With markets swooning yet again over eurozone fears, it's time to revisit spreads and yields for a look at just how likely a default or disaster is likely to be, according to market pricing. As should be apparent, the fears are much worse than the facts.

First, a look at 2-yr sovereign yields, which are a decent barometer for the likelihood of a near-term default. What stands out in this chart is how much things have improved in Portugal and Ireland. It was almost exactly one year ago that yields on Irish and Portuguese debt exploded skywards. Since then they have settled back down quite a bit, with Ireland now trading through Spain and approaching Italy. Who would have thought there could be such a dramatic change in Ireland's fortunes? (It helps that Ireland has been serious about reining in government spending while keeping tax rates as low as possible.) Portugal was thought to be a basket case sure to follow in Greece's footsteps, but Portuguese debt spreads now trade within the realm of high-yield corporate debt: 5-yr Portuguese CDS spreads are about 800, with the average high-yield spread being 580.

Another thing to focus on is the amount of outstanding debt in each of these countries. At $900 billion, Spain's debt is a serious chunk of change. Spanish debt is trading between 70 and 90 cents on the dollar, so the market has already priced in something like a 20% default. If Spain goes all the way over the cliff, its debt might suffer a 70% haircut in a worst case scenario (Greek debt has suffered a loss of about 85%), which would mean wiping out an additional $450 billion of debt. But: would that be enough to bring on the end of the world as we know it? Considering that there is something like $50 trillion of debt in the world, so even a disastrous Spanish default would be only a drop in the bucket.

And as I argued a year ago, the money that the Spanish government borrowed was long ago wasted. Whether the government ends up defaulting on its debt or not, serious losses have already been incurred because the money was effectively squandered. In a true economic sense, the losses are water under the bridge. All that remains to be seen is who will be stuck with writing off the losses on their balance sheet. So the angst over potential debt defaults is overdone, and the reality of a default is likely to be much less awful than most people imagine.

Eurozone 2-yr swap spreads are now back to where they were about a year ago, and down significantly from the highs of late last year. This represents a substantial improvement in the health of the Eurozone financial markets and banks' liquidity. This is not at all consistent with fears that a Spanish default could bring down the eurozone banking industry. Moreover, euro basis swap spreads are closing in on relatively healthy territory, suggesting that Eurozone banks have reasonably good access to dollar liquidity. Spreads are still elevated, to be sure, but nothing here is even close to suggesting a near-term collapse. Meanwhile, U.S. swap spreads remain low, with financial markets in the U.S. clearly avoiding any Eurozone contagion.

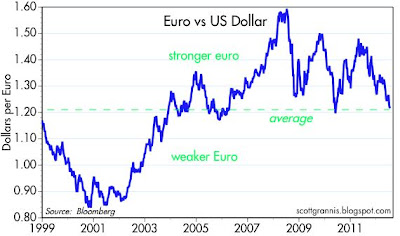

Finally, although the euro has been falling in the past year, it is hardly a catastrophic decline. As the first chart shows, the euro is now equal to its average against the dollar since the euro's inception. And according to my estimate of purchasing power parity, the euro is still somewhat overvalued against the dollar. This is not what you would expect to see if the eurozone were on the verge of disaster.

11 comments:

"Lehman is priced in"

Thanks Scott. You have the uncanny ability of separating the trees from the forest. There are so much noise out there that it is difficult to comprehend at times. But you break it down and simplify it. Great work again.

BTW, Dr. Perry over at Carpe Diem has a nice post on inflation and inflationary expectations. As in dead.

The hysteria, and misplaced emphasis on inflation-fighting today is inexplicable. The anti-flouridation crowd has somehow seized control of monetary debates.

There was a time when Reagan Treasury Secy Don Regan said Fed powers should be shifted in the Treasury, as then-Fed chief Volcker was being "too tight." The Reaganauts wanted Volcker to ease up.

Inflation then was 4-5 percent! That was 1984.

http://news.google.com/newspapers?id=hUBVAAAAIBAJ&sjid=55QDAAAAIBAJ&pg=5524,8412282&hl=en

Today inflation is minuscule, and many (such as Don Boudreaux, the hard-core right-winger at George Mason University) say government measures of inflation are too high, due to rapidly evolving goods and services. When you can buy a very good, used computer for $30, I have to agree.

