Wednesday, August 25, 2010

Credit spread update

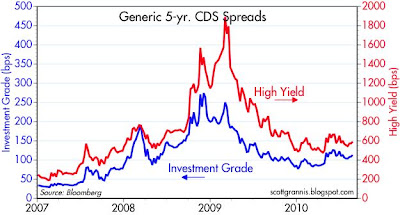

These charts use data from the Markit indices of credit default swaps, as of yesterday. Spreads have widened a bit over the course of this month, but when you put this in the context of the past few years, the widening is hardly noticeable. Is the recent widening a sign of emerging economic weakness (e.g., the dreaded double-dip)? I don't think so. The magnitude of the widening isn't big enough to signal anything other than random noise or subtle shifts in sentiment—there has been no significant or fundamental deterioration in the economic outlook at all this year, according to these figures. And the outlook remains dramatically better today than it was early last year.

Of course, these charts also show that the fundamentals of the economy are still much worse than what we would expect to see in a normal expansion—spreads are still substantially higher today than they were in early 2007. So the economy is doing much better than the market expected a year ago, but the economy is still far from being termed "healthy." I think the explanation for the relatively poor performance of the economy is not too difficult to pinpoint: it's fiscal policy, stupid—huge increases in government spending and regulatory burdens, coupled with huge uncertainty over the level of future tax burdens. We could argue about monetary policy, since it has created huge uncertainty about future inflation risk, but at this point monetary policy is a minor problem compared to fiscal policy. The Fed can't create growth out of thin air, but intelligent tax and spending policies can, by altering the incentives to working and investing.

The economy has been facing serious fiscal headwinds for the past several years. That's a bummer, to be sure. But if anything, the outlook for fiscal policy today is not as bad as it was a year ago. Cap and trade is dead, and it appears highly likely that the Democrats will lose enough seats in Congress this November to make regulatory gridlock a reality (and one devoutly to be wished). With a little luck, the November elections could result in outright reform of fiscal policy.

My point here is that the problem of bad fiscal policy is nothing new, and sensitive indicators of the economy's health (e.g., swap spreads and credit spreads) do not reflect any meaningful deterioration in recent months. All of the angst and hand-wringing over a double-dip recession might just be the growing realization that we have had a big fiscal problem on our hands for quite some time. If that's the case, then the hue and cry might actually be a good thing, since it could nudge policymakers and the electorate in a direction that might restore some common sense to Washington.

Yes, things are bad, but that's nothing new. What's important on the margin is how things are likely to change in the future, and whether those changes are being factored into today's prices.

Subscribe to:

Post Comments (Atom)

7 comments:

OT, but possible good news for SG.

"Joe Miller poised to take Senate seat from Alaska's Lisa Murkowski

By Philip Rucker and Karen Tumulty

Washington Post Staff Writers

Wednesday, August 25, 2010; 1:40 PM

The 43-year-old bearded Alaskan who shocked the political world overnight by pulling ahead of Sen. Lisa Murkowski in the state's Republican primary fashions himself as a rugged individualist who campaigned on weaning Alaska off its dependence on federal largess.

Results on Wednesday showed Joe Miller holding a slim lead of about 1,900 votes over Murkowski, but a winner might not be declared until election officials count as many as 10,000 absentee ballots, which could take several days.

Nevertheless, early returns suggested a stunning upset, as Miller carried the anti-spending furor of the "tea party" movement to the most unlikely frontier: a state that has benefited far more from pork-barrel spending over the years than any state in the Lower 48.

Whereas Murkowski continued a long tradition of Alaska politicians touting their ability to steer an outsize proportion of Washington dollars back home, Miller campaigned on his belief that the federal investment there had made Alaska a sort of "federal fiefdom." Miller argued, apparently with some success, that with the government effectively bankrupt, Alaska should assume responsibility for its own destiny. "

If this is not just rhetoric from Miller, and he actually starts to pare back federal outlays to Alaska, this is incredible news.

As I have pointed out, the bulk of federal income taxes are eaten up by outlays to agencies with deep ties to rural America--a generation ago, that was Democrats (think LBJ). Now, it is Republicans.

Rural Red States receive back far more than they send to Washington DC in taxes, so they have a stake in the continued expansion of the federal government (check out Tax Foundation stats.) In a state like Kentucky, the federal excess largesse is more than $4000 per capita. Incredible.

Miller says he will stop the lard-train.

It will be fascinating to watch. Maybe the Tea Party will amount to something--especially if they explicitly battle Red State Socialism.

Speaking of Constitutional amendments, I favor one that states get back from the feds roughly what they send in every year, in terms of reveneus and outlays. Boy, that would start to shrink the federal government pronto.

