Tuesday, April 20, 2010

The bond market sees little inflation risk and very slow growth

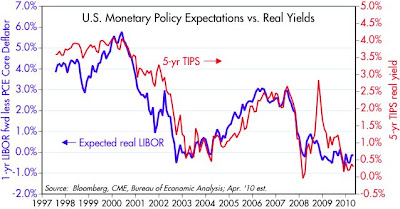

Always on the lookout for the key assumptions that are lurking behind market prices, I offer this update to similar posts here and here. Real yields on TIPS are, I believe, very good indicators of the bond market's growth and inflation expectations. Currently they are telling us that the bond market expects sub-par growth and no significant increase in inflation.

I detect no sign that the bond market is unusually concerned about future inflation. 5- and 10-year breakeven spreads are in the range of 2.25-2.35%, which is actually lower than the 2.45% that the CPI has averaged over the past 10 years. The 5-year, 5-year forward breakeven spread is about 2.65%, again very much in line with what we have seen in the past. 10-year Treasury yields today are at the same level (just under 4%) as prevailed during the early 1960s, which was a time when inflation was extremely low and stable—about 1.5% per year.

I infer from the chart above that the bond market is not concerned at all about any significant tightening of monetary policy over the next year. The level of yields on 5-year TIPS is consistent with an expectation that real yields on short-term interest rates will be roughly zero. That expectation (of no Fed tightening, which I define as increasing the Fed funds rate by more than the increase in inflation) is in turn consistent, I believe, with a view that economic growth is likely to be sub-par (consistent with the popular "new-normal" forecast for 2-2.5% growth). If economic growth were expected to be 3-4% or more one year from now, I have to believe that the bond market today would be expecting at least some modest tightening, if not significant tightening.

Since there is no reason to believe that the expectations driving the bond market are any different from the expectations driving the equity market, I can further infer that there is little reason to believe that the equity market is a bubble waiting to pop. The capital markets today are priced to very conservative and unexciting assumptions about the future.

Subscribe to:

Post Comments (Atom)

12 comments:

Well, there is also the idea that even if investors fear inflation, they have to park their cash somewhere.

We have global capital markets, and money crosses borders more easily than people.

The global is capital rich--savings rates are high in Asia and Europe.

A global capital glut, and it will get worse and worse (or better and better, if you are solid business that need cash).

If you want safety in bonds or Treasuries, you might have to accept small negative real returns in the future.

I think it's very difficult to argue that a "savings glut" is causing all sorts of distortions to market prices. What I see out there is a broad array of market prices that are all internally consistent with a view of a slow-growth, low-inflation future. Besides, I think the term "savings glut" is just another word for a market that doesn't see much in the way of future growth opportunities. If growth expectations were strong, then entrepreneurs would be gobbling up all the world's savings and there would be no "glut."

Scott-

The global economy did boom from 2000 to 2008, eating up record amounts of capital--yet a Niagara of capital swamped demand, and was looking for a home, some sort of yield. In part that led to huge amounts of capital pouring into the US housing markets (yes, abetted by Fannie, Freddie, RMBS, Moody's et al, Goldman Sachs et al and the US tax code) where yields higher than T-bills could be had.

A Niagara of capital searching for yield swamped the market and reason.

I heard this mantra in 2007-8: "Too much capital chasing too few deals." I heard this from venture capitalists, private equity guys, mutual funds, real estate guys.

Some VC deals were done in the energy sector on very iffy circumstances--the money was there.

Okay, we know the global economy tanked since then--but it is recovering. That will radically increase the amount of investable capital.

It seems inevitable. Again, there will huge and growing pools of capital seeking yield--but wary of shabby portfolios of real estate.

The money will pile up in safe investments, such as TIPS--driving real yields into negative range.

This scenario does not conflict with the outlook for interest rates, which, as you point out, is very benign. At least the market thinks so.

At bottom, I think this augurs well for the global economy. Abundant capital will mean business growth egst financed, proeprty developed etc. There will be some busts along the way.

And remember, while you say the market is anticipating for slow growth, China right now is growing at 11 percent annually. I do not think global markets are antipating slow growth in Asia, which is rapidly becoming the largest market on the globe.

This may mean equities and property have a great future--not so sure about "safe" bonds. Look for negative real yields there.

