TIPS are complex securities that only reveal their true message upon careful consideration of a variety of factors. A casual glance at the fact that every TIPS issue out to 20 years' maturity is trading at a negative real yield—with 5-yr TIPS trading at -1.62%—would lead one to think that demand for TIPS must be intense, and that therefore, the market's desire for a hedge against inflation (which TIPS are designed to be) must also be intense, and that therefore the bond market must be extremely worried about inflation. But that would be wrong.

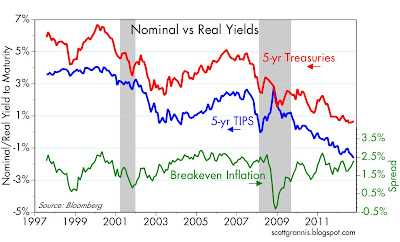

The chart above compares the real yield on 5-yr TIPS with the nominal yield on 5-yr Treasuries. The difference between the two is the market's expected annual rate of inflation over the next 5 years. While inflation expectations have indeed risen of late, they are not greatly different from what they have been over the past 15 years. There is no real inflation message to be found here; inflation expectations are up, but they aren't unusual.

The true message of TIPS can be found in the chart above. The negative real yield on TIPS is not a message about inflation expectations, it's a message about real growth expectations. When the real yield on TIPS is negative, as it is today, it's because the bond market holds very dim expectations for real growth in the years to come. This chart suggests that the bond market is calling for growth to be essentially zero over the next two years. That's just my interpretation, of course, but if the market expected real growth to be improving, then it wouldn't also expect the Fed to be on hold, and short-term rates to be close to zero, for the next several years, as it now does.

This reiterates the point I've been making for a long time: the market has very pessimistic assumptions about the future of economic growth. Therefore, if growth fails to be as weak as expected, then optimists will be rewarded. The bar for growth and optimism is set very low these days. I think the economy can beat those dismal expectations, which is why I remain optimistic.

Wednesday, October 10, 2012

Subscribe to:

Post Comments (Atom)

16 comments:

Thought provoking post. Thank you.

I'm afraid my UK centric view, where TIPS yields are also negative, is that this is very much demand driven. The TIPS market became a way of extracting extra carry at short maturities because inflation was notably higher than cash rates (i.e. why get 0% on cash when one can buy short dated TIPS with a higher nominal yield). This buying has driven the TIPS yield negative as cash rates and the nominal yields on TIPS have converged.

As you note elsewhere, TIPS are expensive and worth avoiding.

Ben (UK based portfolio manager)

Gallup unemployment poll fell to 7.3% today.

We are living during a window of maximum pessimism, which means a "buy" window of opportunity for value investors -- now is the time to acquire rent and dividend-earning equities on the cheap -- economic growth goes up and down, and trends upwards, and robust growth will return, certainly by 2035 (only 20 or so years away) -- make sure you are acquiring your share of the value-priced equities now for your portfolio -- I also advocate converting wealth into world-class skills in any of the science, technology, engineering, and mathematics (STEM) disciplines in order to earn premium wages in the global economy -- the future looks great for long-term investors with world-class skills -- invest now before prices and interest rates suddenly rise!

well just in case you're wrong here's another perspective from john hussman who admittedly has been wrong for a long time:

"Examine the points in history that the Shiller P/E has been above 18, the S&P 500 has been within 2% of a 4-year high, 60% above a 4-year low, and more than 8% above its 52-week average, advisory bulls have exceeded 45%, with bears less than 27%, and the 10-year Treasury yield has been above its level of 20-weeks prior. While there are numerous similar ways to define an “overvalued, overbought, overbullish, rising-yields” syndrome, there are five small clusters of this one in the post-war record: November-December 1972, July-August 1987, a cluster between late-1999 and early 2000, early 2007, and today. The first four instances preceded the four most violent market declines in the post-war record, though each permitted a few percent of additional upside progress before those declines began in earnest. We do not know what will happen in the present instance, particularly over the short-run. But on the basis of this and a broad ensemble of additional evidence, we estimate that the likelihood of deep losses overwhelms the likelihood of durable gains. To ignore those four prior outcomes as “too small a sample” is like standing directly underneath a falling anvil, on the logic that falling anvils are an extremely rare occurrence."

