Monday, April 12, 2010

Federal budget outlook still deeply troubling

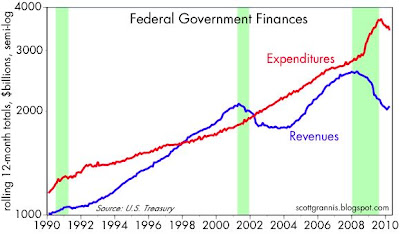

Although in the past few months there has been some improvement on the margin in the state of the federal government's budget, the overall picture is still deeply troubling. The improvement comes mostly from a decline in outlays (measured on a rolling 12-month basis), which in turn is a function of the running-off of the crisis-mode spending that occurred in the early months of last year. In addition, in the past few months there has been a slight firming in revenues, which is not surprising given the improvement in the economy since last summer.

But unless big changes are made to the government's spending plans, we are likely to see spending rise back up to 25% or more of GDP in the years to come, especially if healthcare reform is implemented. In an optimistic scenario in which the economy continues to post growth of 3-4% per year, revenues could move back up to 18% of GDP, but that would still leave a deficit of 7-10% of GDP. The deficit over the past 12 months is just under $1.4 trillion, and even "optimistic" numbers such as these would yield annual deficits of $1.1 to $1.7 trillion two years from now.

Thus, our debt to GDP ratio is on track for 100% within the foreseeable future, with the lion's share of the deterioration coming from government spending fueled mainly by transfer payments and entitlement programs. We will be passing on a huge debt to future generations with nothing much to show for it save a growing and cancerous culture of dependency. In a best-case scenario, this will mean a substantially slower trend rate of growth in the future, and lower living standards for most of us than would otherwise have been possible.

The prospect of trillion-dollar deficits is already driving calls for higher taxes on the rich, but that has limited potential to solve the problem since the rich are already paying most of the income taxes these days. The only way to generate a significant increase in revenue is with a VAT tax, such as is being proposed by Paul Volcker, that would land squarely on the shoulders of the middle class.

In the meantime, the prospect of higher income taxes next year is probably helping to drive the improvement in the economy and in the budget situation this year. That's because people have a powerful incentive to accelerate the recognition of income and capital gains to take advantage of today's lower rates. This positive dynamic has its cost, of course, and that will be seen next year in the form of slower income growth and reduced capital gains realizations. (This reminds me that the capital gains tax is the only tax you can legally avoid, simply by not selling whatever you hold at a gain.)

We have seen this dynamic happen several times in the past, as the above chart shows. Prior to the scheduled increase in capital gains taxes in 1987, capital gains realizations surged in 1986, only to collapse once the higher rates kicked in. Conversely, the reduction in the capital gains tax rate in the late 1990s produced a surge in capital gains realizations in subsequent years. Yet despite the abundant evidence that changes in tax rates have profound effects on people's tax strategies and their incentive to work and invest, OMB routinely projects (and politicians happily agree) that higher tax rates will always produce higher tax revenues, and vice versa. Unfortunately it just ain't so: higher tax rates next year could well lead to an even worse budget situation.

Where does this leave us? It's my hope and expectation that this budget picture is ugly enough to grab the electorate's attention. That attention will become laser-focused by the emerging discussion of the need to close an enormous budget gap with hugely higher taxes. With a little luck the electorate will decide we are on an unsustainable path (i.e., too much spending) and vote for change of the positive variety (i.e., less spending). So even though the outlook is deeply troubling, there is still plenty of reason to be optimistic about the future.

Subscribe to:

Post Comments (Atom)

17 comments:

Just the synthesis of rates discussion:Caron vs Hatzius

http://alturl.com/ur6v

Mr. Grannis:

Milton Friedman said many times it was the “spending” which is/was the real problem not the deficit/accumulated debt. That is, the deficit/debt got there in the first place by over spending. Friedman was exactly right.

