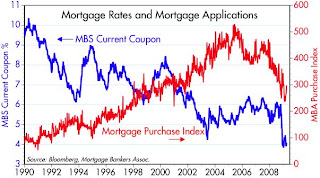

I keep hearing politicians and government officials bemoaning the fact that "banks aren't lending" and the economy is foundering because financial markets are frozen. Hmm. These two charts suggest that business is essentially booming if you work for a bank or institution that still engages in mortgage lending. With the big decline in mortgage rates in the past six months, refinancing activity has surged to levels almost as high as the record-setting peak in the summer of 2003. Applications for new mortgage purchases aren't nearly as high today as they were at the peak of the housing boom in 2006, but they have jumped 25% since the end of February, and they are back to the levels we saw in 1999-2000.

I keep hearing politicians and government officials bemoaning the fact that "banks aren't lending" and the economy is foundering because financial markets are frozen. Hmm. These two charts suggest that business is essentially booming if you work for a bank or institution that still engages in mortgage lending. With the big decline in mortgage rates in the past six months, refinancing activity has surged to levels almost as high as the record-setting peak in the summer of 2003. Applications for new mortgage purchases aren't nearly as high today as they were at the peak of the housing boom in 2006, but they have jumped 25% since the end of February, and they are back to the levels we saw in 1999-2000.To be sure, the boom in mortgage lending and refinancing is largely confined to conforming loans (up to $730K in high-cost areas). Those needing jumbo loans must pay about 1 1/2 points more, but even then, according to BanxQuote, the national average for 30-year fixed rate jumbo loans is 6.37%, which is not exactly usurious when viewed in an historical context.

1 comment:

Scott -- great point. We've noticed the same thing. It seems like the entire discussion about banks not lending is a huge red herring to distract attention from what is really going on in the banking sector. We posted some other data that supports your same conclusions recently, at http://taylorfrigon.blogspot.com/2009/01/its-panic-not-great-depression.html

Dave Mathisen

Director of Research

Taylor Frigon Capital Management

Post a Comment