Thursday, August 26, 2010

A bond bubble?

Like many others, I remain fascinated by the rally in bonds that has taken the 10-yr yield to 2.5%, only 50 bps above its all-time lows which first occurred when the economy was mired in a decade-long depression and deflation. Is that the fate—depression and deflation—that awaits us today? How can we have ultra-low yields at a time when the federal deficit is gigantic and federal debt/GDP ratios are soaring? I have some thoughts and speculations.

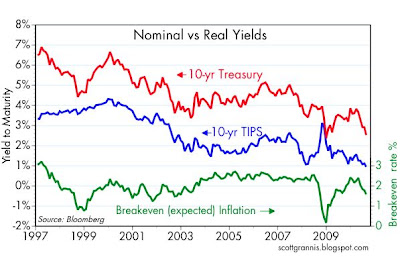

One explanation would be that the market is simply priced to the expectation of deflation. But that hypothesis is not validated by TIPS spreads, because inflation expectations are still reasonably positive: a 1.4% CPI on average over the next 5 years, and 1.6% over the next 10 years (see next chart). Deflation was our expected destination at the end of 2008—TIPS spreads were flat to negative, and TIPS yields soared because deflation fears were so strong that nobody had any interest in the securities. But things are very different today, with 10-yr TIPS real yields of 1% reflecting very strong demand for TIPS.

So perhaps the explanation behind ultra low yields is simply that growth expectations are extremely low; after all, we know that the market has been obsessed with a double-dip recession for awhile, so perhaps a real doozy of a recession is being priced into 10-yr Treasuries—something like a depression but without the attendant deflation that we saw in the 1930s.

But that hypothesis is not convincingly validated by the corporate bond market, where spreads are trading at levels that are similar to or less than what we saw in advance of the (very mild) 2001 recession, and at levels that are an order of magnitude less than what we saw at the end of 2008, when a depression was indeed priced in.

So perhaps there is, in addition to weak growth expectations, an inordinate fear of the future: a fear of big tax hikes, and of a prolonged economic malaise caused by an overbearing state that absorbs the fruits of and smothers the private sector. Japan comes to mind, with its massive deficits, a debt/GDP ratio that has been well into triple digits for years, and sluggish growth. Perhaps it's the case that as debt approaches and exceeds 90% of GDP the economy simply loses much of its forward momentum, a thesis supported by the findings of a recent research paper by Rogoff and Reinhart. There's even some support for this thesis in our own history—muddled of course, by WWII—when federal debt surged to 120% of GDP in the early 1940s, even as 10-yr yields traded at 2% or so.

This last explanation appears to be the most satisfying, given the various signals available in our capital markets. Animal spirits are seriously lacking, thanks to a massive expansion in the size and role of the government, coupled with the host of uncertainties which surround the future course of monetary policy—for example, many observers argue today that the Fed has run out of ammunition to jolt the economy out of its (supposedly) current funk. If the market is scrambling to buy bonds yielding 2.5% or less, it only makes sense if market participants hold little or no hope for a better alternative in the foreseeable future on a risk-adjusted basis.

It also makes sense that today's almost-zero yields on cash, extremely low yields on risk-free bonds, and massive debt sales become in a sense a self-fulfilling prophecy. Low yields represent very low hopes and aspirations on the part of the private sector, while the bonds being sold and the money absorbed from the private sector by our federal deficit are being used to fund a level of spending and wealth redistribution such as we have never seen before. For those of us who believe the spending multiplier is much less than one, it makes perfect sense that a huge increase in spending can only result in a dismal return on investment—i.e., a moribund economy. Ultra-low yields on Treasuries thus reflect dismal growth expectations while at the same time virtually ensuring that growth will be disappointing.

We're not witnessing a bond bubble in the making, we're living in a statist nightmare. Bonds are not in a bubble, because they are priced rationally if you believe, as the market seems to, that the outlook for the future is grim.

The future, however, is not written in stone, and there is little reason—in my view—to expect that the current state of affairs is going to go on forever. But you have to be an optimist to venture outside the safe haven of ultra-low Treasury yields that only the pessimists are content to receive. Today's bond market will prove to be a bubble if and when the people take back control of government from the statists currently occupying the White House and running Congress. I believe they will, come November. If you don't, then go out and buy some of those Treasury bonds; you'll have plenty of company.

