Tuesday, March 16, 2010

Fed's MBS purchase program ending with a yawn

The Fed's program to purchase $1.25 trillion of MBS will end in a few weeks, but for all intents and purposes, and as far as the market is concerned, it is over. The big question all along has been how much these purchases, which began about one year ago, were distorting the market, and therefore how disruptive the end of the program might be.

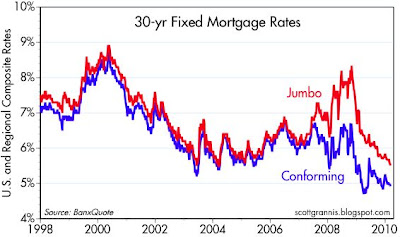

A quick glance at the top chart here would suggest that the Fed's purchases have played a significant role in bringing down mortgage rates and thereby supporting the housing market; fixed rates on jumbo mortgages have fallen 235 bps since the program was announced on Nov. 25, 2008, and conforming rates have fallen about 125 bps.

But since the Fed has only been purchasing conforming MBS, that doesn't explain the outsized decline in jumbo rates, and the huge narrowing of the spread between jumbo and conforming rates. If the Fed were artificially supporting the prices of conforming MBS, then the spread between conforming and jumbos should have widened, not tightened.

Spreads on conforming mortgages have fallen to their lowest levels ever, as shown in the second chart. Could this be all due to Fed purchases? I tend to doubt it. If the Fed were artificially supporting the market, then the proximity of the end of the support should have already caused the market to push spreads wider, but there's no sign of that yet. Yes, spreads have widened just a bit in the past several days, but that's no more than just a random blip.

I've argued in the past that the end of the Fed MBS purchase program could result in a 30-50 bps widening in MBS spreads. That's still possible, but right now it seems less likely. The explanation for why spreads are so tight is therefore this: spreads are tight because the market expects Treasury yields to be relatively low and stable for a long time, and MBS are therefore very attractive since they offer higher yields with virtually no default risk.

Subscribe to:

Post Comments (Atom)

5 comments:

Hi Scott- as you know there is a difference between spread (as you detail) and OAS (option adjusted spread).

I think the OAS is currently the much more important measure and likely shows a larger discepency between conforming and non-conforming mortgages.

This is based on my view that the key going forward is the optionality of mortgages. As you mentioned, if rates remain low, there is no concern. BUT, if rates do jump, even without credit risk to an investor, these securities will extend dramatically as these homeowners will have a huge incentive to stay in these subsidized loans for a much longer time frame.

While it depends on the OAS model used, some models show the OAS is trading through Treasuries. This makes them absurdly rich.

Forgot an additional note... I am completely dumbfounded as to why they have not sold off yet too, though not ready to say it is due to valuation.

There is indeed the potential for ugly performance in MBS if rates shoot higher, and as you note OAS are very low. Why would the market be trading so tight under these conditions? The only explanation seems to be that the market seems very sure that rates are not going to rise by more than the forward curve suggests.

Would I be a buyer of MBS at these levels? No, and I have been bearish on MBS since my year-end predictions. My main point here however is to discover what the market's thinking about the future. I think the action in MBS land tells us the market is still very pessimistic about the economy's future. Otherwise 10-year yields would be higher and MBS spreads would be wider.

What if at a high level there are no marginal sellers and the only marginal buyer has been the Fed? Absolute buyers remain those investors tied to indices (i.e. the BarCap Agg).

If this is the case, the fact that the Fed is still buying (and not dumping Agency MBS like most active managers did as the Fed was buying) may be keeping OAS low.

In this case, when the market needs a marginal buyer going forward, spreads should (in theory) widen, but not necessarily before as those that influence spread are already out of the market for the time being.

We shall see.

You have a point, but what is there to prevent managers tied to the BarCap Agg from severely underweighting the MBS sector? In aggregate they probably held as least as much MBS as the Fed has since purchased. Plus, the Fed's recent purchases have been very small on the margin.

I won't be surprised if spreads widen some after the end of the month, but I think it is less likely to happen than I previously thought.

Post a Comment