The chart above shows 10-yr Treasury yields (the main reference point for mortgage rates) in orange, and the yield on current coupon Fannie Mae collateral (the benchmark yield for mortgage rates) in white. In the past two months, Treasury yields have risen while mortgage yields have not fallen. The spread has narrowed in favor of mortgage rates, but the level of mortgage yields has not changed. If inflation expectations continue to increase, Treasury yields and mortgage rates will rise. The Fed can't stimulate without causing Treasury yields to rise, and if they rise further, mortgage rates will have no choice but to rise as well. Rising mortgage rates will be an excellent indicator that the Fed has succeeded in stimulating the housing market. Rates could rise by a lot before they became a burden on the housing market.

The chart above shows the market's forward-looking inflation expectation (i.e., the expected average annual inflation rate over the 5-yr period beginning five years from now). This has now reached 2.85%, up from a low of 2.0% a year ago.

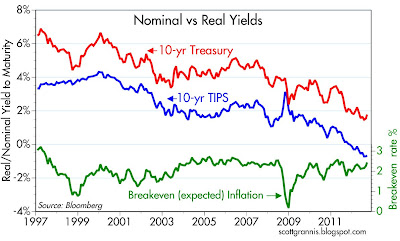

This same result (higher inflation expectations) can be observed in the spread between 10-yr TIPS and 10-yr Treasuries. The average annual expected rate of inflation over the next 10 years is now 2.48%. Not unusually high, but it's clear that the market is figuring that QE3 increases the odds of higher inflation in the future. Not dangerously higher inflation, but the risks of deflation have now almost vanished, and that is presumably a good thing.

How about the stock market—is it discounting stronger growth, or higher inflation? That's a tough question to answer, but my reading of the market tea leaves suggests that the stock market views QE3 as a sign of stronger nominal growth: businesses are more likely to see improvement in their cash flows in coming years. Whether than improvement comes from more inflation or more growth or both, matters little at this point. Stronger nominal growth means less likelihood of defaults, better profits on average (at least in nominal terms), and less risk of a recession or depression. On balance, the odds have shifted in favor of those who have a claim on future corporate cash flows, so stocks look more attractive. I don't think the market is yet discounting stronger real growth. Let's get nominal growth up and then we'll worry about how much of that increased nominal growth is real and how much is inflation.

I worry more about the risk that the Fed has made an exit strategy from QE more difficult, and thus I worry more about inflation rising in the years ahead. But so far, those fears are somewhat offset by a reduced risk of recession and/or deflation. It's unfortunate the Fed had to come to this, but it's premature to say it's the end of the world.

Regardless, inflation hedges just became more attractive. Seems to me that the cheapest inflation hedge right now is real estate, while the most expensive asset is Treasuries. So: buying real estate using 30-yr fixed mortgage debt (equivalent to shorting Treasuries) looks like an incredibly attractive proposition. With the banking system set to accumulate even more excess reserves, it seems inevitable that banks will want to increase their lending. At the same time, the demand for inflation hedges like real estate should be picking up, and with it the demand for more lending and thus more monetary expansion. Whether this will be good for the economy or just good for the real estate market and inflation hedges in general is a question that will be answered in the next year or two. For now it looks like inflation hedges are the better bet.

18 comments:

Dollar Index Friday before Lehman 78.96.....today many QE's later....79.26...

The FED tied their QE to unemployment. If unemployment stays above 7% we have unlimited QE.

But what if labor laws and other structural things keep unemployment above 7%? Doing QE takes the incentive away from congress to correct the structural unemployment problem. The dual mandate has really ruined things as full employment has been the target of all monetary policy that stayed easy for too long.

we don't necessarily have unlimited QE. Presumably, QE would be called off if inflation rises above some level that in the Fed's view would violate their dual mandate.

Benjamin undoubtedly will be happy.

Does this assure Obama's re-election?

I found it odd that Ben Bernanke said today that the reason for the purchases was that the inflation rate was in danger of falling below their 2% target rate. Go figure, unless they know something the market doesn't know.

