This morning, markets were a little disappointed that Fed Chairman Bernanke failed to pledge more monetary ease, despite increasing evidence that economic growth has slowed in recent months. As I see it, there is no reason for the Fed to do anything, so Bernanke did the right thing. There is nothing wrong with inflation or inflation expectations, so there is no need for the Fed to do anything different at this point.

June Consumer Price Inflation came in as expected. Although the headline number has fallen at a 0.8% annualized pace in the past three months, the core CPI continues to register inflation that is comfortably at or above the upper end of the Fed's target. The chart above shows the 6-mo. annualized pace of core inflation, and also highlights the times when the Fed began to undertake a significant quantitative easing policy. Clearly, a substantial decline in core inflation encouraged the Fed to act, in an effort to forestall deflation, which has been Bernanke's Public Enemy #1 for years. With core inflation now running at a 2.4% pace over the past six months, the threat of deflation is nonexistent, so there is no reason for further monetary ease. And as my earlier posts today noted, the housing market is continuing to improve and industrial production continues to expand. Where's the problem that warrants still more expansive monetary policy?

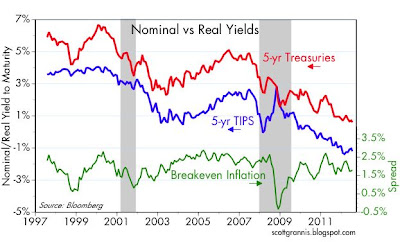

This next chart shows the nominal yield on 5-yr Treasuries, the real yield on 5-yr TIPS, and the difference between the two, which is the market's expectation for the average annual gain in the CPI over the next 5 years (i.e., "break-even inflation"). Note that near-term inflation expectations by this measure have been fluctuating between 1.5% and 2.5% for the past 30 months, with the current number being 1.8%. This is consistent with the view that the market expects the headline CPI to pick up over the next year or so, and that is particularly likely now that energy prices have stopped declining.

The chart above shows the Fed's preferred measure of inflation expectations: the 5-yr, 5-yr forward break-even inflation rate. The preceding chart shows that the market expects inflation to average 1.8% from mid-2012 through mid-2017, and the chart above shows that the market expects inflation to average 2.6% from mid-2017 to mid-2022. Again, no sign of any deflation threat here, and every reason to think that inflation will be on target, so no need for the Fed to do anything.

TIPS spreads such as I've posted here are important and reliable gauges to market inflation expectations, and they are rationally linked to the facts on the ground. They deserve attention.

If nominal Treasury yields were artificially depressed, because they are the object of global investors' affection and the object of the Fed's quantitative easing efforts, then the spread between TIPS and Treasuries should be artificially depressed as well. But on the contrary, we see that the spread (the break-even inflation rate) is behaving quite normally; the market has bid up TIPS prices in line with rising Treasury prices. That is very important, since it means that the decline in both real and nominal yields is not driven by declining inflation expectations, but by declining growth expectations. Once again, we see that current conditions do not point to any need for the Fed to take further action. Today's problems are not about inflation or monetary policy, they are about growth, and monetary policy has no power to conjure growth out of thin air as long as there exists no risk of deflation.

This next chart confirms this, since it shows that real yields on TIPS have declined in line with the slowing growth of the U.S. economy. As I see it, the current level of 5-yr TIPS yields is saying that the market is expecting real growth in the U.S. over the next few years to be close to zero. If we do indeed experience zero growth in coming years, then there will be lots of companies that are struggling to survive, and that will pose real problems for equities and corporate bonds. In order to avoid likely losses, investors are willing to sacrifice 1.2% of their future purchasing power (which is what a real yield of -1.2% on 5-yr TIPS implies) in order to enjoy the no-default-risk safety of TIPS. That is rational.

The future growth of the U.S. economy is now in the hands of our politicians in Washington, who need to remove barriers to growth, reduce the size and scope of government, and reform the tax code by broadening the tax base and keeping tax rates as low and as flat as possible.

Tuesday, July 17, 2012

Subscribe to:

Post Comments (Atom)

20 comments:

Today, Chuck Schumer told Bernanke to get to work as he is the only game in town since congress is gridlocked. Bernanke is a coward and didn’t say no, it is up the voting public to get to work and throw you butt out.

http://advisorperspectives.com/dshort/guest/Shedlock-120717-Government-Role-in-Inflation.php

dshort chart: everything the government gets involved in gets expensive.

Scott -

Where do you think we will bottom on the 10 yr? It seems to me that a global spike in fear (attack on Iran, more instability in Europe, etc) could drive us down to 1% or so. So I am inclined to wait on an investment in TBT. What do you think?

