. I see no reason why a typical investor would prefer to be in safe and liquid cash as opposed to liquid and safe Treasuries, which offer a minor yield.

What is interesting is no one really seems to know who the bond sellers really are (that is the people who sell bonds to the primary dealers) and what they do with their money once they have sold their bonds. Some macroeconomist assume they reinvest the money in other securities, but it is also possible they consume a portion of their new cash.

Another confusing factor is that capital markets are liquid, fungible and global. And there are other major central banks operating upon the same global capital markets (PBoC, ECB, BoJ, etc.). BTW, I think global capital markets are glutted, due to higher incomes globally resulting in a flood of savings. Sad to say, but capital is no longer scarce.

Add on, the Federal Reserve now pays interest on excess reserves.

To quote my late great Uncle Jerry: "If you are not confused, then you probably don't understand the facts."

I have disagreed with Scott Grannis on certain aspects of monetary policy for years and years. But I sure benefit from reading his columns.

Scott,

Not to pick nits: But, I am not convinced the low air traffic numbers are related to "fear of flying" as much as they are related to the lack of inter-state commerce opportunities.

There are no (or at least very few) in-person conventions, seminars, expos, shareholder meetings, etc. I can't go visit most of my customers (the bigger ones out of state). No fans allowed at football games, the US Open, etc. And, fewer kids are "going-away" to college.

I think air travel is going to be thin until these situations are reversed.

Randy,

One thing I'm pretty sure of is that there is no reason to think things would have been meaningfully different with an Obama administration, or Harris/Biden.

I am reluctant to make categorical statements related to hypothetical situations. So, I will just say this: It should be clear to anyone that is paying attention that the media has successfully divided the country. Most of the main outlets for (what in the past would have been described as) "news", are now nothing more than PR extensions of the parties they align with. Fox maintains significant ratings simply because the outlets for a conservative point of view are otherwise few and far between. The other outlets have been more than happy create a hysterical environment around a virus that has a "critic" infection rate that is now less than 1%, and dropping.

Again. There is no point in arguing a hypothetical. However, if you think the non-Fox "news" outlets would have created this much hysteria during a re-election year for a sitting Democrat President, I would have to say we must agree to disagree.

Rhapsody - actually we agree. I'm 100% certain that if Obama or Harris was president, and the general outcome was exactly the same, the media would frame them as heroes. Look no further than Cuomo's press coverage in a state with catastrophic mistakes. We can bet on the coverage changing the moment Harris/Biden are elected. The trending improvements will all be due to Harris/Biden performing a superior job.

Wow. I'm so amazed by how much effort you put into creating a well thought out and researched post, FOR FREE. Thank you, Scott.

Donald is now immune to COVID-19, and no longer contagious. Its official.

He is now SUPER TRUMP, able to travel freely throughout the country, without mask or any restrictions, whatsoever.

Look at his rally tonite, packed to the gills in Florida with barely over 24 hours notice to the rabid participants.

The man is acting 20 years younger. SUPER energy. He is amazing. That was a love festival with America, tonite.

All the deplorables and lower class blue collar grunts are rabidly excited. The blacks, and latinos and working poor, too.

Finally a guy who fights for them instead of for the scum of DC.

They will love this man forever, even after he has served his next 4 years. The first President in US history to not break a single campaign promise, and to stay focused on every stated promise. He has never let us down. Nor will he.

Look at the optics: Donald virile and brave and immune. Outworking Joe 10:1 for the next 25 days. Positive and strong. Answering any and all questions from any lying "journalist" or critic. Laying out his America-First course of action clearly and logically. 401-Ks making new highs. China is going to pay for this BS virus scheme with complicit DEMs. Watch and see.

Vs.

Weak-ass Joe, holed up in his basement, separated 20 yards from any sentient being, and yelling at the sky, shaking his withered fist from behind a filthy infected mask that he handles and coughs into...screaming doom and gloom while telling voters "YOU DONT DESERVE TO KNOW" his policy details. Going to great lengths to avoid any press questions, such as they are. EMPTY RALLIES.

