There's obviously a lot going on these days, and most of it good, to judge by the market's recent behavior.

In mid-November I observed that a bond bear market is bullish for stocks. Since then stocks have jumped over 10% and Treasury yields have risen 15-30 bps. Yesterday the Fed strongly hinted that short-term rates are set to rise at the March FOMC meeting two weeks from now—which is earlier than the market had been expecting. The bond market now is priced to an 80% likelihood that the Fed soon will be paying banks 1% on banks' excess reserves, and that has pushed 3-mo LIBOR (a proxy for short-term money market rates) to 1.09%. Interest rates are (finally!) beginning to become more normal, to the great relief of the nation's savers. (UPDATE: As of Mar. 2nd, the odds of a March FOMC rate hike have risen to 90%)

It's very likely we're still in the early stages of more of the same. Interest rates are going to be rising, probably by more than the market currently expects, because the outlook for the economy is improving and inflation is at the high end of the Fed's target range, yet interest rates are still relatively low because of the market's willingness to pay up for safety—and that won't persist for much longer. Stocks are going to be buoyed by improving earnings and the prospect of stronger economic growth. Interest rates will be moving higher because of stronger growth—higher rates are not yet a threat to growth. The Fed is still a long way from raising rates by enough to threaten growth. If the FOMC hikes rates in two weeks it won't be a tightening, it will be a sensible reaction to stronger growth and improved confidence.

It's encouraging that the Fed has decided to pick up the pace of its interest rate "normalization." But I still worry that the Fed could fall behind the inflation curve, because short-term interest rates are still very low (well into negative territory) at a time when inflation is running a solid 2%, the economy is showing clear signs of improvement, and confidence is rising. We're not in a stable equilibrium situation: in my view, interest rates need to move higher than the market currently expects. Otherwise we will find ourselves in a situation where inflation is undesirably high and the Fed will be forced to forcibly tighten monetary conditions—which is exactly what has happened prior to every recession in recent memory. It bears repeating: to date the Fed has kept monetary policy very accommodative in response to the market's persistent risk aversion and strong demand for money, and that's why Quantitative Easing has not resulted in an unwanted rise in inflation. But now that confidence is returning and risk aversion is declining, the Fed needs to reverse course by shrinking its balance sheet and/or raising interest rates.

President Trump is still totally wrong on the subject of trade, but on almost everything else he is right. Last night's address to Congress was much more presidential than Trump's detractors feared, and the general thrust of his policy proposals is reassuring. He's a businessman who understands what makes the economy work, and he is thus very likely to reduce the headwinds that have held back the private sector for far too long (i.e., by reducing our onerous regulatory and tax burdens).

Now for a dozen or so charts and the stories they tell, in no particular order:

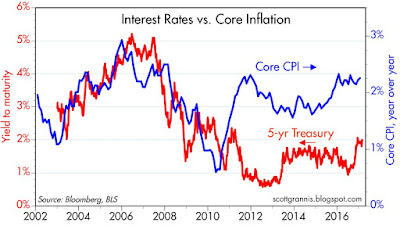

The chart above tells us that 5-yr Treasury yields, currently about 2%, are very low relative to core CPI inflation, which is running just over 2%. In a more normal environment, interest rates would be at least a percentage point higher than the prevailing level of inflation. Many argue that the Fed is artificially depressing yields, but I don't agree. I think yields are abnormally low because the market's risk aversion is abnormally high; people are willing to pay a high price for the safety of Treasuries. In any event, I anticipate that yields will move significantly higher in the next year or so. The Fed hasn't done anything to bring inflation down (in fact they seem to want it to remain at least 2%), but President Trump is likely to push through policies that boost the economy's growth rate, and in turn boost confidence and reduce risk aversion. A stronger economy will make higher yields a necessity—a welcome necessity, I dare say.

The chart above shows the level of nominal and real 5-year Treasury yields, and the difference between them, which is the market's expectation for the average annual inflation rate over the next 5 years. Inflation expectations have risen quite a bit over the past year, and are now firmly at 2%. If the economy picks up as I expect it will, then both real and nominal interest rates ought to rise from current levels.

