Tuesday, August 10, 2010

Today's FOMC announcement adds marginally to inflation risk, and might help the housing market

The FOMC today announced that it will reinvest principal payments on its mortgage holdings into longer term Treasury securities. What that means is that bank reserves will remain constant: the line on the above chart will not slowly decline as we had been told it would earlier. The Fed will effectively reduce its trillion-plus holdings of mortgage-backed securities over time, but now it will replace them with Treasury holdings instead of allowing principal repayments to reduce the size of its balance sheet. This will result in a lengthening of the maturity and duration of the Fed's security holdings in a manner that could be likened to another "operation twist," in which the Fed attempts to flatten the yield curve by selling shorter-term securities and buying longer-term securities. In fact, it has already had that effect, and it has helped bring down fixed mortgage rates to new all-time lows.

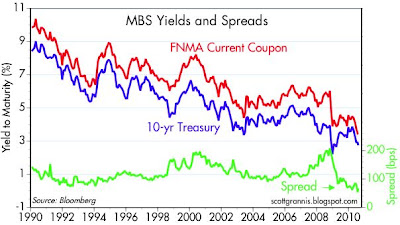

The first of the two charts above reflects the degree to which the Fed's policy intentions have affected the yield curve. The spread between 2-yr and 10-yr Treasuries has narrowed by almost 70 bps since hitting an all-time high earlier this year. The second chart shows that the spread between 10-yr Treasuries and MBS has not changed materially, so the decline in MBS rates is almost entirely due to the decline in 10-yr Treasury yields. By insisting that it will not tighten policy for a long time, and that meanwhile it will make no effort to reduce the size of its balance sheet, the Fed has managed to bring about a significant decline in intermediate interest rates, with the result that borrowing costs for homeowners have been reduced substantially.

We can't know how much stimulus this will provide to the economy (probably very little if any), but it should be a positive on the margin for the housing industry, since the Fed has so far succeeded in lowering mortgage rates, and that has the immediate impact of making current housing prices more affordable for the marginal buyer.

Since the vast majority of the reserves that the Fed created in the latter part of 2008 have been sitting idle on the Fed's books (banks haven't used the reserves to create new money), the Fed's announcement today was almost a non-event. Whether excess reserves (currently about $1 trillion) remain unchanged or decline slowly (as the market previously expected) will not have any practical impact, per se, on the amount of money sloshing around the economy, nor will it make any difference to banks' willingness to lend. But by lowering borrowing costs for homebuyers, the Fed's actions might increase the public's demand for loans (thereby having the effect of reducing the demand for money), and this could increase the inflationary impact of monetary policy. Confirming this, I note that the values of the dollar and gold changed meaningfully on the news (the dollar weakened and gold rose, signaling an effective increase in the supply of dollars relative to the demand for dollars), the spread between Treasury and TIPS yields widened marginally (signaling a modest rise in inflation expectations), and the 10-30 spread has widened to its highest level in history (signaling an increase in long-term inflation risk).

From my supply-side perspective, the FOMC announcement was disappointing. Instead of standing firm in defense of the dollar and in favor of low and stable inflation, the Fed has (once again) bowed to political pressures by giving priority to the economy and attempting to manipulate the yield curve in support of the housing market.

Does this make me less bullish on equities? Yes, but not by much. Today's announcement does not mark any significant change to the way the Fed has been conducting monetary policy over the past 22 months. But it does push forward the day when the Fed eventually moves to tighten policy, and that is a negative for the economy since it reduces confidence in the dollar and inhibits productive investment. Nevertheless, we are only talking about small changes on the margin to the policy outlook; monetary policy has been part of the problem for some time, and now we know it will remain part of the problem for somewhat longer. The bigger problem right now is fiscal policy, and the Fed made no attempt whatsoever to address that, which is unfortunate.

Subscribe to:

Post Comments (Atom)

22 comments:

Scott-

Oh, jeez, please give unto an inflationary Fed policy.

Yes, the signs of runaway inflation are all around. Office buildings being bid up in value, and wages skyrocketing. You have to bribe a plumber to come fix your toilets. Long-term bond holders are getting skittish at anythng under double digits. Oh wait--wrong country, wrong decade.

Dudes, the Cold War is over, Selma Alabama is over, and inflation is over.

Fight today's wars.