The reason the Fed is 'doing something' to try to make the economy move is because the Government continues to do nothing.

The Fed would rather not do this, I suspect. But at some point, someone has to do something.

Unless you think that current conditions are excellent, steady as she goes.

With regard to keeping Fed Funds Rate near 0% well into 2015, Bernanke also said that even after the economy begins to grow more strongly and even after the unemployment rate begins to fall more rapidly the Federal Reserve would be very slow to raise the rate to make certain that it didn't damage the recovery. This was during the Q&A and discussion period for the media.

I hate to say it but I think Paul is right with the Fed. They need legislative oversight since the only sane negative vote was the Richmond Fed.

You can count on the mother of all market crashes coming that is for sure.

I am not surprised that the Fed has embarked on QE3, especially given the complete failure of America to create new jobs for the future -- that failure has the potential to overthrow the USA as we know her, something that economists simply cannot comprehend -- said another way, QE3 is required to avert the overthrow of the USA by fascists and socialists -- the same is true in Europe, so I expect to see the ECB announcing monetary expansions as well -- politics always wins over economics -- always.

The jobs that America will create will be low paying -- while the number of jobs will increase, real working wages will continue to stagnate at late 1960's levels through the remainder of the century.

The good news is that those who have been buying up cheap equities will see their fortunes rise in the short-run -- assuming that the amount of QE3 required to restore employment growth exceeds a trillion dollars, at least some of that money will find its way into equities.

Watch for cries for capital flight legislation (in one or more of its sinister forms) to appear in the headlines by early 2013 -- also, keep an eye on oil prices, and to some extent gas prices -- finally, watch for global skill poachers to appear in the US seeking to hire professional atheletes, moviestars, skilled surgeons, top scientists, and skilled engineers to work in Asia, either in person or remotely.

We should also keep an eye on the Chinese who are likely to begin buying up equities in the US with abandon, including equity positions in America's prized corporations such as Apple, Cisco, and Intel -- stock prices will surge in the short-term.

Accredited investors stand to win big -- world-class skills will likely earn even higher premium wages in the coming year -- everyone else should remain under cover.

Future looks bright -- gotta wear shades...

Scott,

Yes, what the Fed did today was unnecessary and probably harmful in the long run. I'm wondering if this irrational Fed and out of control Federal Government has finally convinced you that the USA is headed for an economic meltdown? If QE1, QE2, QE-Twist, and QE3, escalating deficit, and an accelerated decrease in the time span before SS and Medicare are insolvent don't convince you, what will?

QE3 is an admission that QE1 and 2 didn’t work.

A great day in monetary history!

I am puzzled that Scott Grannis contends that "political pressure" led to this Fed QE program.

The left-wing has been dismissive of monetary policy, and clueless, and calling for bigger deficits.

The right-wing has been calling for tighter money, led by Gov. Perry's threat to have Bernanke executed if he loosened up before the election (a threat, as Governor, Perry will be unable to carry out).

There is no political pressure that I can see for the Fed to make this move--quite the contrary, what pressure there is calls for an even tighter monetary policy (despite dead inflation and interest rates at zero).

No possible exit from QE. The Fed has plenty of currency to throw at the markets but won't have nearly enough bonds when marked to market to soak that money back up. The slightest hint that they might want to would move prices so hard against the Fed that it would be instantly insolvent. This move is purely fiscal policy. Though not explicitly fiscal policy since that would be illegal.

Mark: I certainly worry about monetary policy and entitlements and inflation and the deficit, but I don't think we're past the point of no return. The deficit is still huge, but it has been declining relative to GDP for the past three years—currently 8%, down from a high of 10.5%. Congress is likely to remain deadlocked over new spending initiatives, so all it would take is some reasonable spending restraint and growth oriented stimulus to bring it down further.

Scott,

You suggest that buying a house is a great idea.

If the fed spurs inflation expectations, but does not create jobs, won't the higher mortgage rates hurt the price of houses as people can't afford to borrow as much?

Thank you for your blog and your thoughts.

Post a Comment