Subscribe to:

Post Comments (Atom)

16 comments:

Scott,

To me your conclusion is rational. Businesses are feeling cowed by a hostile and intimidating government that threatens them with more regulations and compliance issues while attempting to increase their taxes in the near future...then having the audacity to browbeat them for not adding more workers. Small businesses are hunkering down and maybe taking on a temp or contracting out specific jobs but avoiding permanent comittments like the plague. Large multinationals are looking at projects and concluding it can be done elsewhere where their investment is appreciated or are so uncertain that it is being deferred. "Money goes where its wanted and stays where its well treated" (Walter Wriston former chairman of Citibank). Somehow I don't sense money is 'well treated' by this government...Paul Otellini (CEO Intel) doesn't think so either: "at one point no country was more attractive for startup capital (than the USA). That is no longer the case." If America's ruling class continues down this road "people will not invest in the United States..they will go elsewhere."

'Jobs' are job 1? "I think this group does not understand what it takes to create jobs." continues Otellini.

"I can tell you definitively that it costs $1 BILLION (yes, BILLION..emphasis mine) more per factory for me to build, equip, and operate a semiconductor manufacturing facility in the US". He added that 90% of that added cost is due to taxes and regulations that other countries don't have.

'Jobs' are job 1? People are employed by businesses. If you want more jobs, cultivate your businesses. So simple...and this government is so clueless.

Add to the regulatory burden a military-foreign policy-VA complex that now sucks $1 trillion a year out of the jobs- and wealth-creating private sector, and relentlessly gets bigger and more expensive every year--even the collapse of the one adversay of weight, the Soviet Union, only slowed its growth for a while. Military outlays (in real terms) have doubled in the last 10 years.

Now we fight few punk-terrorists who hide in mountains and use homemade bombs.

But the expense to productive U.S. taxpayers gets gets bigger every year.

My view, beyond the fear trade and the massive inflows into bond funds from retail investors:

Insurance companies and banks with huge mortgage businesses (and mortgage servicing rights) are doing unprecendent amounts of hedging. If the 10 year and 30 year decline much further, it has huge destructive value on their insurance liabilities (minimum guarantees to annuity and life insurance policy holders) and on their mortgage servicing rights. For banks, we are getting to the point where all conventional FHA mortgages ever written (that qualify for streamlined refi without appraisal so long as the borrower is current on payments) can be refinanced at lower rates, even below the spike down that occurred in 2003. To protect their MSRs, they must do massive buying of long bonds to offset the decline in MSRs, which would hurt earnings and book value massively. You can bet that large insurers (see article on Fairfax yesterday) and banks like Wells Fargo, are doing massive hedging for MSR book. Its a vicous downward push, because the more they buy long and hedge, the lower rates go, and hedging becomes greater and greater. This happened to a much less degree in 2003, but it certainly happened.

That's my view. And the big hedge funds know this and are front running. And then the Fed is buying. Its a huge one way trade by gov't, hedge funds, insurance companies, banks with large MSR books, pension funds, and investors.

One aspect you seem to ignore from your excellent analysis is the impact of demographics.

My Dad, who turned 74 last week told me how his excellent broker made him change his investment portfolio. When he turned 65, his broker told him, get out of tech stock go for more conservative stocks. The impact was that he literally sold his tech exposure in 2000.

When my dad turned 70, his broker told him income is key, so in 2006 he sold the remainder of his stock and was essentially fully invested in bonds.

OK, first he was unbelievably lucky with his timing, but that's just luck. The reality is that as you move down the age curve your portfolio has to change. The Baby boomers are now entering retirement, those who do have savings are moving those to the bond market, because they are more concerned with their principal than with earnings.

Demographic changes the number of household formation, it also changes the investment profile of investors. These investors are not concerned with earning higher returns, they are concerned with their capital as they consume their savings

Are you saying that the removal of our statist nightmare will release cash caught in the bond market? You're talking about a big rise in rates over the next 12 months if the Republicans take over Congress. Do you have targets for US bond yields and the equity market in that case?

