Markets have been worried that the big drops in commodities and oil prices might be symptomatic of weakening global demand, and today those concerns intensified because December retail sales came in much weaker than expected (-0.9% vs. -0.1%). Falling gasoline prices explained a lot of that decline, since ex gasoline sales fell only -0.3%. But is a decline of 0.3% something to worry about? Hardly.

The above chart shows the monthly percentage change of retail sales less autos and gasoline. Even abstracting from these volatile sectors, retail sales are notoriously volatile from one month to the next. A normal range for this monthly change over the past 15 years is -0.5% to +0.5%. So a one-month change of -0.3% for retail sales ex-gasoline is nothing at all to worry about.

The chart above shows the nominal level of retail sales less the most volatile sectors (autos, building materials, and gasoline stations). Here we see that last month's downward blip is barely noticeable. The underlying trend of retail sales is almost surely rising.

In any event, retail sales are the result of the more important things happening in the economy, like jobs growth, income growth, investment, and the underlying health and liquidity of the financial markets. Sales don't drive growth—prosperity does (more jobs, rising incomes, rising productivity). Work and productivity comprise the dog that wags the retail sales tail.

As I noted last week, jobs growth has been increasing of late, and is now running at a 2.5% annual rate. As the chart above shows, nonfarm productivity (output per hour) has been rising at a 1% annual rate for the past three years. The combination of those two gives us a real growth approximation of 3.5% per year. This suggests that retail sales are very likely to do better in the months to come.

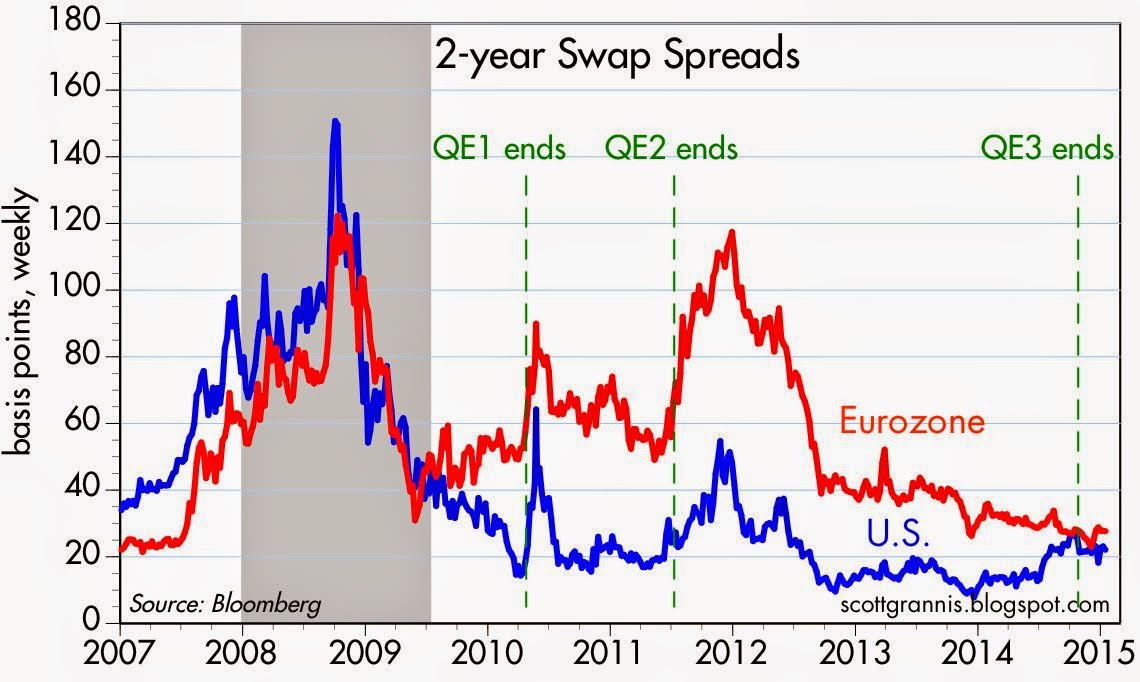

Swap spreads are key indicators of financial market and economic health, and as the chart above shows, swap spreads are firmly in "normal" territory. Financial markets are healthy, liquidity is plentiful, and systemic risk is low. If something were really amiss with the underlying fundamentals of the economy, it would be showing up in the form of rising swap spreads. But it's not.

