Here are some charts that put the severity of the current situation in perspective:

As with other stock market selloffs, the current one comes accompanied by a significant increase in fear, uncertainty and doubt (proxied here by the ratio of the Vix index to the 10-yr Treasury yield). Panics that result in a big increase in the implied volatility of equity options sometimes bring with them their own solution, since buying options to limit one's risk becomes extremely expensive (thus making it very expensive to sell on dips and buy on rallies), while selling options becomes potentially very lucrative (rewarding those who are willing to buy the dips and sell the rallies). Spikes in fear of this nature thus attract more liquidity to the market, which in turn makes it easy for those who wish to exit. Real panics feed on themselves when the exit doors are crowded and/or shut, but that doesn't appear to be the case today.

Gold prices and TIPS prices (proxied here by the inverse of their real yield) have been trending down ever since the resolution of the PIIGS crisis. I've interpreted this to mean that markets were gradually regaining the confidence they lost, since both assets are safe havens. Gold appears to have broken out of this downtrend of late, suggesting that panic is setting it.

It's worth noting that industrial commodity prices have been rising in recent months, tracking the rise in gold prices. Outside of the oil patch, it appears that commodity prices are beginning to recover. A weaker dollar is helpful in this regard. But if industrial commodity prices are recovering, that further suggests that the global economy is not exactly collapsing.

Corporate credit spreads are certainly elevated, but still far below the levels that characterized the 2008 global financial panic.

Default risk is highly concentrated in the energy sector. High-yield energy bond spreads are now at the extreme levels that we saw in the HY market back in 2008. Spreads at these levels indicate that the market is priced to the expectation that a significant number of bonds will default. Back in November 2008 (just prior to the peak in credit spreads) I had a post which discussed the significance of super-wide spreads. I referenced a Lehman analysis which calculated that spreads in the range of 1700 bps implied that 70% of HY bonds would be in default within the next 5 years. I also referenced a Barclays study that said that HY spreads of 1700 implied "3-4 years of a 15% annual contraction in GDP," which would have been far worse than what we saw during the Great Depression. Bottom line, the current level of spreads in HY energy bonds is consistent with catastrophic conditions in the oil patch. The market may be exaggerating the actual risks, but we can say with confidence that it doesn't get much worse than this.

As I've been noting for quite some time, it remains the case that swap spreads are very low despite the elevated level of corporate credit spreads. This is a significant non-confirmation of the distress in the HY sector. Although the market is extremely pessimistic about the prospects for the oil patch, and quite concerned about the health of speculative bonds in general, the bond market as a whole exhibits little if any systemic risk and generally healthy liquidity conditions. Swap spreads were good leading indicators of the distress in prior recessions, but this time around it's very different. At the very least this suggests that the market's level of panic is exaggerated—that the underlying fundamentals are not as bad as the panic would suggest.

The chart above suggests that the decline in near-term inflation expectations can be fully explained by the decline in oil prices. Oil prices are depressed because of abundant supplies, not because the Fed is too tight. If overly-tight monetary policy were the driver of conditions today, as it was in the third quarter of 2008, we should be seeing falling gold prices and a rising dollar, much as we saw back then. But the dollar today is weak and gold is rising, which again suggests that it's not tight money that is the problem, it is just very low oil prices.

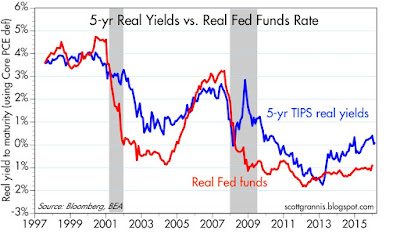

The chart above compares the real yield on 5-yr TIPS with the ex-post real yield on overnight interest rates. The blue line thus represents the market's expectation of where the real Fed funds rate will be in five years' time. As it stands, the market is expecting real yields to rise from their current level of -0.9% to about zero. That is properly characterized as monetary policy becoming gradually "less easy" over the next five years. Nobody is expecting the Fed to actually tighten policy (which would show up in this chart as a narrowing of the spread between the red and blue lines) for the foreseeable future.

