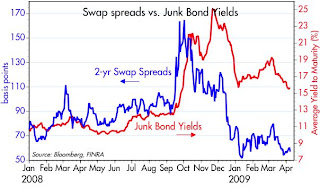

I've been touting swap spreads as a good leading indicator of the health of the financial market for years. When swap spreads fell significantly last October, I took that as a sign that the fundamentals were beginning to improve, and that financial markets in general were going to be turning up. I first showcased this chart last November, arguing that junk bonds were a steal. And indeed, junk bonds have done quite well since and look to do even better in the future.

I've been touting swap spreads as a good leading indicator of the health of the financial market for years. When swap spreads fell significantly last October, I took that as a sign that the fundamentals were beginning to improve, and that financial markets in general were going to be turning up. I first showcased this chart last November, arguing that junk bonds were a steal. And indeed, junk bonds have done quite well since and look to do even better in the future.The extraordinarily high yields and spreads on corporate debt that we saw a few months ago were telling us that the market expected something like half of all the companies in the U.S. to go bankrupt within the next five years. Driving this extremely grim forecast was the market's belief that collapsing demand would give us years of deflating prices, and that the world economy would therefore spiral downwards into a black hole worse than what we saw in the Great Depression.

As it is turning out, the reality is proving to be much less grim than the expectations. Monetary policy is extremely easy, and it is gaining traction. Bailout efforts have been massive, costly, and probably ill-advised, but they have succeeded, apparently, in restoring some measure of liquidity and confidence to the credit markets. The market has had plenty of time to heal itself. Confidence is the key ingredient to an eventual recovery from this crisis, and it is slowly returning.

To hang out in cash and earn almost nothing, while junk bonds are yielding in the double digits, requires a profound degree of pessimism. One example of how pessimistic the pundits are can be found in a NY Times Op-Ed piece two days ago. Four out of five economists could not muster even an ounce of optimism, despite all the "green shoots" of recovery. Such overwhelming pessimism is an essential ingredient for a market rally such as we have witnessed over the past month.

Full disclosure: I am long EMD and HYG.

21 comments:

I like mci and mpv for high yield well managed stocks; Scott, are you returning from Argentina soon? I will be in your neck of the woods around April 19-20 and it would be fun to meet over coffee if you are available.

Scott,

I am long EMD also. I am amazed at the returns from Emerging Mkt Debt over the past 10-15 years. So much so, I have a hard time understanding how the return were so high.

Can you explain it? What is your analysis for Emerging Mkt debt gone forward?

Nice blog. Thanks for sharing. What I will say is that swap spreads are a very, very useless indicator beyond short to intermediate term. Case in point was right before this crisis started. In fact, the high yield bond market was completely delirious with the lowest anticipated default rates ever recorded. That compares to recently being the highest.

Here's the reality. We are in the eye of the storm. This is not a normal recession. It is a permanent change in trend. That the Fed has backstopped so much of the economy is witness to this. At some point in time, the theoretically limitless ability of the Fed's ability to backstop markets will meet with the practical limits of reality.

At that time, I expect to see high yield debt explode again as we actually do see the economic consequences of a permanent change in trend.

To date, all we have seen is a credit crunch. Next comes to economic consequences. But, first, the markets need to digest all of the mistakes the Fed is making by ramming more bad credit through the system. ie, They are making the mess substantially larger.

Until we start to see that deterioration again, high yields may be a good bet for a trade. But, it will be just a trade.

Cheers....

Beavis: I beg to differ on the issue of swap spreads and their ability to predict. Swap spreads widened significantly in the early summer of 2007, well before the onset of the blowout in credit spreads which started almost a year later. Similarly, swap spreads surged in 1997 and 1998, way in advance of the 2001 recession and subsequent credit blowup.

Whether the decline in swap spreads that we've seen recently proves to be an accurate predictor of the end of the recession of course remains to be seen.

Clearly the Fed has adopted a very aggressive policy stance, but so far it has mainly been in response to a massive increase in the demand for liquidity. They are simply adding the reserves that the market is demanding, and that is not inflationary. So to date there has been no forced increase in "bad credit." That could change, to be sure, but it has yet to happen.