Considering Friedman’s remarks, when you build a social welfare state based upon unfunded entitlements and constant accumulation of debt, you eventually create an environment in which we find ourselves today:

(1) constituency groups of entitlements (what FDR taught progressives to build) that don’t want any cuts in government spending,

(2) tax payers resistant to tax increases,

(3) inability to deficit spend as the credit line is either running out and/or about to become much more expensive.

Exactly who wants to take the pain in order to match government expenditures with government revenue? What about the pain to reduce massive accumulated debt?

An examination of the problem mentioned above lands you squarely in the realm of political-economy and an examination of the political class, the producer class, and the receiving class.

The political class merely wants to continue to spend and spend. The political class casts a blind eye at facing the deficit/debt/tax revenue. In other words, business as usual for the political class with a continued dependence on number three (3) above even though the day of reckoning is upon us. Passing a pork barrel stimulus plan fueling social engineering (placate their entitlement constituency class and continue building constituency through transfer payments) and continued expanding the size and scope of an already bloated government. Passing yet another unfunded entitlement program aka ObamaCare further building a transfer payment constituency in the face of unsustainable current entitlements, current account deficits, and accumulated debt. All the while, the backdrop is government revenue falling in relation to spending.

The producer class is facing disincentives in the form of tax increases. A smaller and smaller producer class is asked to prop up an ever increasing sized receiving class through the moral obligation argument put forth by a completely out-of-touch political class. The political class wants to raise taxes at a rate that is increasing at an increasing rate upon the producer class which is decreasing in size at an increasing rate.

The receiving class has all the incentive in the world to demand the continuance of current entitlements (transfer payments). When the political class which has build a constituency of people dependent on transfer payments propose more transfer payments, this constancy of recipients have great incentive to support such transfer payments.

Ah the evil of it all! An 80 year experiment in marginal Marxism yields Margaret Thatcher’s prediction of running out of other people’s money.

We have met the enemy and they are the political class.

Family Man: In my view, the existence of large budget deficits does not have a predictable effect on interest rates. Interest rates are driven primarily by inflation and secondarily by the growth rate of the economy. If both are low, then interest rates will be low, even if budget deficits are trillions of dollars every year. Japan is the prime example.

We are not only in a war, we are in two wars, and some say we are in a 80-year global war on terror (mostly right-wingers and defense-related people in our military-foreign policy elites).

Friedman proposed progressive consumption taxes to finance wartime mobiizations (see American Economic Review, 1943).

Our defense budget will run us about $10 trillion in the next 10 years. We are permanently mobilized. MF has shown the least destructive way to finance this mobilization.

The gigantic and institutionalized rural welfare system we have created is another easy place to cut. Eliminating the USDA, raze it to the ground, and rip out the roots is one good idea.

HUD and Commerce are two more very dubious entities. I can see no reason for a federal Department of Education in this era of the Internet.

So, there are places to cut, or rearrange financing. I see little hope that the sacred cows I mention will be cut or financed through consumption taxes.

The ultra-right Cato Institute has called for a 50 percent cut in federal defense spending, and the elimination of most overseas bases.

Of course, we could go all out down the Friedman road, and wipe out the FDIC and the SEC, as he wanted to do. And the homeowners mortgage interest tax deduction. Usually, most people stop quoting MF at this point.

"Usually, most people stop quoting MF at this point."

Unlike the pure-of-heart Benji who votes for radical socialist, Big Ag loving Presidents; calls for single-payer health care; and wants to raise taxes on the rich.

This is the same Benji who 2 days ago decided Friedman was out of touch when he disagreed with him: It is nice to listen to MF's utopian visions. He might have spent just a few too many years in an ivory tower somewhere, but nice reasoning.

Not sure if MF every ran a small manufacturing company, or grocery store, or ever drove a big-rig for five years. My guess is not.

But you'll keep selectively quoting him, won't you Benji?

How about we cancel your boyfriend Barack's massive government agenda instead of raising taxes?

Paul-

I am disappointed in the Obama presidency. Just like I was with Bush and Bush II.