Finally, the chart above compares the equity market in the U.S. with its Eurozone counterpart. The current crisis has affected Europe much more than it has the U.S. The magnitude of the current decline in European equities is similar to what happened as a result of the PIIGS crisis and the subsequent Eurozone recession.

Things are ugly out there, but I don't think we are on the cusp of the end of the world as we know it.

29 comments:

Thanks for the summation, Scott.

That's why this blog is invaluable.

Negative rates hurt banks as unconventional policies backfire

"In theory, negative rates could be the panacea to cure sluggish global growth: by charging lenders fees for parking money at central banks, policy makers hope banks will use that cash to make loans, jump-starting their economies. In practice, investors worry it may squeeze bank profits and rattle money markets.

“We’re here in an environment where central banks have to learn one message, and that is that negative interest rates are not desirable and they are not workable,” Hans Redeker, head of global foreign-exchange strategy at Morgan Stanley in London, said in a Bloomberg Television interview. “When you cut into negative interest rates you have to think about the profitability of the banking sector.”

http://www.bloomberg.com/news/articles/2016-02-11/racked-markets-hand-verdict-to-central-banks-on-sub-zero-rates

COMMENTS FROM BANK CEO's AT DAVOS CONFERENCE 01/22/2016

Axel Weber, UBS AG Chairman: "There may be no limit to what the ECB is willing to do but there is a very clear limit to what QE can and will achieve. The problem is that monetary policy has largely run its course."

Ralph Hamers, chairman of Dutch bank ING NV: "We have limited opportunities to lend on the other side of customer deposits because of those negative yields. The only thing we can do is extend credit we would normally not do and that leads to an accident waiting to happen.”

Nikhil Srinivasan, CEO for Generali: "The trade now is to hold as much cash as possible. Markets need to stop expecting miracles. Now it’s time for the fiscal side to do its job."

http://www.wsj.com/articles/investing-in-2016-the-only-winning-move-is-not-to-play-the-game-1453485940

BTW, I posted this link shortly after reading it.

Bull markets climb the Wall of Worry. Bear markets descend the Slope of Hope.

Scott-

Another reader thanking you for your analysis. Things are very interesting right now. It will be very interesting to see how all this unfolds. :)

1) Why isn't the Obama Administration putting pressure on the Saudi's to cut production; and

2) The central banks need to find a way to take coordinated action. The trade war signals (which are not on our Fed) are helping no one.

Excellent blogging...a few cavils.

When 10-year Treasuries offer 1.60% interest, I cannot believe money policy is "easy." Some people say the Fed has been recklessly easy since 2008 and probably

continuously since 1913.

The result: 1.6% on 10-year Treasuries?

The Fed is much too tight!

I said the Federal Reserve will be able to raise interest rates the way a kangaroo can fly. Sadly, I was correct.

Now we have to painfully watch the Federal Reserve as it attempts to "maintain credibility" and not face up to the errors it has made and has been making for years. In the private sector, a company must make an abrupt about face sometimes in order to survive. In the public sector, and organisation can "maintain credibility" for years even while pursuing the wrong policy.

How much oil in terms of barrels per day was the world producing on 2008?

As the chart on this page demonstrates, comparing oil prices in 2008 to current oil prices in the absence of the oil production differential, is ridiculous:

http://peakoilbarrel.com/world-oil-yearly-production-charts/

http://economistsview.typepad.com/timduy/2016/02/the-fed-will-take-a-pause-on-rate-hikes-an-indefinite-pause-the-sooner-they-admit-this-the-better-off-we-will-all-be-inde.html

Scott's analysis is objectively data driven and he is not afraid to change his mind. However, it does not seem plausible that the FED can do a 180 degree turn from tightening to QE with any face saving credibility, absent a great deal more "panic". In effect, will the FED change it's mind?

For those who like Scott's work (otherwise why would you be reading this?), I highly recommend, Franz Lischka http://franzlischka.blogspot.com/ Lischka's work is logically data driven, and like Scott, he believes a US recession is not around the corner.