The Fed's announcement today vindicates those who have been arguing that the economy is off track. My worry is that the Fed's actions will still not be enough to avoid an accelerating deflation. The US is now grappling with a Main Street Depression that those with wealth or in government cannot truly appreciate or empathize with. Econometrics is a poor tool for measuring human suffering...

Calling all drug lords:

The United States needs you. Please come to America with your hundreds of billions of dollars of greenbacks, and start spending your money.

There are lots of pretty girls here, and large McMansions. We promise a major Hollywood studio will issue a re-make of “Scarface,” and HBO will produce a long-running “Scarface” series. The National Musuem will host a “Scareface” art retrospective. We can talk Cadillac into a large chrome grill design. Just come here, please. Our central bankers won’t help us–you can.

If the United States eocnomy sinks too deeply, you will lose your best market. Helping us is helping yourselves.

Deflation is the natural counter balance to excessive and destructive credit creation.

As with inflation, deflation is a zero-sum game. Therefore, the losers who leveraged up in hopes the ponzi-scheme would continue indefinitely will hand over the productive resources to those more able to manage them.

We need deflation. Not more mis-allocation of resources assisted by a blundering central bank.

As Scott smartly points out, the housing market may stand to benefit on the margin.

As if we need to keep dumping good money after bad by leveraging up on more housing stock! Sheeeesh!!!

Pub,

Vast numbers of people want to own and live in a beautiful and comfortable home. It is a possession that symbolizes the American dream probably more than any other thing. They buy a home, spend large amounts of money fixing it up, live in it and harbor hopes of someday selling it and buying/building something nicer. I do not believe there is anything wrong with that. What we need to get back to is a normal real estate and housing market with stable/slightly rising prices so confidence can return to existing and prospective homeowners. Unstable home prices are not conducive to positive, confident behavior by consumers.

I believe you are correct in saying the last bubble to pop does not recurr immediately. There may not be another real estate 'bubble' for a long time...but it does not mean we cannot have a normally functioning, reasonably liquid real estate market again...and quite soon.

I also agree with you that the interventions by the Fed and Congress will have consequences...I believe you called them 'short term pops'. I remain interested in where you think these might manifest and how to take advantage.

I enjoy reading your posts.

A Wall Street Journal survey found that by a two-to-one margin Wall Street economists see deflation as a bigger threat to the U.S. economy over the next three years than inflation.

Bloomberg News

"Falling prices aren’t the same as sale prices. “Deflation is dangerously close,” said David Resler of Nomura Securities, one of 53 economists surveyed by the Wall Street Journal. Among economists who answered the question, nearly two-thirds said that deflation poses the bigger risk to the economy over the next three years; the remainder said inflation is the bigger threat. That compares to an April survey, when the economists were split 50/50 over whether inflation or deflation posed the bigger risk over the next year."

Public-You can rhapsodize about deflation, and if you plan to stash serious money in a mattress and keep it there for 20 years, maybe you should.

But for the vast bulk of investors, deflation will be a disaster. When property and equity owners see values fall every year, they pull in their horns--worsening the cycle.

I would rather live through a long, inflationary boom (of the type extolled by George Gilder in "Wealth & Poverty," when he was shilling for the Reaganites) than a long deflationary recession.

Public:

"As with inflation, deflation is a zero-sum game. Therefore, the losers who leveraged up in hopes the ponzi-scheme would continue indefinitely will hand over the productive resources to those more able to manage them. We need deflation. Not more mis-allocation of resources assisted by a blundering central bank."

At least with inflation there IS allocation of resources (i.e. investment). Right now we have just the threat of deflation, and no one wants to invest in anything. The “losers” include just about ANY business owner, levered or not, who invested in people, research, capital equipment etc in hopes that the US (and world) would not collapse. There aren’t any others “more able to manage” those resources. I suspect you are focusing those remarks on real estate and financial investors (and I’m not reading it as inflammatory) but I do think you are over-looking the scope of those affected.

Well, I cant say Im surprised by todays announcement. It was already priced into the bond market last week.

This the fed doing what he thinks is necessary to avoid a longer recession or even a depression. Ben Bernanke has spoken often about his feelings about the great depression and how it could have been avoided with a more easy monetary policy.