Nevertheless, don't overlook the fact that even if the Fed ends up being massively inflationary, that will greatly reduce the odds that low quality issuers will default. After all, inflation is a debtor's best friend, and a creditor's worst enemy. Rising inflation should be good for junk bonds since it will reduce default rates.

Would you be so kind as to explain what swap spreads are and how they can be predictive?

In 2006 swap spreads were narrow and high yield bonds were pointing to the lowest default rate in recorded history. Yet, upon further investigation, the housing market was already collapsing and your west coast criminal bretheren at Countrywide were already noting internally that sub prime and alt-a loans were defaulting at an incredible rate. ie, Swap spreads were delusional to the reality building before them. Or more appropriately put, you are relying on people who were clueless as to what was this coming to predict the recovery => Those who trade in the swaps market.

I appreciate your experience and remarks. And, I don't discount your ability. But, then you have no idea who I am either. :) haha. Along those lines, who said anything about inflation? I said backstopping the economy. I didn't say printing money. There is absolutely no way the Fed could inflate their way out of this. Our country has $63 trillion in debt. Our sustainable economy is around $12 trillion in GDP. Government spending will be 44% of GDP this year including state and local spending. The global economy's debt is north of $230 trillion. These numbers as a percentage of capital output dwarf anything ever seen in the history of mankind. Literally. You are in the eye of the storm.

Central bankers couldn't begin to monetize this avalanche. Especially given half of all of the world's wealth has diaappeared in the last year. So, not only do we have debt to capital output ratios never seen, but now we have half of the capital we had two years ago.

I am stating that the Fed and the government are demanding banks lend through this environment and the standards used are going to lead to future defaults on loans being written today. I know this for a fact unless we are entering a brave new world where what happened the last five years is the new normal. The loans being extended are NOT being used for capital deepening. They are being issued to "float" this environment in hopes of a recovery that isn't coming. And, I happen to know a lot of shitty loans, excuse my French, are being written. The same shitty loans that are now blowing up. So, they are forcing poor loans through the system in order to restart the credit markets.

China and emerging markets are headed for the scrap heap. The U.S. is headed for a major devaluation or default or new terms on its debt or some combination. In due time. In due time. Bankers are too busy making the mess larger in the interim. And, helping those who think the system can be restarted to lose even more of their wealth as they fantasize about a recovery.

There is no way the economy will fall off of a cliff in coming months because of so much stimulus. Both market induced and government induced. But, it will happen. I'll stop back to tell you why after it happens. In the mean time, enjoy the calm before the next storm.

Again, nice blog.

Thank you Nouriel Roubini.

Beavis and others who share his apocalyptic view: your most logical course of action at this point would be to liquidate everything you own, then use the proceeds to buy a remote island in the South Pacific, stock it with plenty of guns, ammunition and food, and move there with all your loved ones.

Golly, Beavis sure thinks he wears the big boy pants, eh?

And notice how he refers to Scott's "west coast criminal bretheren" but then accuses him of starting personal attacks.

Though Beavis inferred he might be knowledgeable, important, and well known, he didn't bother to tell us who he is.

beavis: i think we all think you are a coward.

bob: Here's my quick and dirty summary of swap spreads:

Swaps are transactions that allow people to redistribute risk. They are over the counter agreements between any two parties to exchange one cash flow for another. The most basic swap is fixed rate for floating rate payments. If I own bonds (fixed rate instruments) but I worry about the prospect of interest rates rising, I might want to reduce my fixed rate exposure by entering into a swap with someone else; I would pay him the fixed rate I receive on my bonds and he would pay me a floating rate, typically Libor. I reduce my risk that way, and he increases his. He also becomes exposed to the risk that if interest rates fall, I might renege on my promise to pay him a fixed rate and he might lose out on the profit inherent in his position. In order to compensate him for these risks I need to pay him the floating rate plus a little extra, which is the swap spread: the difference between the rate I am paying him and the rate on a Treasury bond with a maturity equal to the term of the swap agreement.