Again, you are making a very basic mistake. You assume that the Treasury market is indeed a free market. It is not. The FRB has forced rates down, probably by 200 basis points. Take that into consideration and inflation prospects using TIPs makes potential inflation much higher. You could be absolutely correct, though, on predicting poor economic growth. Europe and Japan have none and won't and thus what growth we might get from selling into those markets is gone. China's growth is deteriorating and probably never was what they said it was. But on the other hand, our economy has had one hand tied behind its back because of very low new housing, now about 30% of what it should be.

As Residential investment returns to 4% of GDP ( which is below the 65 year average of 4.6%) the unemployment rate will decline 2%

OEDC Composite leading indicators

09/08/2012 - Composite leading indicators (CLIs), designed to anticipate turning points in economic activity relative to trend, continue to point to an easing of economic activity in most major OECD economies and slowdowns in most major non-OECD economies.

The CLIs for Japan and the United States show signs of a fading growth momentum.

For the Euro Area, France and Germany the CLIs continue to point to weak growth. In Italy the CLI points

more strongly to a slowdown. The CLI for the United Kingdom shows tentative signs of a pick-up in

economic activity. In Canada the CLI points to continued weak growth.

In China, India and Russia the CLIs continue to point to a slowdown. In Brazil the CLI points to a more

moderate pick-up in economic activity than in last month’s assessment.

http://www.oecd.org/std/leadingindicatorsandtendencysurveys/compositeleadingindicatorsclisoecdaugust2012.htm

Inflation is dead. Forget about inflation.

The TIPS market is saturated as there is trillions of capital, globally, sitting on the sidelines looking for a home.

The world may be doing a Japan--zero inflation, zero interest rates and anemic growth.

The Fed and other central banks should be monetizing debt in the trillions of dollars, not mere billions.

NormaB: I maintain that the Fed cannot directly influence the level of Treasury yields. They control only a fraction of the total outstanding. They can't lower the yields (i.e., raise the price) on all Treasuries outstanding by buying just a small fraction of the existing stock each month.

The Fed can influence the level of yields only to the extent that the market believes that the Fed's stated intentions are plausible.

steve: Re Hussman, I have attempted for many years to make sense of his forecasts, and have never succeeded. At the same time, his forecasts have never succeeded in working. I don't understand his analysis; it doesn't make sense to me at all. In the end, how can earnings 10 years ago have any relevance to the value of stocks today?

Great post. I disagree in that this whole thing is an illusion, and we are not far from the tail of Japan.

I cannot help shake the idea that all of this QE which in the final analysis is nothing more than financial manipulation will result in a pernicious ending. you reap what you sow and bernanke has planted the fallacious concept that you can manipulate markets without repercussion.

Scott Grannis: I've read from economists that prices are set at the margin. If that is true in the Treasury market then the FRB can set that price as long as they keep pumping. But here's some 'proof' in your favor: Since the Sep 13 QE3 announcement both the S&P500 and 30yr Treasuries are about where they were just before the announcement when the markets moved markedly. I still think that with the 10yr Treasury selling 60-70 basis points below the 1930-40 Depression era that the FRB has to have something to do with it.

NormanB: lots of things happen on the margin but Treasury yields are determined by the markets willingness to hold the entire stick of treasuries, which is very large relative to the Feds purchases. Marginal buying cant have a big influence in a large asset market.

Meant to say "stock" of Treasuries.

you say: " The market has been braced for deterioration", uh, what? it's up 15% or more this year equities and credit products. you just can't keep chearleading, even when its to pretend everyone's down when they're exuberant, so they can get more exuberant. childish.

Post a Comment