Today's release of December housing starts and industrial production add support to the view that the economy continues to grow at a moderate pace with a tendency to strengthen on the margin. Importantly, there is no sign of the economy slipping into a recession.

Housing starts were slightly above expectations (999K vs. 989K), and as the chart above suggests, they are likely to continue to rise in coming months based on the strength of the builders' sentiment index.

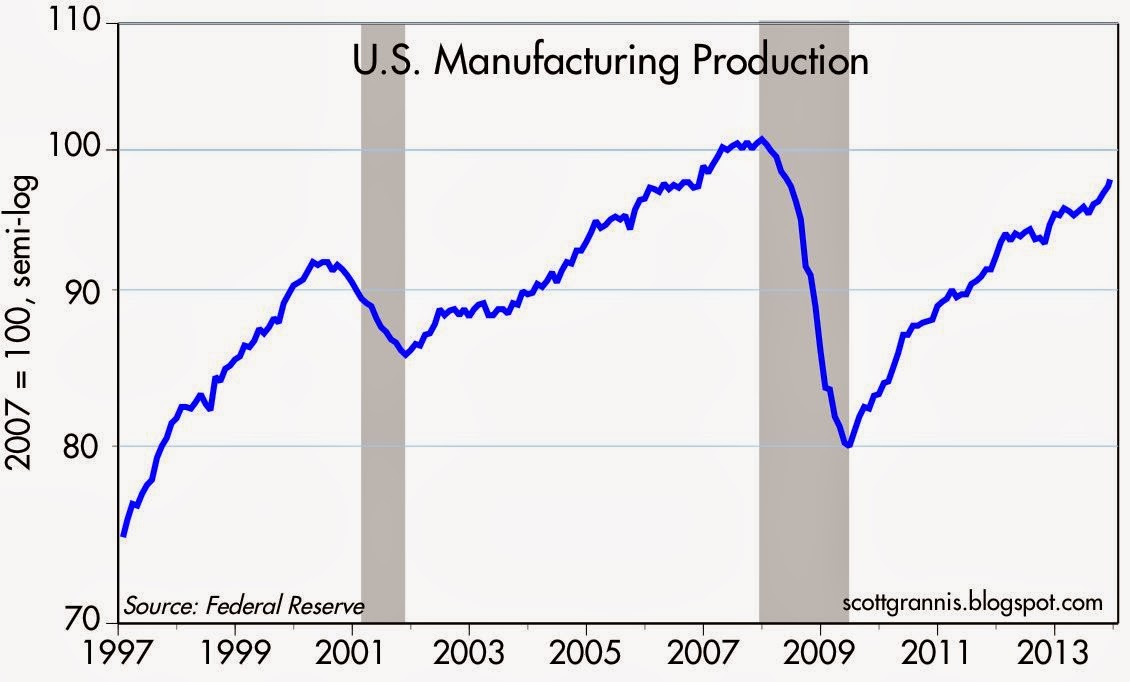

December industrial production and its subset, manufacturing production (see charts above), matched expectations (+0.3%), but both have accelerated meaningfully in the past six months. Industrial production rose at a modest 2.1% pace in the first half of last year, while expanding at a much more respectable 5.3% pace in the second half. Similarly, manufacturing production rose at a 1.1% pace in the first half of 2013, and accelerated to a 4.2% pace in the second half. This is very encouraging.

As the first of the above two charts shows, U.S. industrial production has now pulled way ahead of Eurozone industrial production. Nevertheless, it is comforting to see that the latter has also picked up of late. Europe is regaining some of the strength it lost in recent years, and that translates into reduced headwinds to U.S. growth going forward.

1 comment:

Anyone who thinks a "single mandate" for a central bank is a good idea needs to consider Europe and the ECB. They have whipped inflation...ain't it grand? They crushed inflation in Japan too....

Post a Comment