One quick way to reduce the size of the Federal government would be to replace the Federal government -- in other words, all Federal contracts, pensions, debts, treaties, and so forth, would have to be renegotiated from scratch -- also, the Federal Reserve Bank would become defunct as well -- any takers...?

PS: During the mid-1980's, I was serving as a diplomat in the former Soviet Union -- I recall having dinner with an old Soviet Colonel during which I asked the man point blank, "...what would a post-Soviet government look like...?" -- the Colonel took the view that a breakup of the Soviet Union would be inconceivable because of the hardships that such a breakup would create for workers, pensioners, and other nations who were dependent upon the Soviet Union for survival -- not too many years later, the Soviet Union crumbled...

The moral of the story is simple and instructive -- we old people should beware of the future...

PPS: The government needs to cut spending by at least 40% immediately, or I doubt that the USA as we know her will survive...

We old people…

Medicare in 2011 cost $469 billion. Medicare, Medicaid, CHIPs, together cost $786 billion. Medicare has been doubling every five years, again see dshort.com chart. Together they have been doubling every 7 or so years, I think.

Do you seriously think that in 5 to 7 years the federal government will be spending nearly a trillion dollars on Medicare and on all three $1.538 trillion. When total income taxes now are only $2.3 trillion dollars?

And this doesn’t even include the VA or Obamacare. So in 5 to 7 years we will be pushing $2 trillion dollars of federal medical care spending?

It will bankrupt the country. So it isn’t going to happen.

And the FED isn't going to print to pay for health care as Scott's article makes clear.

"Politics of Low Prices

Mitt Romney is not satisfied with low prices of autos or apparel. Nor is president Obama. Nor is the Fed. Romney has even declared he would label China a currency manipulator if elected.

Romney desperately needs to study history, specifically the results of the Smoot-Hawley Tariff Act that compounded problems during the Great Depression.

Consumers like and want low prices (with the exception of home prices after they buy).

Who doesn't want a bargain? The answer is Romney, Obama, the Fed and unions.

All of them want to rob you blind in misguided belief that high prices are better than low prices. It's a mad, mad, bureaucratic world where cheap, plentiful goods are considered a problem."

Public: Romney is unfortunately lacking when it comes to his understanding of economics. More generally, I think economic ignorance among politicians and voters (who let themselves be pandered to by ignorant but clever politicians) is one of the biggest threats to our long-term prosperity. Punishing China for selling us cheap stuff is one of the dumbest ideas around.

I can only hope that Romney's economic advisors (who are pretty smart guys) will dissuade him from taking action against China once he's president, and that all his talk is simply another case of pandering to ignorant voters.

No president is ever going to be smart about everything, so the advisors that surround him are extremely important, as is his willingness to listen to them. The good advisors that Obama had have left because he never paid attention to them.

Romney understands economics. He was a superstar at Harvard when he got his MBA. I've attended a couple of fundraisers and he's demonstrated to me that he understands better than any other candidate how the economy works. His China comments are unfortunate but there are a lot of business owners who feel that China is a cheater and they would agree with Romney even if its better overall for the economy to have cheap imports.

Obama is a "big government" Chicago politician -- Romney is a "big business" bankster -- neither Obama nor Romney have a clear vision of what is best for America beyond their personal realms and empires -- I personally think the future of America must include concern and faith in Main Street USA -- to that end, I would be fine with the USA going away and the states taking over, but I doubt that will happen -- what I do see happening however, is both Obama and Romney focusing on "grand enterprise" instead of focusing on plain and simple businesses, including owners and the communities that house businesses -- but again, I have little confidence in Obama and his "big government" cronies, or Romney and his bankster brotherhood -- what America needs is a clear focus on doing what is right for small businesses, communities, homes, and good citizenship -- neither Obama or Romney come close to meeting that calling...

PS: I keep saying this, but the future of America is being decided in California right now -- the budget challenges in California are very real, very serious, and have catastrophic implications for dividing the nation...

puffer: I have been dead wrong on the direction of Treasury yields for over three years, so I have no credibility on the subject. But I do think this is a great time to take out a fixed rate mortgage if you haven't already.

"puffer: I have been dead wrong on the direction of Treasury yields for over three years, so I have no credibility on the subject. But I do think this is a great time to take out a fixed rate mortgage if you haven't already."--Scott Grannis.

Well, Scott Grannis will always have credibility with me, even if he made a wrong call or two. Who hasn't?

I do think Scott Grannis needs to re-think his take on interest rates, inflation and monetary policy. Right now, it seems we are doing a Japan---maybe not exactly at zero bound, but close to it. Maybe not huge declines in asset values, but similar stagnation.

Interestingly, Allan Meltzer, in 1999, advised Japan to shoot for yen devaluation and for the BoJ to announce it was targeting higher asset values (this would have helped property markets and thus banks. Sour loans can become okay if property values rise).