Deflation is visible everywhere you go, the car dealership, the real estate market and restaurants. Deflation is a worst case scenario because it causes those who hold wealth to save more in hopes for cheaper prices in the future. Deflation is a bit a of fear indicator too, its telling the market that people are not risking anything and saving every dime they get their hands on. Also, its a very slippery slope, once deflation begins to sink in its very hard to shake because the perception that prices will fall forces even more to hold back spending.

Bernanke is concerned about deflation and extending duration on treasuries but Warren Buffet is worried about inflation and lowering duration on his bond portfolio. Herein lies the major problem for the FED. There is little room for error. Easy too little and deflation rears its ugly head. Ease for too long or do not tighten quickly enough and the equally ugly head of inflation will be wagging.

I think the FED continues on with its very easy monetary policy and maybe even expands beyond the expected 300 billion in new purchases but announces another round of treasury purchases next yr.

Randy,

Deflation has a finite existence based on the money supply while Inflation has an infinite power to destroy value.

Both are a zero-sum game. If you beleive there are no loser in the inflation game then therein lies the missing logic. Lets not goret deflation is a byproduct of excessive and destructive credit/money expansion.

Inflation masks the winners and loser while deflation (brought about via excessive credit expansion) makes it clear who the beneficiaries are in a free and open economy.

Eventually deflation ceases and those with the most resources are able to takeover the productive capabilities from those who mismanaged the resources.

There is nothing to fear in deflation. Will we have losers, of course, but inflating away is a losing proposition no matter how you slice and dice the pie.

The question is not how much "inflation" or "deflation" occurs - the question is how much human suffering will result -- deflation creates more human suffering in absolute terms than inflation - more at:

http://wjmc.blogspot.com/2010/08/human-suffering-is-absolute.html

We as economists and commentators must not lose sight of the reality that human suffering is absolute...

Slowing inflation is both a result of the deleveraging process and a factor that makes the deleveraging process more difficult. The fed has a limited ability to increase the price level through open market operations and they should use the tools they have. When, but not until, deleveraging is over, it will take very aggressive action on the fed's part to contain inflation.

Policy should focus on facilitating the massive structural adjustments that we face, restoring the rule of law, deregulating, fixing tax rates on small business owners and entrepreneurs at the current level and avoiding any action that increases employment costs. MICRO-economic policy is where the action is and here the Obama Administration is failing across the board.

Doc McKib,

And that is why the Fed will continue to err on the side of inflation.

Again, to use Alan Greenspan's words, "the fed is a creature of Congress" and the politicians demand that the issue of unemployment be addressed.

You are correct that recession/slow growth & high unemployment creates hardships. But also, government does not 'owe' everyone a job. It just needs to create the favorable economic circumstances so that those who are motivated to work have a reasonable opportunity to do so.

Hi John, I agree that the US does not "owe" anyone a job. But, if the prosperous in America are to save the goose that lays golden eggs, then more attention must be directed at avoiding depressions such as the one now underway. The US does not "owe" anyone a job -- likewise, the US does not "owe" anyone their savings -- in the final analysis, human suffering leads to devastation that neither the government nor society are ever prepared for. I commend Gibbon's "Rise and Fall of the Roman Empire" for more about my reasoning. Ending the ongoing Main Street Depression is an urgent prerequisite to avoiding anarchy...

Did you read what David Stockman had to say?

http://www.marketwatch.com/story/reagan-insider-gop-destroyed-us-economy-2010-08-10

Benjamin: Remind me: when was the last time that the majority of Wall Street economists got their forecast right?

"As we have seen, deflation comes in response to previous inflation. Note that as a rule a general increase in prices, which is labeled inflation, requires increases in the money supply. Hence a fall in the money supply leads to a fall in general prices — labeled as deflation.

This amounts to the disappearance of money that was previously generated out of thin air. This type of money gives rise to various nonproductive activities by diverting real savings from productive real wealth generating activities."

Unless Bernanke finds religion contrary to his prior economic religion, consider us on an unsustainable path to nowhere...

"Obviously, then, a fall in the money stock on account of the disappearance of money out "of thin air" is great news for all wealth-generating activities; the disappearance of this type of money arrests their bleeding. A fall in the money stock undermines various nonproductive activities. It slows down the decline of the pool of real savings and thereby lays the foundation for an economic revival."

Edward-

That is a terrific link--sadly, Stockman is not nearly condemnatory enough.

Sad what has the R-Party sunk to. Sad.

Post a Comment