OT again, but turn to page C11 of the WSJ today, re falling prices prompt large commercial property owners to "turn over the keys."

Buried in the story is the figure that $1.4 trillion in commercial r/e loans are underwater, and coming due by 2014.

So, all those loans get turned over to banks, and we have another financial 9/11 on our hands.

Of course, a round of property inflation would resolve this problem--that is why I am firmly ensconced in the reflationist camp, and I encourage others to join, to get the Fed to start stimulating.

You saw what $2 trillion in bad home loans did. This is another $1.4 trillion. It starts to add up.

It appears there is little in the credit spreads that would indicate the economy is 'rolling over' as many bears are opining.

I indicated the other day to Public Library that I thought the equity markets were 'irrational' and that there exists real value for those willing to accept some volatility in exchange for an ususual return. As Keynes famously said, "markets can stay irrational longer then (you) can stay solvent". I see the equity investor's job today as remaining solvent through this rough patch of volatility that has been with us since the end of April. As for values, I submit the following:

1) During quarters when economic growth contracts (there is still no evidence that this is such a quarter) there is a 50% chance the S&P 500 can advance, and by as much as 9% (per Miller Tabak's Dan Greenhaus). The equity market appears to have priced in such a contraction already.

2) Versus interest rates, equities' value looks quite attractive.

a) earnings yield (E/P) is the highest since the early 1980s.

b) according to JP Morgan there has never been a decade when the performance between bonds and stocks has been this extreme.

c) two year bank swap spreads are trading at the same level as April when the S&P 500 was over 1200 (vs today's 1055). These are improving risk metrics and do not indicate stress in the system.

d) The dividend yield on the DJIA is above the yield on the 10yr treasury bond. This happened briefly once since 1982: In november of '08 thru march of '09.

e) Junk bond yields are signaling no stress. They are barely 3% off their highs and are up ~9% YTD. Equities are 14% off their highs and down 4% YTD.

3) Historicly, valuations are skewed negatively.

a)The average PE multiple during low inflation/low interest rate environments over the last 25years has been a range of 15X to 17X earnings. Today's PE multiple stands near 12X (some say slightly below it).

b)Since 1962 the yield on the 10yr treasury bond has averaged ~3.65% ABOVE the pace of GDP growth. Today's 2.65% is thus discounting another recession (the double dip).

c) Industrial companies like BHP Billiton and Intel are bidding $30 Billion and $9 Billion respectively for Potash and McAfee. Both are paying CASH, not stock, and in BHP's case is borrowing at low rates to pay for the deal.

The above are exerts from an article by Doug Kass explaining why he is bullish on equities.

I offer these points as evidence the equity markets are currently 'irrational'.

John,

The global financial system is insolvent. This trumps anything US corporations can do to stem the tide. Bank swap rates are essentially government backed liabilities. You will not see stress in this market unless the Fed says they are walking away like they did to Lehman. Ain't gonna happen.

Benji, Fed QE2 bonanza is almost guaranteed and if Scott thinks the Fed is a minor issue now, you ain't see nothin' yet. I believe you will get your wish. I just don't believe you will get your result.

I apologize for the use of 'ain't' twice ;)

As we all found out, the Fed is willing to back the entire US and international financial system and ride this horse into the ground. TBTF means you need to get even more TBTF.

The playing field is so distorted by the sheer amount of debt and liabilities historical metrics should be re-examined exhaustively.

I read a good article talking about how backward-looking debt/gdp ratios of sovereigns do nothing to explain the growing and forward-looking problems that lie ahead. We truly have nothing to draw reasonable comparisons to.

I do not think the markets are irrational right now. Periphery Europe and the Euro are going bust and the US, UK, and Japan are virtually bankrupt.

No countries have ever paid off their debt. They have all, including the US, defaulted in some form or other on their obligations.

Marmico,

First, I choose not to plagerize. I give credit to the work of others.

Second, what I pay for is none of your business.

Third, I post where I live. I notice that you do not. I could comment further on that but I was taught manners.

Fourth, I can take criticism as well as anyone but I won't tolerate rude insults 'funnin' or not. One more post like that and our blog host will be asked to choose between us.

Public,

I agree many nations are insolvent. It may very well be why investors are so frightened. However it appears to me that a lot of the bad news is 'in' the market. For those who do not subscribe to the 'end of the world as we know it' the argument for equities is getting better.

I find it encouraging that despite very bearish news today (housing and durable goods), the market turned positive and ended positive for the session.

Of course, one session doesn't make or break a cycle, but today speaks volumes IMHO.

John,

I do hope you continue to comment on this blog. You have no idea how many times over the past year you have provided helpful insight and comfort to me on economic issues. Please ignore those who like to garner attention through bad manners.

Post a Comment