Wednesday, September 9, 2009

Fear subsides, prices rise (11)

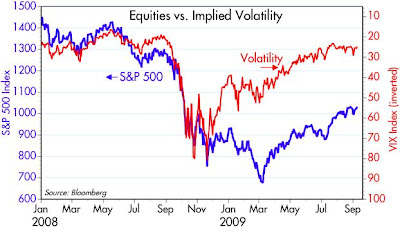

Another update to a very long-running series of posts that show how fear and uncertainty (as represented by the implied volatility in equity options, aka the Vix index) have been very important factors in the pricing of risky assets such as equities.

Subscribe to:

Post Comments (Atom)

6 comments:

It is amazing how you get a different perspective of the world when you look at it on the margin.

Sorta sucks when you are living in the foundation among the termites.

Clearly, confidence is rising on the margin.

Hello Scott,

Maybe you addressed this and I missed it - the correlation between the two datasets is compelling, but where does it go from here? The fear has subsided substantially. Could it actually have subsided too much given the challenges still facing us. And the gap created post-crisis - does it represent a potentially permanent rise in risk premium, and / or recognition that even if things have stabilized, earnings growth from this point may be permanently below the leverage charged growth prior to the crisis? In other words, is there any reason to anticipate any further improvement in either of those datapoints?

Randy

I just watched the President. Fear is NOT subsiding in this household. I'm scare to death of this man and his party. They are going to bankrupt us all!

Then who is going to bail out the United States of America? No one! It will just be reflected in the CONTINUING decline of our currency. A declined orchestrated by the largest debtor in the world addicted to big government spending and about to be taken to an unbelievable new level with government health care.

I’m scared.

Look at it this way: if enough people remain scared, and not convinced by this highly partisan speech, then Obama's presidency is in big trouble. The message of smaller government will have gotten through.

Only a starry-eyed, ivory tower liberal would believe any of Obama's claims for how he is going to magically transform 1/6 of the U.S. economy without incurring any problems or additional costs.

I AM SCARED TOO!!!!!

As these termites keep biting my backside and government keeps spending money that doesn't exist..

I wish I had looked at the margin more.

Randy: implied volatility in stock and bond options continues to decline, and remains well above levels that would be consistent with "normal" conditions. I had a post on Aug 31 which showed both in an historical context. Both remain at levels that would have been considered recessionary in the past.

So I don't think vol has gone down too far. There are still a lot of uncertainties out there. Nothing is ironclad, even if the charts look like there is a very tight fit. But I think if you look at everything in context, you see that most things are pointing in the same direction: things are gradually getting better but they still have a long ways to go to become normal again.

I suspect that earnings growth will continue to exceed most people's expectations. Easy money is great for cash flow, and we are in a V-shaped recovery even though most observers continue to doubt it.

I expect to see a lot of improvement in these datapoints in the next year.

Even if we have a listless recovery, implied vol can come down and prices can rise.

Post a Comment