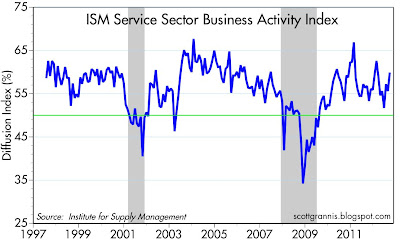

Coming at a time when the market is still skeptical of the economy's strength and many continue to see signs of an imminent recession, the September ISM Services report was surprisingly stronger than expected. It's not off the charts, of course, but as the chart above shows, a comfortable majority of firms see improving business activity. In fact, at 59.9, the September reading is substantially higher than the 56.3 average over the 15 year life of this survey.

Another "surprisingly strong" number in this report was not so cheerful, however. The 68.1 reading for the prices paid index was way above the 59.6 15-yr average for this survey. It's now flirting with the levels we saw in mid- to late-2000s, when consumer price inflation moved up from a low of 1% in 2002 to a high of 5.6% in 2008. At the very least, this index has all but ruled out any risk of deflation.

The September employment index was fairly neutral: 51.1 vs. an average of 50.6.

As this last chart shows, the U.S. economy continues to look much better than the Eurozone economy. Truth is, things here could be a lot worse, and they could be a lot better too. But we're not in danger of recession.

1 comment:

Thanks Scott.

I think the last chart of the ISM Service Sector for the US and Eurozone is particularly instructive. The large divergence between the two series over the last twelve months (the same goes for manufacturing) has coincided with strong relative performance of the US stockmarket (versus Europe). In isolation, the latest figures suggest that this outperformance may continue for a while yet (despite the sell siders dipping their toes back into Europe).

Ben (UK based portfolio manager)

Post a Comment