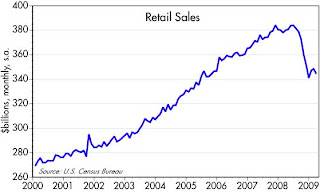

Retail sales unexpectedly fell in March, but the way I read this chart, sales in March were higher than they were in December. The market has been priced to the expectation that the economy is entering a depression of almost biblical proportions. The best news to date is that the economy is not falling off a cliff—it is likely stabilizing, and that is a much better outcome than the market has been expecting. Sensitive indicators, such as commodity prices, are actually rebounding after plunging in late 2008.

2 comments:

Scott, I'll accept that you didn't want to get drawn into commenting on a bunch of other bloggers. But you did previously refer to Mitch Shedlock as a "perma-bear". I would just urge you to stay open and flexible to your sunnier scenario not materialising. Remember, the wisest men don't get stuck to *any* single view or ideology. I have come to regard you as the "winner" in this past 6 months or so of blog commentary on the economy because your sunnier view now seems prescient based on recent stock market activity. And let's face it, most of us want to know how to use all this blogonomics to trade, not just to read passively. But what happens next? As people have commented, 1932 had plenty of bull runs in the stock market. Figures like the ones you quoted here indicate that things can go back down again, recovery is not a one-way street. How many false dawns will we see and how many of us will get burnt by a sucker's rally in a very long and winding bear market? Thanks again for your blog.

Almost every day someone sends me a doom and gloom report from some analyst or economist. They all argue that we are not even close to the end of this disaster. They all see a downward spiral that can't possibly end, driven by fewer jobs, increased savings, reduced income, falling prices, the downturn in commercial real estate, higher taxes, etc. What they all seem to neglect is that things can happen on the margin to change what now looks like a negative feedback loop.

They make mistakes. Increased savings is not a drag on growth, for example. Any money that one person saves must necessarily end up in someone else's hands and be spent.

I will grant that the fiscal policy situation is extremely ugly, but monetary policy is correctly addressing the market's surging demand for money. Housing prices have almost fully adjusted; key financial indicators like swap spreads and volatility have improved dramatically; commodity prices are bouncing; global trade is restarting. And bidding wars for houses are starting to crop up! Equity markets may already be sniffing out the seeds of a recovery.

I'm still optimistic, but remain vigilant for signs that I may be missing something important.

Post a Comment