Also remember, it took two substantive, widespread speculative bubbles (internet & residential real estate) to push the US into the last two recessions.

Can a financial crisis based on Sovereign Wealth Funds (Value $7.5 Trillion) sell off in oil assets do the same thing? This is a question for Scott & Franz.

xr-3609. Just read franzlischka link, very interesting. I have heard from some others of the impact of SWF selling. Scott, would be interested in your perspective. Thanks

Are the Eurozone swap spreads behaving similar to the spreads you presented in the article above? If they are then why do you think European bank shares are collapsing? Fear of negative interest rates?

I like reading this data blog but have to admit not understanding much of it. In 2008 an economist compared the situation where the Libor went to 400-plus to the economy's plumbing freezing up. I haven't dumped stocks yet because I figure lower energy costs should be eventually stimulative. What is out there now that would cause the pipes to freeze?

Deutsche Bank buying back $5.4 billion of CoCos might make a bit of a floor here.

Supply/Demand market indicators remain above Jan 20 lows.

Bottom still in place....so far.

I smell capitulation.

give us QE

John ("What could cause the pipes to freeze?"): Great question and analogy. I prefer to watch swap spreads instead of Libor, but the analogy applies to both. With swap spreads at very low levels, I might say that the pipes have a good dose of antifreeze and are very unlikely to freeze. When the financial markets are liquid and functioning, they act as a shock absorber (metaphor alert) for the real economy by distributing risk from those unable or unwilling to bear it to those who can and want to. Liquid financial markets are essential to a healthy economy.

So what could go wrong? We could end up with another Smoot Hawley tariff war on our hands if Bernie or The Donald get to call the shots. The wheels of global commerce would begin to freeze up and that would be very bad. Our own government might try to regulate the banking industry even more in an attempt to "punish the bankers." We've had more than enough of that already. Prohibiting corporate inversions could do the trick as well, since that would almost be like capital controls (which are the death knell for any flailing economy).

In short, the things to watch for are government attempts to "fix" problems. Whatever the government tries to do invariably has perverse consequences.

I am most uncomfortable with the notion that the monetary challenges facing the world are somehow psychological rather than structural...

William, re negative interest rates: This is a very important topic that needs further discussion. In principle, negative interest rates imposed by a central bank seem like a very bad idea. The idea behind it is that negative rates will compel banks to lend money to the private sector rather than to the central bank. That's akin to destroying the demand for money, and what sense does that make? How can that strengthen an economy? I can see banks imposing a negative rate on depositors, if they have no ability to invest deposited funds in something that will earn them a profit, however small. But for a central bank to impose negative rates on the banking industry is another matter.

In my mind, negative interest rates are a monetary perversion that I can't get my head around -- additionally, the only effect negative rates have had thus far in Europe and Japan has been to cause companies to pre-pay their taxes -- said another way, I can see how central banks and governments win via negative interest rates, but I see no advantages rendered to Main Street and the economy at large -- add the growing outcry for oil tariffs to the negative interest rates caldron, and who knows what might happen -- as I said previously, negative interest rates are a monetary experiment at best -- the fact that the Fed is looking to experiment with negative interest rates is scary in itself...

Negative interest on reserves is like designing a play from your own end zone.

You should never be there. A central bank should maintain moderate rates of inflation and mild positive interest rates. Those are the most conducive to real growth.

The sad thing is, the Fed treats 2% inflation as a inviolate sacred ceiling not to be approached when it should actually treat 2% inflation as a floor.

Umm... reading these comments gives inpart a "why" gold is rising...

William... thanks for the questions... I was believing that everyone understood negative rates and the markets....

Keep the questions coming.

Scott, the UK press has been full of this ex-central banker's very alarming forecast (he apparently was one of the few to predict the 2008 crash). Would love to know what you make of his comments !

http://www.telegraph.co.uk/finance/financetopics/davos/12108569/World-faces-wave-of-epic-debt-defaults-fears-central-bank-veteran.html

Post a Comment