The chart above shows the current level of real overnight yields (red line), and the market's expected level of real overnight yields 5 years from now (blue line). The gap between the two is positive, and that means that the real yield curve is positively sloped, and that in turn means that the market expects the Fed to raise the level real yields by almost one percentage point over the next 5 years. That is nothing to worry about. The time to worry is when the Fed pushes real short-term rates above the level of longer-term real rates (as it did prior to the past two recessions), since that is symptomatic of very tight money and very tight money almost always results in a recession.

The chart above expands on that same theme. It shows that every time the Fed pushes real short-term rates up to 4% or more—thus making money very tight—the economy subsequently falls into recession. It also shows that every time the slope of the nominal yield curve (defined as the difference between 1- and 10-yr Treasury yields) becomes flat or negative, the economy subsequently falls into recession. In other words, when the Fed tightens aggressively, pushing real yields to strongly positive levels and the yield curve to very flat or inverted levels, it kills the economy by making money scarce and expensive. This is what we would like to avoid, but it might become necessary if inflation moves uncomfortably high. Fortunately, I doubt that is likely to happen within the next year or so. But beyond that we'll just have to wait and see.

The chart above shows that there is a strong tendency for the level of real yields on 5-yr TIPS to track the economy's underlying growth trend: the strong economic growth is, the higher real yields are, and vice versa. This is normal and understandable, since investors in TIPS receive a government-guaranteed real yield whereas investors in the real economy receive a real yield that is, on average, determined by the economy's real growth rate. Being risk-free, real TIPS yields ought to be somewhat lower than the market's expected real growth rate for the overall economy. Today, real TIPS yields are still slightly negative, and that suggests the bond market does not expect the economy to grow by much more than 2 or 2.5% per year. If stronger growth does happen, real yields will almost certainly rise significantly, as will their nominal counterparts.

The chart above shows the rate of inflation according to the Personal Consumption Deflator. For the year ended last January, the overall PCE deflator rose 1.9%, while the core version rose 1.7%. Both measures are likely to move higher in the months to come, to judge by their behavior over the past several months. Deflation is officially a thing of the past, and there is no reason for the Fed to continue to be aggressively accommodative. Raising rates by even as much as one full percentage point would not constitute "tight" money, since real rates would still be relatively low.

The chart above breaks down the PCE deflator into its main constituent parts. Here we see the huge divergence between the prices of durable goods, which have fallen by more than one-third over the past two decades, and the prices of services (mainly labor), which have risen by more than two-thirds over the same period. It's not a coincidence that durable goods prices started falling (for the first time ever, on a sustained basis) right around the time that China became a major exporter of durable goods in 1995. Thanks in large part to China's emergence as a manufacturing powerhouse, U.S. consumers have seen their purchasing power soar to unimaginable heights: an hour's worth of work today buys 2.6 times as much in the way of durable goods as it did in 1995 (1.74/.66). No wonder everyone has a smartphone.

Trump is crazy to want to stop this. Taxing imports would only result in higher prices for all consumers.

The latest consumer confidence survey by the Conference Board shows that optimism is returning in a big way. This is also seen in a big rise in the Small Business Optimism index, which is now almost as high as it has been in the past 40 years. Rising confidence should go hand in hand with a decline in the demand for money, which until recently has been exceptionally strong. As money demand declines, the Fed must take countervailing steps to reduce the supply of money and/or raise interest rates in order to boost the demand for money. Otherwise higher inflation will result.

Today's ISM manufacturing survey was stronger than expected. As the chart above suggests, this points strongly to a pickup in overall economic growth in the months to come.

It's very encouraging to see that the same survey in the Eurozone also shows improvement, as seen in the chart above. A coordinated pickup in activity both here and overseas can really change the mood of the markets, and I think that's one reason global equity markets have been moving higher of late.

The chart above is one I've been showing for years. With fear subsiding and confidence in the economy rising, it's no wonder that stocks are moving higher.

The two charts above show the S&P 500 index in both nominal and real terms, together with my estimate of their long-run trend channels. I don't want to suggest we're due for a decline, but I do think it's worth noting that this is not the time to take outsized risks. I would be a lot more worried about a market correction if bond yields (both real and nominal) weren't so low, since today's low yields are symptomatic of an enduring and pervasive degree of risk aversion. The market is most vulnerable when everyone is optimistic.