I have to say, Clinton proposed and ran surpluses. I was pleasantly surprised with the Clinton job. He avoided foreign entanglements, very important, as we are finding out.

So voting for Obama in 2008 was a reasonable choice, given the alternative. It hasn't worked out.

We seem to getting in deeper into Afghanistan, and defense spending is soaring. You are right, Obama has not tackled the Red Bloc of rural welfare snufflers. Deficit spending is high.

As for taxing the wealthy, I am happy to do so in the form of consumption taxes. I am reluctant to tax anyone's income, or productive behavior.

As to MF, my comment that he may be an Ivory Towerist stems from MF's statement that public schools and the minimum wage are what keep blacks down.

Since Asian students excel in public schools, I think the problem of black poverty is much deeper than poor public schools and the minimum wage.

The minimum wage has fallen in real terms since the 1960s, while unemployment rates have risen, especially for teenage blacks.

I hardly want to fan any flames of prejudice, and in a diverse country such as the USA, we must always look for the best in each other, not the worst. Hatred is always the wrong choice.

That said, I don't think it is the minimum wage or bad public schools that prevent any race of people from getting ahead. I think the probems lie within the people. That is where I think MF is a bit niave.

"So voting for Obama in 2008 was a reasonable choice, given the alternative. It hasn't worked out."

Statements like that help explain why we are in such deep doo-doo. You, like so many millions of people, missed all of the many danger signals Obama was flashing. Instead, you voted with the cool kids while looking down your nose at Sarah Palin. And you give no indications you won't make the same mistake in the future, or even reconize the vast differences. McCain would not be in thrall to Big Labor or Big Ag. He wouldn't have poured a trillion dollar "stimulus" down a rat hole. He wouldn't have nationalized our health care, took over the car companies, effective control of the banks, etc. He doesn't take earmarks. He voted against Medicare Part D. His whole career has been devoted to fiscal sobriety. War hero.

vs.

Obama, the community organizer from Chicago, one of the biggest Liberals in the Senate. Up to his ears in pork and corruption.

Yeah, tough choice. But keep going after those rural subsidies, Benji.

I recall arguments with a lot of Obama supporters prior to the 2008 elections. They said he was going to be something new and great and positive, and I kept saying, "no matter what, he is a socialist at heart." The most important thing to know about a politician is what he truly believes deep down inside, because that tells you how he will react to adversity. The danger signs were all there.

Scott, I usually agree with you. But not when you say this:

"With a little luck the electorate will decide we are on an unsustainable path (i.e., too much spending) and vote for change of the positive variety (i.e., less spending)."

When has the electorate ever favored less spending? Do you really think voters are going to reward politicians who say, "Hey, let's make Medicare ration care" or "Here's an idea: how about cutting cost-of-living adjustments for social security beneficiaries?"

No way. Won't happen.

Even Scott Brown, hero of Tea Party activists, voted for Big Government porkulus II:

http://michellemalkin.com/2010/02/22/the-15b-porkulus-ii-cloture-roll-call-vote-scott-brown-the-voinovich-pay-off-business-as-usual/

If even Scott Brown is for Big Government spending, what hope is there that any meaningful spending cuts will come to pass?

The rise of the Tea Party is all about demanding less government spending and less government control over our lives. The enduring and strong reaction against ObamaCare is all about less government rather than more. Even though the majority of people receive more from the government than they pay in, I firmly believe the heart of this country is in favor of Limited Government. Check out the battle lines being drawn in New Jersey these days. I think Gov. Christie is going to win the fight.

Well, hindsight is perfect, but you all are quickly forgetting that McCain, like Obama, lacked a serious track record in the private sector.

McCain was no businessman, thought a budget was something you spent, and bragged about not understanding the economy. I don't recall him bashing Bush's gigantic and socialist bailout of our financial sector.

McCain never ran a grocery store, a furniture-making operation, or drove a big rig.

He also signalled a vast expansion of the federal government through a bewildering array of global commitments. I lost count of the number of countries that he planned to invade unless they danced to our tune, but I think it was six.