So swap spreads are a lot like credit spreads since there is counterparty risk involved. Swaps have mechanisms such as collateral agreements to minimize counterparty risk, and so can be thought of as equivalent to the spread on a AA-rated bank bond. Swap spreads are also a barometer of risk aversion in the marketplace. The more people want to swap out of their risky exposures, the more they must be willing to pay to induce others to accept that risk. So rising swap spreads equate to more risk aversion. Swap spreads can be thought of as barometers of systemic risk for the same reason.

Swaps are extremely liquid markets (much more liquid than the corporate bond market, where everything is quoted on a spread to Treasuries basis) and represent a key mechanism for the transfer and/or redistribution of risk among large institutional investors. They help make markets efficient. When they all but shut down, as they did in September, that is a sign that liquidity has dried up because a) everyone wants to reduce risk, and b) everyone is terrified of entering into any transactions because they are unable to quantify the risks out there.

Swap spreads during normal times and normal markets typically trade in the range of 30-40 basis points.

There are swap markets for all sorts of thing: interest rate swaps, credit default swaps, index swaps, currency swaps, etc.

Short version:

Swaps are agreements between two parties to exchange cash flows. In a typical swap, A pays a fixed rate of interest to B, and B pays a floating rate (Libor) to A. A also needs to pay B a spread above the fixed rate to compensate him for the increased risk he takes on.

Swap spreads are thus an indicator of how willing people are to transact with each other, how much it costs to reduce your risk, and how liquid the market is. Swap spreads can also be thought of as representing the riskiness of a generic AA rated bank--the higher the spread the more risky banks are preceived to be.

The swaps market is huge but generally restricted to large institutional investors and broker-dealers.

Thanks Scott, for the long and short of it - so to speak.

Would it be fair to say then that swaps are a way to bet on the direction of interest rates - to continue your fixed-rate/ floating-rate bond example?

Would this be a bet or a hedge? Is this a distinction without a difference?

Banks are not lending more money. Is everyone delirious? Banks have slashed revolving credit and jacked up interest rates across the quality spectrum. I know, it happened to me even though I have a high credit rating, exactly zero debt, and been a good customer for 15 years. This is their last attempt to milk the cow before it runs dry. I cancelled my card and will never borrow to finance a consumer purchase again. I will have no need for a good or bad credit rating. It is time to get bank to our Grandparents values.

The technocrats are sending the USS Titanic directly into an iceberg. We all know it. Would you borrow 5X your debt load to get yourself out of debt? At some point you have to call the horses in.

“The borrower is always a slave to the lender”

That proverb has never rung more true and consumers know it. Problem is, .Gov hasn’t got a clue.

B

Swaps are just another way to do a transaction. Selling bonds or paying a fixed rate in a swap transaction are effectively equivalent--they have the same economic effect. Swaps are often preferred because of their lower transaction costs and/or the fact that they can be very specifically tailored to meet a particular need of one party in the transaction.

Swaps, like buying or selling bonds, can be used either to bet on something or to hedge against something. And, like futures, for every person who sells or buys there has to be another person willing to take the opposite side of the trade. For every winner there is a loser, and vice versa.

Bernard: believe it or not, consumer lending by all commercial banks is at a record high and rising. Some people are being cut off, but other people are having no problem getting credit.

In any event, it sure wouldn't hurt if we all became a bit more prudent with our finances as a result of this crisis. Unfortunately, while households are learning this painful lesson the hard way, our politicians have abandoned all pretense at fiscal prudence. That will be the sad legacy of all this.

Scott-

Justin Lahart has a silly article today on wsj.com saying bonds are signalling worse to come.

http://online.wsj.com/article/SB123929216724105401.html

Upon further reading though, I can't detect exactly what about bonds today is signalling what. The article talks about an academic study and some historical patterns, but doesn't seem to nail down today's state of affairs. What do you make of it? Same?

Donny: I am a WSJ subscriber but can't seem to get access to the article. But I can guess that it says that since corporate bond spreads are still huge, that means the economy is still in big trouble. Credit spreads have often risen in advance of trouble, but they can easily overshoot, and the market can get overly pessimistic. Case in point: credit spreads peaked in Nov. 2002, but by that time the economy was already on the road to recovery.

Sorry Scott, the ".html" got cut off..

http://online.wsj.com/article/SB123929216724105401.html

did it again...just type in "tml" to the end of the link.

Post a Comment