Wednesday, March 1, 2017

Subscribe to:

Post Comments (Atom)

13 comments:

Great post; thanks again for reviewing the markets so carefully.

I had lunch with a very liberal friend of mine a few days ago. He WANTS to be bearish. He WANTS the market to be bearish. I mean after all, DT is a crazy man, right! I told him to not confuse policy he disagrees with-with bearishness. The stock market is in an uptrend and yesterday was a classic bear squeeze. I would hate to be short this market. As a bond trader I'm 100% long corporate HY and preferreds. This is becoming a very dangerous market but for now the trend is your friend.

Great post.

Trump is Trump but mostly pro-business and that is good.

I hope Trump avoids foreign entanglements and thus saves taxpayers several trillion dollars.

You know, a trillion here, a trillion there, and pretty soon you are talking real money.

Great post.

Trump is Trump but mostly pro-business and that is good.

I hope Trump avoids foreign entanglements and thus saves taxpayers several trillion dollars.

You know, a trillion here, a trillion there, and pretty soon you are talking real money.

You could all be right and the road ahead is paved with gold...tax reform is necessary but will be messy, repealing the ACA is now almost a certainty, there will be no meaningful replacement. Savings account for "health" will just be another loophole for the wealthy, since most Americans live from payday to payday.

The market seems to believe in lower taxes, lower deficit and massive spending on military and infrastructure. Maybe! But if Trump continues to ignore diplomacy his administration is almost certain to find itself in another messy foreign conflict. He wants to "win wars" aside from winning Panama the past 50 years have been less than kind to America's foreign entanglements.

I wish him luck, but I am betting that there are too many risky outcomes. Investing is not about making money, its about not loosing money. Right now, I will keep my TIPS that protect my capital, invest in banks (because they are well capitalized and will increase profitability once Dodd-Frank is gone) and non-cyclical stocks -- I've missed a good part of the rally and I don't care.

Scott,

Thanks a lot for the post. With everyday something new from DT, it is really reinforsing to read your blog.

Worth worrying about:

Commercial and real estate loans have flatlined since October.

If the Fed raises rates, then commercial banks will receive 1% interest on excess reserves for doing nothing.

And the Fed will be very reluctant to reverse course.

Worth worrying about:

Commercial and real estate loans have flatlined since October.

If the Fed raises rates, then commercial banks will receive 1% interest on excess reserves for doing nothing.

And the Fed will be very reluctant to reverse course.

Re: the slowdown in C&I Loans. I have been watching this play out for the past several months. It is now definitely observable that C&I Loan growth has flatlined for months. But I am uncertain what to make of this. In a sense it reflects a stronger demand for money (more borrowing and lending is symptomatic of a decline in money demand). Or it could be symptomatic of increased caution on part of both borrowers and lenders (which is also symptomatic of increased money demand). There has also been a slowdown in M2 growth and a slowdown in Total Bank Lending, but neither are as yet flatlining, so the C&I Loan slowdown could just be a relatively small event.

Scott:

Yes, worth watching.

The old lady in me also worries about commercial property values flatlining since August.

https://www.greenstreetadvisors.com/insights/CPPI

That's Green Street Advisors, smart guys in your neck of the woods.

So, with the PCE at 1.7% YOY and commercial property flatlining, and loan volumes going stale, the Fed is raising rates….add on about 70% of global central banking is keyed on Fed policy through currency pegs and what not.

Trump is the best thing for animal spirits since Geritol, and tax cuts and de-regging all good. Attitude is great---when was the last time a US President had lots of different industry leaders to the White House?

The question: A year from now, will Trump conspiracy-theorists say the establishment Fed suffocated Trump's economy?

Re Commercial Real Estate. I've long followed the Commercial Property Price Indices published by the CoStar Group. Suggest you look at their latest release, which shows prices increasing by 5-7%, especially at the low end of the range. Prices were rising by 10-12%, so they have slowed down, but they haven't flatlined.

http://www.costargroup.com/costar-news/details/latest-costar-composite-price-index-steady-price-growth-at-low-end-of-property-market-offsets-top-end-slowdown

what an echo chamber of lame analysis and praise from the uninformed.

It will be interesting to see how the CRE market equilibrates as online sales grows.

Post a Comment