First-time claims for unemployment insurance continue to be relatively low, which suggests that the labor market remains reasonably healthy. However, this month marks a big change on the claims front: the expiration of the unprecedented emergency unemployment claims program that began about four years ago. As a result, today about 1.3 million fewer people are receiving unemployment checks than just a few weeks ago. While this is undoubtedly painful for many, it should help strengthen the economy in the long run, provided Congress resists the temptation to reinstate the program.

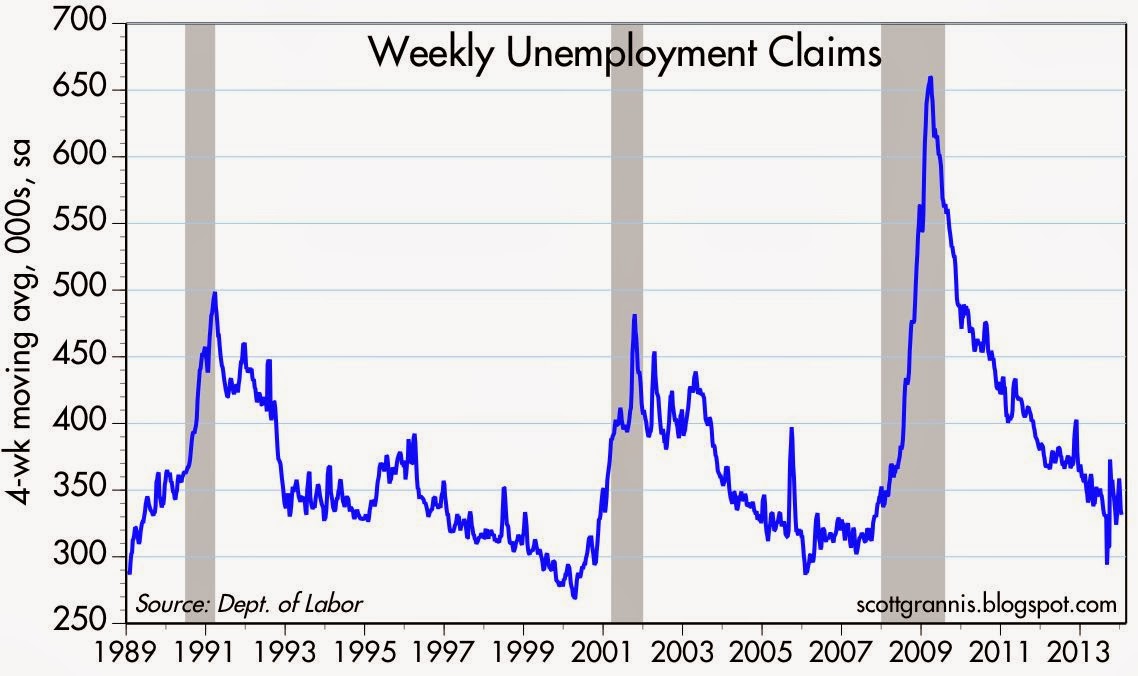

On a seasonally-adjusted basis, first-time claims for unemployment are running about 325K per week and trending slowly down. It doesn't get a whole lot better than this, to judge from prior economic cycles.

The chart above documents the expiration of the emergency claims program, and puts it into the context of non-seasonally adjusted continuing claims.

On a non-seasonally adjusted basis, 3.56 million people are currently receiving unemployment insurance checks every week. On a seasonally adjusted basis, that is about 2% of the workforce, as shown in the chart above. Government support for the unemployed has finally returned to levels that in the past were considered "normal" at this point in the business cycle. It is arguably not a coincidence that the unprecedented level of government assistance for the unemployed in recent years has coincided with the current recovery being the weakest ever. The existence of the emergency claims program likely retarded the labor market's ability to adjust to the new post-recession realities.

Also released today were the leading indicators (although "coincident" would probably be a better adjective) for December. As the chart above shows, the fundamentals of the economy are relatively healthy, to judge by the increase in the leading indicators index over the past year.

Congress should consider the wisdom of John Cowperthwaite before deciding to reinstate the emergency claims program. When it comes to government assistance, doing nothing is usually better than doing something.

6 comments:

ECRI Weekly Leading Index Ticks Up

A weekly leading index designed to forecast U.S. economic activity over the coming months increased to 134.5 from 133.4 in the previous week.

According to the Economic Cycle Research Institute, its weekly leading index grew 3.7% in the week ended Jan. 10, up from 2.5% in the prior week and the strongest rate since late September.

http://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-weekly-leading-ticks-up-12

LIPPER FUND FLOW REPORT

Monthly November 2013

Equity Fund Inflows $29.2 Bil;

Taxable Bond Fund Outflows -$9 Bil

xETFs - Equity Fund Inflows $19.9 Bil;

Taxable Bond Fund Outflows -$7.5 Bil

Weekly 01/15/2014

Equity Fund Inflows $3.6 Bil;

Taxable Bond Fund Inflows $2.1 Bil

xETFs - Equity Fund Inflows $5.1 Bil;

Taxable Bond Fund Inflows $2.3 Bil

Weekly 01/08/2014

Equity Fund Inflows $1.9 Bil;

Taxable Bond Fund Inflows $4.6 Bil

xETFs - Equity Fund Inflows $1.9 Bil;

Taxable Bond Fund Inflows $4.1 Bil

AAII Sentiment Survey 1/22/2014

Bullish...38.1%

down 0.9

Neutral...38.1%

down 1.4

Bearish...23.8%

up 2.3

Long-Term Average:

Bullish:...39.0%

Neutral:...30.5%

Bearish:...30.5

Interesting.

A larger number of Americans now receive monthly disability checks from the VA than are receiving unemployment insurance.

About 3.7 million vets get monthly checks for disability, though only about 50,000 have been reported wounded in Iraqistan.

If getting checks for not working is a work disincentive, then right now the VA is creating larger work disincentives than national unemployment insurance.

Moreover, a vet get get disability forever. Unemployment eventually runs out. I know a guy in the 1980s who was still getting checks from WWII, due to a foot he hurt while in the service. Not in battle, just hiking stateside.

He had desk-job, like me at that time, and if no way was impeded by his "injury." I never even saw a limp.

But rest assured: Right-wingers will never, ever bring up this facts.

It is not PC.

"slowest recovery ever?"

Let me offer a different interpretation. Look at the slopes, d number d time, in the unemployment claims graph for various recessions. The slope of the current recovery is quite steep, steeper than the last two recoveries at this point in the cycle. That's a fast recovery. It's just we had a lot to recover from.

Similarly, the rate of job creation is about 2.5% a year, which is about as fast as the economy has done in recent decades. Perhaps I am simply more optimistic.

See my explanation for why this is the weakest recovery ever:

http://scottgrannis.blogspot.com/2013/11/two-reasons-this-recovery-has-been-so.html

Post a Comment