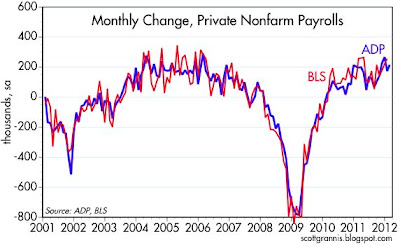

ADP's estimate of February private sector job gains came in about as expected, but they also issued revisions to past data that had the effect of increasing prior estimates to bring them more into line with BLS data. As the chart above suggests, ADP's estimate doesn't point to any surprising strength in the BLS number to be released tomorrow, so the market's current guess of 225K is probably reasonable. A number like that would be similar to what we have been seeing in recent months, and is neither impressive nor disappointing.

Q4/11 unit labor costs were revised sharply higher in today's BLS release. As this chart suggests, unit labor costs are now adding to the economy's overall inflation rate (the GDP deflator being the broadest measure of inflation available), rather than subtracting.

Higher unit labor costs mean that the productivity of labor is declining. Businesses typically squeeze more productivity out of their workforce in the wake of recessions. But you can't increase productivity without limit, and it looks like we are now in that phase of the business cycle when businesses start having to pay more to expand their output; fortunately, that's not hard to do when corporate profits are at record highs.

But more importantly, as the chart above suggests, declining productivity (blue line) is typically associated with rising inflation (red line). We've probably seen the high in productivity gains, so we've probably also seen the low in inflation, and we should expect to see inflation continue at current levels or (more likely, given accommodative monetary policy and a weak dollar) move gradually higher.

2 comments:

Unit labor costs adding to inflation while we have 8.5% headline unemployment, U-6 unemployment in the teens and a multi-year low in labor force participation...? How can that be? Mr. Bernanke will not believe it. Too much "slack" to have inflation!

Huge scoop! TrimTabs exposed!

Tons of people think TrimTabs' monthly job estimates are the end-all and be-all of job estimates because ... well, because TrimTabs says they are. But look what we have here!

After January's NFP report came out, TrimTabs made a big stink about how inaccurate it (and ADP) was, to the point where their gripe got printed in a lengthy article on Zerohedge, where they said their own estimate was a mere 45,000 jobs created.

A couple weeks later they quietly posted on their blog that, oops! they messed up and the real number was more like in the 100-130,000 range.

Now, in their blog post today, once again they've quietly revised UPWARD their estimate of January jobs to a healthy 181,000!!

Post a Comment