Tuesday, March 16, 2010

The VIX is down, but the market's fears are still huge

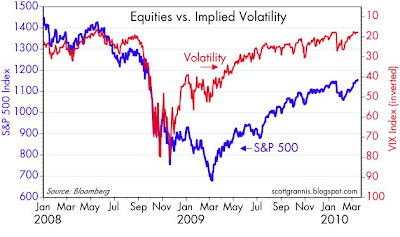

I'm showing this chart for the umpteenth time in order to emphasize a point I haven't made in quite awhile. The chart shows how tight the relationship between implied volatility (a proxy for the market's level of fear, uncertainty, and doubt) and equity prices has been over the past year. As fear and uncertainty subside, equity prices rise. It makes perfect sense, especially since the crisis that set in starting in mid-2008 was all about widespread fears of a global financial collapse.

The point I want to make here, however, is that when the yield on cash is basically zero, and the Fed tells you yet again, as they did today, that cash is going to yield zero for quite some time to come, you have to be consumed by fear, uncertainty and doubt to want to hold on to cash. You have to be extremely, extraordinarily worried that the economy is fragile and likely to suffer a setback; that the housing market is on the verge of another collapse; that the Chinese are going to sell all their bonds and send our yields soaring; that the Fed is going to make a huge inflationary mistake and then have to crush the economy; that Obama and the Democrats in Congress are going to take over the healthcare industry and end up spending trillions more than they are claiming it will cost; that the U.S. government will lose its AAA rating and sink under the weight of many tens of trillions of unfunded liabilities; that no one in Washington, nor any group of concerned citizens in the heartland, will be able to stop this runaway federal government spending train, much less turn it around.

If instead you think that there is a glimmer of hope that catastrophe might be averted; that the economy might manage to eke out a moderate recovery with growth rates of 3-4%; that the political winds are now blowing to the center-right instead of the left; that the housing market, after one year of price and construction stability, can manage to avoid another collapse; that the gradual return of confidence will boost consumer spending and lift the animal spirits of businesses just a little bit; that some people out there have enough of a profit motive to figure out how to put at least some of the economy's many idle resources and workers back to work; then you have no reason to hold cash, and every reason to invest in something other than cash. And as investors who currently hold cash gradually come to understand this line of reasoning, the very act of shifting out of cash will add to the economy's upward impetus and become a self-fulfilling prophecy.

There are many wise investors who argue that the equity market is overvalued, that it has risen too far, that it's another bubble waiting to pop. I take issue with those concerns, because I see plenty of evidence that tells me the market is still very conservatively priced. T-bond yields of only 3.65% tell me that the bond market has virtually no hope of the economy returning to trend growth in the foreseeable future. MBS spreads at historically tight levels tell me that the bond market has almost no fear that the economy or inflation will surprise to the upside. Credit spreads are still at levels that in the past have been the precursors to a recession. Corporate profits are well above average compared to GDP, yet equity prices haven't budged for over 10 years and P/E ratios are only average. On the whole, I think the level of yields, spreads, and equity valuation is only consistent with a belief that the economy will be very weak for a long time, and that downside risks still outweigh upside risks.

So if you are even the slightest bit optimistic, it pays to take some risk these days. And to top it off, that's what the Fed thinks as well, and that's what they are trying to encourage people to do.

Subscribe to:

Post Comments (Atom)

13 comments:

Excellent post. Let's hope the worst is behind us.

great post. you put words to my thoughts.

perhaps it does not have to be as dire as you assert in someone's mind to compel the desire to retain liquidity; perhaps it is the unknown of never before attempted monetary and fiscal policy worldwide along with extensive bail outs. perhaps it is just the unwillingness to embrace the unknow without more evidence.

The Fed + Global central banks need to provide this much liquidity and stimulus just to offset the massive shift in deleveraging of not only private households, but corporations and financial institutions the world over.

The fundamental drivers have shifted from profit maximization to balance sheet repair and de-risking on a global scale.

I don't think its as much about dire straits as it is about the deleveraging mindset.

For many people + institutions you are suggesting they stick their fingers in the light socket after having just been shocked.

While this will inevitably happen again, the stingy sensation is too fresh to have another go at it so quickly.

You cannot force people to consume or take on new risk even if economically speaking it makes sense for them to do so.

Fear is only one aspect of the equation.

We have just witnessed commercial banks financing the highly leveraged purchase of commercial property globally--and that property often sinking in value by half.

We just saw credit-rating agencies throwing a AAA on portfolios of subprime mortgages--and sophisticated investors buying by those AAA's by car load.

We know that many hedge funds were and are able to leverage investment plays at 100-to-1 (in the footsteps of Long Term Capital Management). We do not know if they can honor their bets. Long Term Capital Management could not, and it nearly wrecked the global economy. That was one player. Now we have dozens, and perhaps hundreds of players, some of them on bank's capital sheets.

We know that Warren Buffett and Bill Gross call derivatives as "financial weapons of mass destruction."

No wonder investors are a bit skittish.

We have the same financial system that collapsed on the Bush Watch. And now Obama is President?

Investors today need helmets and flak jackets.

septizoniom: I think your suggestion fits right in with my list of reasons for holding cash

Thank you for a thoughtful post, Scott, with compelling evidence to support your belief that the economy will surprise to the upside. Do you see a lack of lending to small business based on banks holding assets that are underwater?

ronrasch: There are widespread reports that bank lending is insufficient to meet the demand of small businesses. This is undoubtedly holding back the economy, but I don't think it's a killer, nor do I think this will last much longer. Banks' profit motive will eventually triumph, and since there is no shortage of money, lenders will eventually find a way to connect with borrowers.

I am aware, so want to hold cash. The economy is fragile and the housing market is ill; the Chinese must protect themselves; the Fed is failing with jobs and inflation; federal healthcare portends tens of trillions of unfunded liabilities; and the runaway federal government spending train needs to crash. Local, county, and state spending cuts have barely begun. A protracted slowdown sounds like a good thing to me.

Scott

I would love to see a chart showing the unemployment rate overlayed with the federal funds rate going back to say the late 1980s. It would be interesting to see how far the unemployment rate fell during tthe early phases of economic expansion before the fed began their inevitable tightening cycle. I would guess several quarters after the peak unemployment levels but I am guessing.

I love reading your posts. I think you are correct about fear among potential equity investors.

Scott,

As a faithful reader of this blog, I note that you are basically an optimist but you consistently characterize the market as "pessimistic" or "feaful." From a historical basis, how long does it typically take to get back to a previous high following a deep bear market trough? I know it took 20 years to get back to pr-'29 market crash highs. We seem to have come back pretty fast so far from the March lows. Wouldn't it be unusual to get back to the 2007 highs this fast?

Bill: I'm generally reluctant to use historical parallels such as you suggest. There are too many variables involved. But given the depth of this recession and the still-depressed level of valuations, I don't think this rally shows any signs of being overdone or too rapid.

Post a Comment