It is inexplicable to me that we are nearly repeating the poor monetary policy of Japan.

I will always agree with Scott Grannis on the need for a smaller federal government and reduction of structural impediments.

And I wait the chance to vote for a party that does that!

The China thing is real simple. Romney wants the Renminbi to go up in value to the USD. That China has held it down all along has been the thing everybody complains about.

China would not have been able to hold it down were it not for U.S. deficits where China could place the USD it collected from trade. If there were no U.S. deficit China would have had too many dollars and would have had to raise the value of the yuan to stem the inflow of dollars. So quit with the deficits. The low cost goods came at too high a price – excessive debt. There is no rate of return on this debt, which debt is supposed to be created for making investment.

That the Chinese cheat is an understatement. I want a strong president to deal with this.

Squire:

I'll not disagree with you, but I will note that global savings rates are high, especially in Asia. These guys have no place to put all their capital. China has been buying a lot of Japanese stuff lately.

This is what I contend the changed paradigm is about: Using capital, boosting demand.

QE is a great way to do that.

Times change; When I was young, we spoke of "crowding out," that is borrowing by the US government pushing aside private borrowers.

The US was by far the largest player in commodities, and the dollar was the de facto global currency.

Times change. Now we have capital everywhere---capital is cheap. The globe likes yen, euros and dollars, and soon I guess the Chinese currency. The US is a minor player in global commodities markets (except for oil).

Inflation used to be a problem (limited int'l trade, structural impediments, strong unions). Now deflation is the threat.

Sadly, everything becomes partisan dogma in the United States. Left-wing or right-wing.

But the global and domestic economic landscape has changed. Ergo, we have to change our policies.

"Where's the problem that warrants still more expansive monetary policy?"

The problem is that there are only slightly more people employed today than there were in 2001. While those of work force age have increased 8 - 10%. The economy is underproducing from its potential by 10% to 12% -- accounting for some gains in productivity. This is a deadweight loss of at least $1.5 Tn per annum. So many of todays financial problems would be greatly reduced if the economy were producing at full potential.

PS: Your "prove you're not a robot" has gone off the deep-in

Ed R: exactly how is easier monetary policy going to make the economy grow faster?

"The threat of deflation is nonexistent." I disagree.

1. Although the BLS core inflation rate is running higher than 2 percent, other measures of underlying inflation are coming in below the core. For example, the Cleveland Fed's 16 percent trimmed mean inflation rate, which throws out the prices with highest and lowest inflation, rather than arbitrarily throwing out food and energy, went up at just a 1.9 percent annual rate in June, and the the CF median inflation rate rose at just a 1.45 percent annual rate. On balance, the Fed seems to be slightly undershooting its inflation target. Unless you are among those who believe there is no output gap, or that the Fed should just ignore the other half of its dual mandate, there is a case here for easing.

2. There is more information to be squeezed from the TIPS rates than what you give. Even though the TIPS-based estimate of future inflation is positive, it is still possible for there to be a positive risk of deflation. Think about it: Just because the center of the expected inflation distribution is above zero does not mean the tail can't cross into negative territory. The Atlanta Fed's Inflation Project uses TIPS numbers to figure the probability of deflation over a 5-year horizon. Their most recent estimate is 17 percent risk that the April 2017 CPI is lower than the April 2012 CPI. Five years with no net price rise would be massive, Japanese-style deflation. For more commentary on the deflation risk, see here: http://tiny.cc/qqilhw

Re deflation risk: yes, there must be a small risk of deflation when core inflation is running at about 2-2.5%. But I'm referring to the fact that there is no obvious sign of deflation in market pricing. TIPS spreads are solidly positive. The dollar is very weak; deflation is a risk when the dollar is very strong, as it was in the early 2000s. Gold is extremely high, suggesting great fear of inflation, not deflation. Deflation was a risk in the early 2000s when the dollar was strong and gold and commodities were weak. We have the exact opposite today. Japan suffers deflation risk because the yen has been extremely strong for many years. Commodity prices in general are substantially above their early 2000 levels with no significant weakness apparent. Output gaps have nothing to do with inflation or deflation. If they did then the US would have been suffering major deflation for the past several years.

Romney's chief economic advisor is Glenn Hubbard. I know him and he would never advocate protectionist policies. Sometimes certain things get said on the campaign trail and that is just the way it is - if you want 100% principled, free market economics out of your presidential candidates, enjoy the political wilderness. Truth is, certain crazy policies poll well and they get alot of talk on the campaign trail. I don't think anybody with a brain really thinks Romney would be a protectionist.

What are the chances of stagflation if rates jump because of prolonged war between Israel and Iran and zero growth here in the US?

Post a Comment