Riding around to empty "rallies" in 20-car motorcades of pretention, and fake importance. The only people lining the streets are Trump fans jeering and making fun of him.

A lifelong liar and plagiarist. THREE DEGREES! TOP OF MY CLASS! FULL SCHOLARSHIP!! I GREW UP IN A BLACK CHURCH!! I BROUGHT BACK MANUFACTURING JOBS!!

Joe and his drug-addled son getting everything in place to line their pockets FURTHER from CEOs and foreign nations, paying homage, and hoping for a favorable policy edict. Hillary Clinton Foundation, 2.0.

Meanwhile, Joe wants a massive tax rate hike so that corporations will finally begin to hire. Let that sink in.

Actually, it is so that lobbyists will work their deals and curry favor with a bounty of spoils.

And lets get back in that Paris Accord and TPP! We know you all are clamoring for that. American sovereignty is so overrated, doncha know. Voters are suckers to be exploited. What better way to serve America than to have world-governing bodies supersede Congress!

There has never been this large of an enthusiasm gap between two Presidential candidates in US history.

Dukakis was the previous winner for most pathetic DEM representative. Joe will lap him. 3 time loser.

SUPER TRUMP in a landslide. God Bless Donald.

Investors Daily poll shows that stock investors overwhelmingly are demanding higher tax rates for themselves and companies, and more want regulations on businesses. Stock investors also overwhelmingly believe that Joe Biden and Kamala Harris have more business acumen than Donald Trump, and know how to best put America on a solid footing for the future.

The Investors Daily poll picked Trump to beat Clinton, and is solidly picking Biden to win this time.

Because of the higher taxes and regulations that all investors demand.

At the risk of seeming rude by posting a link to my own blog, I would suggest that you're ignoring the most corrosive risk of all from our wild spending sprees: a disconnect between ourselves and reality. There's no need to understand what's happening in places like LA, SF, NYC, Chicago, etc. if you can throw free money at the problems and then go back to your lives as if nothing's wrong.

Living In A Bubble Of Money

JBD: What's not to like if Biden/Harris win? Zero interest rates for several years and unlimited stimulus if there is a Blue Wave. People waited 8 hours to vote for Biden/Harris in the Metro Atlanta area yesterday while I sheepishly voted for Trump/Pence. PS: Don't tell my family or firm. I will be banished to solitary confinement if they ever find out!

October 12, 2020

COVID-19 and Excess All-Cause Mortality in the US and 18 Comparison Countries

Alyssa Bilinski, MSc1; Ezekiel J. Emanuel, MD, PhD2

JAMA. Published online October 12, 2020. doi:10.1001/jama.2020.20717

The US has experienced more deaths from coronavirus disease 2019 (COVID-19) than any other country and has one of the highest cumulative per capita death rates. 1,2 An unanswered question is to what extent high US mortality was driven by the early surge of cases prior to improvements in prevention and patient management vs a poor longer-term response.3 We compared US COVID-19 deaths and excess all-cause mortality in 2020 (vs 2015-2019) to that of 18 countries with diverse COVID-19 responses.

Interesting write up, and it shows the new "orthodoxy" in the monetary system. Many have the same view as you do, I think its the correct view too.

On Covid-19 I would not use Trump as an example; he received health care that 99.999% of Americans don't have access to! The cost of all these doctors must have been in the 100,000 of thousands and some of the medication is simply not available.

It's like saying that you should live your life like a billionaire

Aside from that glad that Trump recovered...that way the GOP cannot bitch that he was not there when he gets voted out of office

Johnny B. Dawg

Trump didn't break one campaign promise?

You must be kidding. The huge spending and deficits before the pandemic were not promused. A "wall" was promised that Mexico would pay for. Not much was built. The negotiations with China were a disaster. CO2 is still officially a pollutant. Economic growth was only slightly better than under Obama during the 7.5 years after the December 2007 recession ended, in spite of large corporate tax cuts that boosted growth for one year.

Trump promised more than any other candidate in my lifetime so there was no way any human could deliver all those promises. My honest evaluation, based on two long articles in my former economic newsletter, is a grade of B for Trump's first two years, and a C for Trump's last two years. The last two years were ruined by Democrats in the House and then the pandemic. Those grades may sound low, but I'm a libertarian, not a Trump cheerleader.