As the chart above suggests, the "problem" with commodity prices is that they were very high for most of the past 7 years because the dollar was very weak. Now the dollar is back to normal and commodity prices are falling from lofty levels to more reasonable levels. In fact, we've probably not seen the end of falling commodity prices, as the chart suggests. In any event, the key thing to remember about commodity and especially oil prices is that their decline is not likely symptomatic of a shortfall of demand, but rather of a surplus of supply.

The proximate cause of falling oil prices is the 65% surge in U.S. crude oil production in the past four years, which in turn was driven by new drilling technologies. As I noted last month, since 2008 the U.S. has added over 4 mbd to the global oil market, while at the same time reducing its consumption of oil by about 2 mbd. The net effect has been to add upwards of 6 mbd to global oil supplies. That's enough to tip the balance towards lower prices.

Now, as the chart above shows, the number of oil and gas rigs operating in the U.S. is plunging, in a delayed reaction to the more than 50% decline in oil prices since last summer. We're likely to see further significant reductions in oil exploration and drilling in the months to come. In short, falling oil prices are having the predictable effect of reducing oil supplies, just as lower oil prices are undoubtedly stimulating demand. Sooner or later a balance between supply and demand will be restored and oil prices will rebound—as they did following the more than 60% plunge in oil prices in early 1986—and then stabilize. Markets are perfectly capable of sorting this out.

Today's weaker commodity prices say much more about prolific commodity supplies than they do about weaker global demand. That is an important distinction, since lower prices that result from increased supplies will likely bolster and sustain future economic growth.

Wednesday, January 14, 2015

Subscribe to:

Post Comments (Atom)

9 comments:

Even though my political views are often divergent from yours, this type of analysis is the reason I think your blog is a must read.

Scott, great analysis. Negativity and manic-ness of market is amazing. Last month's numbers will be revised downward. So next month will they revise the most recent month's numbers?

If you had new money to commit to equities, what sectors/issues interest you the most?

Love the shale oil.

But the price signal I love even more. Global consumption of oil has been flatlining for years, due to higher prices.

New supplies, conservation.

The higher oil prices were a positive---spurs new production, and employment in the right sectors.

That's why fighting commodity prices with tight money is improper policy. Higher prices bring on new economic production and growth.

Now that copper and oil are plunging, where are calls for looser money?

The real risk is that central banks, like the ossified public institutions they are, are fighting the last war, the one against inflation.

Boy, talk about rose colored glasses. Economies around the world are in recession. The long bond is breaking records, devaluation of currencies... and everyday I read how good things are. feel like your approach is looking at the trees and not seeing the forest.

Ignoring monthly changes in retail sales is a point well taken. My problem with the report is that it was for the Christmas month and electronics and clothing were down.

Regardless, if one is focused on the stock market, ECB QE is the only thing that matters at the moment.

Lawyer: I was a Democrat through my 20s. I became a libertarian after spending several years as an economist, during which time I learned how economies and markets work. I'm a libertarian because I believe in the power of free markets and free people, and I believe that governments too often intervene with negative results, albeit with the best of intentions. I also believe that people spend their own money far more effectively than governments can. We need government, but government must be strictly limited, and it's a constant battle.

Monthly retail sales reports are not only volatile. They are subject to significant revisions. I suspect December's number will be revised upwards, and one reason might be that online sales were larger than in previous Decembers, and it's extremely difficult for the government to track these figures.

Scott,

core inflation is not rising; do you still think the fed should raise rates?

Thanks.

Re inflation and the Fed. Given the lags between monetary policy changes and their impact on the economy, I believe the Fed can't wait until inflation rises to raise rates. That's like driving by looking in the rear view mirror. The Fed needs to be anticipating where inflation is going. As Wayne Gretzky famously said, "I skate to where the puck is going, not to where it is."

How do they anticipate inflation? In today's situation, I think that means looking carefully at indicators of money demand. We know that money supply is abundant, but that was necessary to offset intense demand for money. The demand for money will weaken as confidence returns, and as risk-taking increases. I think there are early signs of this happening. Confidence is up, and M2 velocity has stopped increasing. Bank lending is rising at double-digit rates.

At the very least, I think this calls for the Fed to begin to raise rates at least by some modest amount.

Post a Comment