His running mate, Palin, bragged about her unionist husband, and the fact that Alaskans in common receive royalty checks from oil companies, and that she borrowed lots of money and had raised property taxes to build that necessity, a skating rink, in her home town. Is small-town socialism okay?

McCain's plethora of proposed global commitments were frightfully expensive, running to the tune of trillions of dollars per occupied country, as we are finding out. In the ninth year of our Afghan venture, we are also finding out how open-ended such expeditions are.

I still can't say it was the wrong choice to vote for Obama, given the choice in a two-party system.

Moreover, I felt that voting R again would only reward the complete lack of fiscal discipline and the roundhouse failure of the R-Party from 2000-2008. Remember, after eight years of R rule, the DJI was lower than when they started, and for good reasons.

If you give an employee eight years to earn a "C," and then still come up with an "F," you have to try a new employee, even an unpromising one.

In this last regard, perhaps my vote was not in vain. We see now some braggadocio in R-Party circles that they mean to cut spending.

Well, we have heard it before, but maybe this time it is real. Let us hope they cut the full spectrum of federal spending.

I doubt it, and socialism remains the strength of our ag sector, according to the R-Party.

It will be a fun to have ringside seats on the next round of elections. But don't believe anybody's rhetoric.

"Well, hindsight is perfect, but you all are quickly forgetting that McCain, like Obama, lacked a serious track record in the private sector."

No hindsight here. Obama's actions were ENTIRELY predictable. But let's pretend they're equal in the private sector background. How many communists and criminals did McCain surround himself with? Did McCain threaten to bankrupt any energy companies? Compare their voting records on fiscal matters...there is no comparison. You always beat the drum against ag subsidies, but Obama was ADM's butt boy. Obama steered nearly a billion dollars worth of pork back to his constituents during his short career as a part-time Senator.

That didn't set off any alarm bells, Mr True Economic Conservative?

"I lost count of the number of countries that he planned to invade unless they danced to our tune, but I think it was six."

Nothing but Benji blather there.

"Remember, after eight years of R rule, the DJI was lower than when they started, and for good reasons."

That's such a mindless statement. The DJIA dot com/Y2k bubble popped in 2000, while Clinton was still President.

"I doubt it, and socialism remains the strength of our ag sector, according to the R-Party."

No, according to your boyfriend the Big Ag hag of the Senate, but not McCain.

It's staggering you still can't see what a horrific choice you made.

Paul-

Perhaps I am cut from different cloth from you. We should try to enjoy each other's stripes, rather than merely carp about the differences.

Benji,

I'll try to remember that the next time you smear us as Red State Socialists.

Paul-

Who is "us"?

I have never taken issue with you on a personal level, or denigrated your posts.

Yes, I regard the current day R-party as hopelessly shot-through with Red Bloc socialists and militarists. As does Ron Paul, btw.

It was on the Ron Paul website that there were keeping tabls of potential McCain invastion-occupations, by nation. "Occupation-itis" etc.

Why not present your point of view, instead of taking issue with mine?

If you have a view of the R-Party returning to fiscal conservatism, present it!

Benji,

"I have never taken issue with you on a personal level, or denigrated your posts."

You routinely do the snide "right-wing blah blah", "Red State Socialists etc.." and "tea-partiers are hypocritical because xyz.."

I live in the reddest of red states and attend tea parties. You're taking a swipe at me and the people I associate with every time you do that. (A)It's just annoying coming from somebody who calls himself a True Economic Conservative yet mindlessly jumped on the Hopeandchange bandwagon. (B) It's fun to point out how full of crap you are.

"If you have a view of the R-Party returning to fiscal conservatism, present it!"

Actually, I don't really say that, generally speaking. What I do say is the GOP's fiscal track record is leaps and bounds better than your boyfriend and Pelosi's. Yet your gunsights are always inexplicably aimed at the right side of the aisle.

Post a Comment