I think you both make excellent points. There appears to me to be an awful lot of money still in the financial bomb shelters around the world that has completely missed this initial surge into risk assets. It is being deployed slowly but steadily and COULD become a rush should the right catalyst emerge. Like the proverbial unseen snake that bites you it is impossible to know what the catalyst might be. We can guess, but we cannot know.

I feel like the great bull market in US treasuries is over. I think it ended with early spring 2009 capitulation price surge that sank yields on the 10 yr to the sub 2% area (not exactly sure of the precise low yield point but I think I am close enough). Global savings (however defined) seeking inflation beating returns is going to have to get more creative than dumping it into US Treasuries or German Bunds. That elusive catalyst that sparks the rush into risk assets all around the world MAY just be the realization that the great bond party is over and all that awaits its investors are steadily declining prices as global inflation slowly builds. It still appears to be a ways off but the idea deserves some serious thought - at least to me.

I remain thankful for the perspective of both you guys.

John-

And I yours!

I think you are right--eventually, capital will come out of financial bunkers, and into equities and property.

But even as it does, huge new pools of capital will be forming, also looking for a home.

Investors will park money in TIPS and elsewhere, brooding over options, and seeking safety.

If we have a couple goods years of global growth, we will agan have "too much money chasing too few deals."

Another Niagara of capital.

Safe investment yield goes to zero.

Capital will swamp most "good ideas."

I think it is a great time to start a business. I worry about returns on passive investing (that is, stocks and bonds). You will be competing with torrents of capital looking for a home. If you get in front of the herd--boom, on the upside.

If you run with the pack, you will find you oversubscribed to the same idea. And most people will run with the pack. That is why it is the pack.

It may be hands-on property development and business startups are the pace to be in the next 10 years.

But hey, I may change my mind tomorrow!

I am throwing this in as just an aside but I've just read a report from a money manager who claims a very diverse set of economic channel checks that include such things as a Korean tire maker that exports to the US,a machinery parts manufacturer, a chinese apparel representative that exports to the US, etc. He claims they are ALL reporting a relentless build in demand over the last few weeks. He adds that he believes the economy is stronger that most are currently modeling.

You heard it from Scott firet.

I'm also hearing that there is widespread improvement out there. This is very likely to continue, as it becomes self-perpetuating given the low level of inventories and all the production cutbacks. We could be setting the stage for a classic "buying panic" at some point.

Last post for the day. PROMISE.

My mentor taught me many years ago that the very essence of successful investing is identifying trends before the crowd and then positioning yourself appropriately to take advantage of it. I am honestly not trying to be a shill for the blog host here but for anyone who cares to see, that is precisely what these charts AND THEIR INTERPRETATIONS have been providing.

Nite, ya'll

John: Thanks, that's been my intent all along.

I concur with John and Scott, seeing widespread reports of improvement.

Real Estate is a dud, but everything else posting north.

Why I expect a rally but not a honking bull market: P/Es already high. We aren't seeing the single digit p/es of 1979.

This sets up an interesting tension in months and years ahead--a Niagara of capital looking for a home, but p/e's above 20 and low bond yields.

Do you buy Coke (KO) at 20 times earnings? It's almost there already. And if it rallies? Do you pay 30 times earnings for Coke?

That situation, repeated ubiqitously, will be the dilemma facing investors in a few years.

Scott,

I have often heard it said that the yield curve lags or the bond market gets inflation wrong. Basically, when metals and commodities suggest inflation but bonds suggest none, you should believe the commodities. Today, commodities and stocks seem to be signaling growth and higher inflation ahead. Bonds, not so much. I've been taught to discount the bond market in this case, but it could be a simple bias.

Do you think the bond market is slow to recognize inflation risk? Have you seen that historically?

Thanks as always for your thoughts.

REW: I've commented many times in posts over the past year or so that the bond market has a bad record of forecasting inflation. Bonds underestimated inflation throughout the 1970s, and overestimated inflation throughout the 1980s and 90s. Bonds follow the lead of the Fed, and the Fed has made quite a few mistakes over the years also. Bonds, like the Fed, put too much emphasis on growth and the so-called "output gap," and not enough on sensitive indicators such as gold and commodity prices and the value of the dollar.

Post a Comment