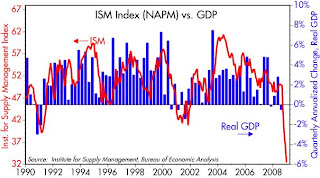

The Institute for Supply Management's December index of manufacturing activity plunged to its lowest level since the recession of 1982, and as this chart shows, the index is consistent with GDP growth in the fourth quarter of last year of -6%, which would also be the worst since 1982. With numbers this bad—and technically worse than expected—why is the stock market up today, extending gains that began last November 21st?

The Institute for Supply Management's December index of manufacturing activity plunged to its lowest level since the recession of 1982, and as this chart shows, the index is consistent with GDP growth in the fourth quarter of last year of -6%, which would also be the worst since 1982. With numbers this bad—and technically worse than expected—why is the stock market up today, extending gains that began last November 21st?There are several possible explanations. The one advanced by the press today is that investors are encouraged by all the talk of an aggressive Obama stimulus plan, since it would all but guarantee an economic recovery.

In my view, the bigger Obama's stimulus plan, the worse it is for the economy. But I think the market has already priced in an egregious spending plan. The expectation of a massive expansion of government and attendant tax increases was one of the principal reasons that the market has been so depressed in recent months; so depressed in fact that prices fell to levels that were consistent with an economy that was worse than the worst of the Great Depression. By this logic, today's disastrous ISM number fell short of the market's true expectations.

Another reason the market is up is that the economy may have passed an inflection point; that it is decelerating but at a slower and slower pace. The financial markets have shown impressive signs of healing in recent weeks—lower swap and credit spreads, declining volatility, slowly rising T-bill yields—and commodity markets are now showing signs of bottoming at levels that are still significantly higher than the all-time lows of late 2001. This crisis began with a severe dislocation in the financial and housing markets, and we have now seen substantial repricing activity, a return of liquidity, and much lower financing costs; it is not unreasonable at all to say that the financial and housing storm is passing.

This crisis impacted the broader economy first through a massive decline in housing construction which began three years ago, then by way of a near-collapse of the banking industry earlier this year, and finally through a panic-induced decline in demand in the past few months. Remove the underlying cause of the problem—fear of losses—and you find that the vast majority of the economy remains intact. Economic life does indeed go on all across the country, even as many companies and many displaced workers struggle.

6 comments:

New to the site. Good stuff. Not to nitpick but isn't the ISM=0 GDP line now at 41.1%? Maybe I'm reading the post at ISM incorrectly.

Thanks. I've drawn the zero line where I think it makes sense, and that is where things appear to correlate best. My line is not necessarily going to be in the same place as theirs.

Since when can you expect a rational explanation for all market moves? Couldn't we simply be getting a long-overdue bear market rally from an oversold condition of historic proportions?

I think the impact on the real economy will be much broader than you are suggesting. Unless the Fed "succeeds" in relighting the credit expansion fires, we are going to see a pretty severe hit on retail establishments of all types, and it sure looks like commercial real estate has also been way over built.

The move toward lower consumption is natural. For many years, people have been spending more than they earn. If the consumer credit expansion has now stopped, or reversed, people will by definition have to spend a bit less thany they earn. If earnings fall as a result of continuing layoffs and poorer job prospects, then this trend toward lower consumption will be strengthened.

These events are hardly explained by irrational fear. They are explained by simple household financial realities. The very last thing we should be hopping is that our government/Fed can somehow push consumers back into that irrational consumption mode that depended on ever growing levels of debt. That obviously was not a sustainable economic model. If we get back on that treadmill it will still be unsustainable.

Tom Burger

Tom, I think we agree. The market is up because prices went to ridiculously low levels.

Where we differ is on the future. I don't think credit fires need to reignited, I think that prices need to adjust in order to stimulate new demand and new investment. I think prices have readjusted a lot already, and we may be nearing the end of the adjustment.

Your view is that the end is still far away. I would counter that by saying that you are in the middle of the pack on those expectations. The market itself is saying that there is no end in sight. So the burden is on you (I hope) since the economy will need to keep deteriorating rapidly in order to validate current prices.

Scott,

How much cheaper does a television or car need to get to spur people to take on more debt just to snatch up bargains regardless of actual need?

It is hard not to think that the vast majority of Americans have seen the recent past as a wake up sign and thus will gragually shift from a credit consumption model to a more balanced save and purchase methodology.

If that were the case, what impact would that have on the future growth of our economy? I would think future GDP growth would be severly limited by this new paradigm?

There has been so much redundancy built into the American service economy that we have come to expect a Starbucks or McDonalds on every corner. I would hope that not only consumers have seen the futility in this model but businesses have as well. The only way to keep expanding under this ridiculous model is to induce people to consume beyond their means.

Is that where we are headed again?

Bernard

To the extent people consume less and save and invest the difference, this should be good for the future of the economy. Living standards can only rise if we make productive investments; they don't rise just because we buy more things.

I think a lot of the excesses of the past will not be repeated in the future, if only because so many people have been burned so badly. That's why I remain an optimist.

Post a Comment