As interest rates begin to eventually rise (and they will), bond yields will take a concomitant dive. My advice is to avoid bonds until the interest rates reach 10-12%, and then buy in aggressively using laddered and international diversifications as required. Take great care with acquiring bonds at current rates and turn to equities instead.

Speak: I do indeed think that a big change in the outlook for fiscal policy (i.e., smaller government) would result in a big rise in bond yields. If fiscal policy gets back on a more reasonable course, 10-yr yields could get back to levels more consistent with healthy economic growth, say 4-5%. I don't think this would pose a problem to the economy, since the rise in yields would be the result of a stronger economy. So I don't think it would be a problem for equities either. Equity gains could and should be quite strong even as bond yields rose.

Miller: what you're describing is the convexity trade. If demand for 10-yr Treasuries drives yields down enough, then the negative convexity of mortgages (which changes them from bonds to cash as rates fall) causes increased demand for Treasuries as a hedge. Note that the process gets started with heavy demand for Treasuries. It then gains steam from hedging activity. Once demand for Treasuries declines, the process can reverse itself with a vengeance, much as we saw in mid-2003, when 10-yr yields jumped from 3% to 4.5% in a matter of weeks. This also happened to coincide with the start of some very impressive economic growth.

Smaller government (and I want it) will lead to higher interest rates?

Guys. we have a glut of capital now. Even less borrowing?

I understand in prosperous times there will be more private-sector borrowing. But there will also be lots more private capital available.

We have low interest rates now due to abundant capital, a dead inflation outlook, and very tight money policy. Japanitis.

The Fed has to get aggressive.

I hope a Tea Party win in November improves matter. I like the TP fellow Miller from Alaska, who actually acknowledged that Alaska is a Red State--that is one of the states that contributes to red ink, by getting back from DC more than it sends in.

I doubt the Tea Party will actually fix the deficit but I like the Miller is talking.

BTW, I think the Fed goes to graduated and increasing quantitative easing. The scare is in--we are facing recession and deflation again.

Benjamin, pardon my lack of exact precision, but Defense spending accounts for about 5% of our spending if I'm not mistaken. I don't think that's too much. There are many other pieces of low hanging fruit in Guvmint spending.

Frozen: It's difficult if not impossible to argue one way or another the question of how much demographics is impacting asset values. I'm skeptical that the impact is significant, but I can't prove it. I note that demographic changes move at a relatively glacial pace, yet asset values have changed rather quickly in recent years. Also, while our society ages, others, such as China, are still very young and very anxious to save for their retirement. So the assets we sell in our retirement are likely very attractive to young Chinese.

As to demographics [and the investment implications], the most important lecture of the past several years for me is Richard Hokenson, formerly with DLJ. You can listen to it at:

http://www.sageadvisory.com/research/guestpresentations

I highly recommend it. Also the Stratfor presentation is outstanding.

I cannot emphasize this lecture enough. It was very very insightful. Forget Dent. Listen to Hokenson.

M Miller, the Hokenson link is dead

http://www.sageadvisory.com/

then go to research and education

then go to guest presentations

It's there. My link doesn't post correctly in this comments section.

Victor:

I calculate it is really at 7 percent to 8 percent.

You gotta add in "Homeland Security" and "Civilian Defense" and VA spending. Even parts of the Department of Energy budget are defense-related.

It is over 8 percent if you count in debt payments from war-spending.

Moreover, if we faced a armed-to-the-teeth Soviet Union, then 6 percent or even 10 percent might not be enough. It hit 10 percent in the 1960s, and maybe that was right for then.

But if all we face is some guys hiding the mountains, then maybe 2 percent is too much.

In short we need a flexible (imagine that) military, that takes advantage of peace-time though radical reductions in outlays.

Our military never does that. Imagine this: South Korea has an economy 40 times that of North Korea, and a population double. It is far more advanced technologically. The Korean War ended in 1953, when Eisenhower refused to prosecute Truman's war, telling subordinates, "never get into a land war in Asia."

We still have bases in South Korea. It is getting on 60 years, the Soviet Union has collapsed, and China is our biggest trading partner.

I suspect those bases with be there in another three decades, meaning the paw on taxpayer's wallets will extend 100 years past the conflict.

Post a Comment