It is very important to note these inflationary measures and expectations are at record-low points after two rounds of QE. In other words, if QE causes inflation in this environment, it is an invisible variety.

Think of it this way...France a socialist government laden European

country..sound bad right?? 2 year yields are .15%....10 year yields

are 2.07%....The French could lend

10 year money to Spain at 4%...especially if the alternative

was a very costly Euro breakup...Low

yields on French debt has diminishing

advantages to the French especially

compared to the alternatives...

There isn’t a monetary or euro crisis. They only say so to achieve political ends. It is simply that some European countries are fiscally irresponsible and are in trouble because of that. Politicians that want a centralized government in Europe, and politicians that want their deficits to be shared by the rest of Europe, are the ones making this into a crisis to achieve their goals. I feel for the poor sucker middle class proletariat over there. At least here, we are starting to make adjustments with the bankruptcy of Stockton, San Bernardino, and Scranton (soon). (What is the matter with these dummies in Scranton that pay federal taxes and don’t want their money to bail out Stockton? Don’t these dummies know that in return the Federal taxpayers in Stockton will bail out Scranton?)

The whole European crisis thing gets solved by having the over indebted countries go BK while staying in the monetary union. Then Europe can get back to their relentless efforts to be less competitive to the rest of the world.

Regarding stimulation: that inflation is at 2% doesn’t seem to me to be the basis of an argument for doing the things that would create high inflation but won’t because things are so bad. If America won’t embark on structural reforms it should pay the consequences just like the middle class prolies are paying in southern Europe.

Squire said...

"There isn’t a monetary or euro crisis. They only say so to achieve political ends...."

All things considered, I have concluded that Chancellor Merkel and Germany would prefer that Spain and Italy be under IMF, World Bank, etc. receivership - as it were - similar to Greece and Portugal so they would have their sovereign budget and spending constantly monitored.

Merkel and the German people don't trust the Italians or Spanish to solve their spending and budget problem if left to themselves. Thus she only does enough to prevent a full blown crisis.

I seriously doubt that she wants a United States of Europe - a strong federal government - because the Germans understand that their preferred policy of austerity would be shouted down and out-voted by an elected European Parliament of all 17 nations.

For the Germans to get what they want - austerity and pro-growth economic reforms in the spendthrift southern countries - their best hope is for Italy and Spain to ask the IMF, World Bank and ECB to bail them out and then be forced to live with their supervision as Ireland, Greece and Portugal must do.

Having an egalitarian, federalized Parliament of 17 Europe nations controlling all budgets and banks would not work to the German's interests and goals - it would be too easy for a majority of elected European officials to over-ride German interests.

Thus the German piecemeal, last second approach to each crisis. They actually want Italy and Spain to go into a kind of receivership as did the Asian countries after their currency crisis. This approach achieves a lowly valued EURO (helping exports) and never quite solves the debt crisis so Italy and Spain edge closer to the brink. JMHO

Squire--

The Japanese in fact instituted many structural reforms in the last 20 years, and advisedly so. Nevertheless, they are stuck in deflation, and their economy (incredibly) is smaller today than 20 years ago, measured in yen.

Moderate inflation is a necessary grease on the skids of a modern economy. Consider the wonderful prosperity in the USA from 1982 through 2008. All with moderate inflation.

The long, long experiment in Japan proves that mild deflation is poison.

This video from a couple of years ago still expresses by view about Euroe:

http://wjmc.blogspot.com/2010/05/those-europeans.html

Central bankers are eager to convince society that the European crisis is behind us -- California as well...

When I am tempted to believe that the global liquidity crisis is behind us, I watch this video in order to get back into reality -- the global economic crisis is far from over folks -- those without means should remain under cover...

So what is the definition of moderate inflation?

If zero inflation is Japan, and low inflation is 2%?

If Japan has implemented structural reforms, I wonder what it would be like if they didn't?

William describes the goings on in Europe well. I just think it would be dumb simple to keep everything the same and let Greece go bankrupt and stay in the monetary union. But I guess those countries that want to have their deficits mutualized will keep the unity movement alive.

Also if I may add, in the previous euro crisis episodes in 2010 and 2011, 3month U$ LIBOR spiked up from 25 bps to 55bps underpinned by funding constrains but this time round the 3month $ rate actually went down signifying that this time is somewhat contained.

Post a Comment