Wednesday, April 20, 2011

Stocks struggle against gold

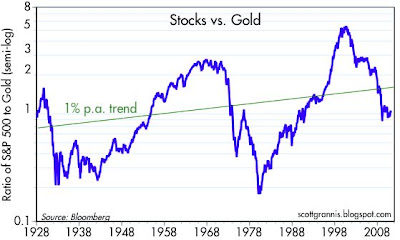

The top chart shows over 80 years of the monthly stock/gold ratio, while the bottom chart shows daily values over the past three years. Over long periods, stock prices have edged out gold prices, but the ratio can be extraordinarily volatile at times. If stock prices are a proxy for productive assets, and gold prices a proxy for physical (hard) assets, then its reassuring to see that productive activities are more profitable over time than speculative activities. But it's a very rocky road.

Stocks need sound and stable monetary policy to flourish, as they did from the 1950s through the mid-1960s (when inflation was very low and stable), and from the early 1980s through the late 1990s (when inflation fell from double digits to a relatively stable 2%). The problem with stocks today is rooted not only in the potentially inflationary consequences of Bernanke's easy money, but also in the potentially crushing burden of excessive government spending.

Subscribe to:

Post Comments (Atom)

8 comments:

Scott, you got my attention with the stock to gold ratio -- I was looking last week at the S&P to gold ratio as well -- I am troubled by the ratio as I would prefer to see strength in stocks -- I have to ponder this some more -- a correction in gold about now would be a good thing...

Intel, Qualcomm, Apple, all reported earnings in significant excess to what was expected. Market participants IMO are still far too pessimistic.

John: Dittos

Well, I don't understand these charts at all, but I still think all gold is fool's gold.

Assets that can generate income, and even increasing amounts of income over time, are the sorts of investments I like.

Gold?

Investors are chary now, and maybe they have a right to be. Who knows where is the next Long-Term Capital Management, or one-day 22 percent drop on the Dow (1987). The tech bubble. The Bush years.

Still, I think we are on the cusp of a global boom, that will include the USA. I am especially interested in the yuan gaining ground as international reserve currency, thus reducing the exchange rate for the dollar. As there are chronic gluts of capital, I do not think this will raise interest rates in the USA, but will result in a surge of exports.

Look for secualr bull markets in real estate and equities.

Gold may rally, as more Chinese and Indians buy baubles. So be it.

Charts are farts from the past. They have zero abilities as to predicting the future.

It is a market of stocks. Not a stock market.

Over these same time periods, there have been plenty of stocks that have far better returns than gold and or silver.

When models and or charts turn on, brains turn off.

I was looking at this chart last week also. The problem is, I don't know what it tells me. How does it revert to trend? Stocks up? Gold down? Stocks up more than gold? What?

It seems that most people do not understand gold. That includes some who post here.

Gold is indeed a tangible, "hard" asset, and not a "productive" asset like a stock, which is a claim against the future cash flows of a particular company.

In relation to the aforementioned gold is not a good investment. Neither is it a bad investment. Gold is not an investment at all - it's a CURRENCY.

When the central banksters of a country deliberately debase that nation's currency, and deny the holders of that currency any REAL return on said currency, then gold - being the ultimate currency - will outperform not only the currency being trashed ("Bernankeed"), but that country's equity market as well.

How can increasing earnings of a rapidly declining currency provide a "real" return to shareholders? And this doesn't even take into consideration the impending fiscal disaster faced by the United States.

Also, ask yourself this question: the central banks have had 40 years to dispose of this useless, barbaric relic, yet they haven't done so; why? Because they know that they issue CONfidence money that has no intrinsic value. And with a knowledge of monetary history they also know that EVERY Fiat currency system has ended in ruin, beginning with the origin of paper money in the Middle Kingdom.

Since they don't trust each other, then why should we trust them?

Post a Comment