The history of the late 1960s and 1970s suggests that rising inflation was very bad for equity investors. From the end of 1965, when inflation started to heat up, through mid-1982, as inflation returned to single-digit levels, the S&P 500 index fell 62% in real terms. That disastrous performance, however, was almost exactly the same as the devastating real decline in the S&P 500 from its peak in 2000 to its low in March 2009. In other words, the bursting of the tech bubble followed by the bursting of the housing bubble were, in a sense, just as bad for investors as the 1970s collapse of the dollar and the emergence of double-digit inflation.

Financial theory, however, suggests that equities should be a good inflation hedge, because nominal earnings tend to rise, over time, in line with the rise in the general price level. Recent action in the stock and bond markets appears to confirm this.

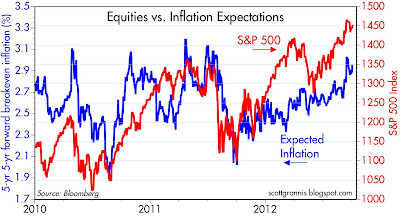

The above chart compares the S&P 500 index to the 5-yr, 5-yr forward expected inflation rate embedded in TIPS and Treasury prices (which happens to be the Fed's preferred measure of inflation expectations). There is a noticeable tendency for equity prices to rise as inflation expectations heat up, and to decline as inflation expectations cool off. This action is particularly evident over the past year, as equity prices have jumped some 30% and inflation expectations have moved up from 2.1% to almost 3.0%.

As I noted a few weeks ago, the Fed's decision to implement QE3 succeeded in stimulating inflation expectations, if not the real economy. And looking back, it is the case that the current equity market rally began shortly after this same measure of inflation expectations hit an all-time low of 0.5% at the end of 2008 and began to rise. One driver of the current rally, in other words, has been rising inflation expectations. The Fed gets some credit for boosting stock prices, just as they can now take credit for having artificially depressed mortgage rates. Whether this means the economy will be better off, however, remains to be seen, because a rising price level does not necessarily translate into rising prosperity. Come to think of it, this helps to explain why the stock market has done so well even though the economy is suffering through its slowest and weakest recovery ever: much of the "improvement" in equity prices is merely a by-product of reflation, rather than genuine recovery. There certainly has been a good deal of reflation already: recall that in late 2008 the TIPS market was priced to 5 years of deflation. From expecting 5 years of deflation to now expecting inflation to average 3% per year 5 years from now is a huge difference—a lot of reflation.

If inflation does indeed move higher, in line with expectations, then sooner or later Treasury yields are going to have to move higher and the Fed is going to have to put QE3 on ice. But as I've argued repeatedly, higher Treasury yields—and higher interest rates in general—won't be a problem for the economy or for the stock market, since they will be the natural result of a stronger economy and/or faster nominal growth.

As for inflation hedges in general: Gold, long considered the classic inflation hedge, has enjoyed a spectacular run over the past decade. So maybe it's already priced in a lot of inflation. Commodities in general have enjoyed fabulous returns. Gold and commodities are arguably very expensive inflation hedges today. Real estate is also a classic inflation hedge. Nevertheless, with prices only recently on the mend after suffering a roughly one-third decline in price, real estate is arguably cheap. And stocks are arguably cheap as well, to judge from the fact that PE ratios are below average, yet corporate profits are at or near all-time highs, both nominally and relative to GDP.

I'm not a fan of inflation, but it's obvious that the market is doing much better today knowing that the specter of deflation has been all but banished. Faster nominal growth provides good support for equity prices and corporate bond prices (better cash flow prospects mean read reduced default risk), but I'd rather seen real growth be the major component of that faster nominal growth, rather than inflation. The Fed is working hard to get nominal GDP growth to move higher, but by themselves they are only likely to push the inflation component of nominal GDP higher. To get real growth moving higher we need better fiscal policy and more confidence in the future. That's what the elections next month are all about.

10 comments:

High quality equities that pay dividends and rents will be the safest hedge from the inflation to come -- gold may also be a hedge, but gold has the disadvantage of not earning dividends or rents -- additionally, the government (and thieves) can steal your gold from you -- now is the time to acquire high quality equities that are earning dividends and interest, and by the way, the "buy" window of opportunity is likely to close suddenly -- again, require earnings before choosing an equity...

I think it was really stagflationthat really hurt stocks in the late 60’s and 70’, and it’s almost never discussed. I also think the current macros argue that we are again within an era of stagflation. Something else seldom mentioned (I don’t really get around as much as the pros do though, and I’ve probably missed a thing or too as well).

During the German hyper-inflation their stocks kept up with the inflation. During our last inflation spurt stocks did well until the long Treasury hit 6%.

To sum it up: inflation is priced in for gold, but not for equities. Must be that equity investors are not as smart as those genius central bankers (who control most of the gold).

My CPA friend’s firm had a speaker from the SF Federal Reserve Bank last week. The speaker said that QE3 would buy mortgage backed securities from Fannie and Freddie and pay for it with currency. The speaker said then Fannie and Freddie would buy more mortgages from the banks and pay with currency.

Is this true? Are they really buying directly from the Agencies. Perhaps the Agencies do not have bank accounts with the Fed for the Fed to credit with accounting entry created money so the Fed has to have currency printed up to pay for their purchases.

In the end, the new money can get trapped at the banks as currency in the vault is the same as reserves.

That doesn't make sense to me. To begin with, $40 billion per month of currency is a small mountain of $100 bills. Total U.S. currency in circulation in the entire world is about $1 trillion. QE3, if it used currency, would increase the supply of currency by almost 50% in one year. There is no way any bank or entity is going to move around that much currency, or allow that much currency to sit in vault.

And even if it were somehow possible, it is always the case that the world doesn't hold currency it doesn't want. Excess currency is simply returned to the banking system in exchange for deposits.

Furthermore, the Fed can only issue currency in exchange for bank reserves, one-for-one.

My CPA friend said the Fed speaker actually said it would only cost six cents per $100 bill to print. Perhaps the speaker was being metaphorical. It didn’t make sense to me either when my friend told me this story. But what about buying securities from Freddie and Fannie? In the end, I am just trying to figure out if the new money can get trapped in the banks.

Thoughtful blogging.

This market has made me schizophrenic. I mean more than usual.

One day I think we will enter secular bull market for years and years, and the next I fear we do a Japan.

The economy is weak, inflation is dead, and the Fed should act accordingly. If Romney wins, I think certain business segments will feel more optimistic, and the pressure for the Fed to fight inflation will evaporate.

(In reality, I think the GOP will run huge deficits, as they have ever since Eisenhower. This is because the GOP cannot cut entitlements really---too many old people---but loves agency spending, especially in GOP districts, many of which are rural, and dependent on federal outlays).

They say Romney did well in the debaters. The race is a toss-up, and exciting.

A question the D-Party is too stupid to ask: What was the DJIA the day Bush jr. was first elected in 2000, vs. the day Obama was elected in 2008, and what is the DJIA now?

Scott Grannis knows the answer, but I doubt he will run the numbers.

Benjamin, the DJIA is irrelevant to the election. Being an actual president is more important. Sorry you feel bad that Obama looked so bad. It is time to move on from Bush derangement syndrome.

Good post, i just want to say that timely investing in equities is a good option.

Post a Comment