A survey in my neighborhood in Michigan found nine Biden signs and only two Trump sogns. Two homes had John James signs - a Republican Senator so they are likely to be Trump voters too. The one Black Lives Matter sign disappeared, and one Trump sign disappeared too. But an All Lives Matter sign replaced it.

I last voted for a Republican in 1980, favoring libertarians. This time I'm voting for Trump, and so is the wife. By absentee ballot tomorrow. Trump is obnoxious -- he better be more polite in the next debate -- that turned off lots of women. It's always smart to let Biden talk until he makes a mistake. Interrupting Biden gives him a break.

"Trump promised more than any other candidate..."

Not to pick nits (or.. is that now regarded as trigger language, I can't keep up) but I'll never forget the Obama primary acceptance speech. About the only thing not laughable is that the road was long. A little credit for ACA providing care to some (with arguably negative impacts to everyone else.)

"The journey will be difficult. The road will be long. I face this challenge with profound humility, and knowledge of my own limitations. But I also face it with limitless faith in the capacity of the American people. Because if we are willing to work for it, and fight for it, and believe in it, then I am absolutely certain that generations from now, we will be able to look back and tell our children that this was the moment when we began to provide care for the sick and good jobs to the jobless; this was the moment when the rise of the oceans began to slow and our planet began to heal; this was the moment when we ended a war and secured our nation and restored our image as the last, best hope on Earth."

IRIS: Take out the deaths from incompetent policies in New York and New Jersey and get back to me on those stats about US deaths vs the world. The NY Governor murdered thousands with his edict forcing infected hospital patients into nursing homes, instead of into the thousands of free hospital beds that Trump provided at no cost to the State. NY Gov made sure those went completely unused.

Cliff: Trump kept every promise. The Mexico deal is paying for the wall. Hundreds of miles have been constructed, and hundreds more are underway.

I’ve been told disrupting China trade and tariffs would cause massive inflation and loss of businesses. The exact opposite occurred. Of course they did retaliate by releasing an engineered virus on the world. But that’s why we need to stop favoring them.

Tax revenue spiked to all time highs, growing at a 6.5% annualized rate after the Trump tax cuts began. That’s because of soaring profits and paychecks.

Trump didn’t break a single promise.

Your comment saying you haven’t voted for a PUB since 1980 tells it all.

Trump did not come close to delivering every promise. Our nation now has far more government spending and far less freedom than at any time since World War II. Did Trump promise that? You, as a Trump cheerleader, may blame others, but it happened during his watch and he did nothing to stop it ... except maybe getting COVID and recovering quickly.

While I am disappointed with the sorry state of our nation's economy so many months after the "temporary flatten the curve" lockdowns should have ended, my wife and I turned over our all Republican ballots today, hoping Trump wins Michigan again. That would be refreshing, as we continue to suffer from Governor "Witless", disappointed that she did NOT get kidnapped.

The people here on this blog who claim COVID, still in progress, was no worse than a typical seasonal influenza are clueless, and hopefully in time will realize how foolish they were. On the other hand, the over reaction to the virus ALONE was worse than ANY prior influenza except the 1918 flu that killed my grandmother.

I now know five COVID infected people and three only had loss of smell and taste. One later developed serious repiratory symptoms after her boyfriend tested positive. She tested positive once and then negative twice - she had bronchitis, not flu.

I no longer trust COVID test results. I do trust vitamin D supplements.

Say hi to the rest of the motorcycle gang Deputy Dawg.

I forgot to add I have not voted for a Democrat since 1972.

Scott:

Your link to the Great Barrington Declaration is broken.

Also...YouTube has BANNED the excellent video by Dr. Reiner Fullmich after 1.5 million views because it exposed the virus hoax.

Thanks JBD, I was wondering how long it would last. Here's a permanent link to the declaration and its signers:

https://gbdeclaration.org

And people wonder why Trump's popularity is so enduring: when the left censors stuff like this we are dangerously nearing full Nazi territory. It's simply outrageous.

Post a Comment