Today the bond market got excited because the minutes of the July FOMC meeting reflected strong support for another round of Quantitative Easing should the economy fail to improve. 10-yr Treasury yields fell over 10 bps on the day, in apparent anticipation of more Fed purchases of Treasuries. This type of knee-jerk reaction is bound to end in tears, however.

As the above chart of 10-yr Treasury yields shows, the bond market's enthusiasm for past episodes of quantitative easing was short-lived. The first phase of QE1 was announced Nov. 25, 2008, and it consisted of up to $100 billion in Agency securities and $500 billion of MBS. In the early stages of QE1, 10-yr yields declined almost 100 bps, but only for 5-6 weeks. (I think Fed purchases were overwhelmed by the widespread fears of a global financial collapse.) By late January, when the Fed announced the purchase of more Agency and MBS debt, and the expectation of the purchase of long-term Treasuries, yields had jumped back up. On March 18, 2009, the FOMC formally announced the expansion of the program to total $1.25 trillion of MBS and $300 billion of longer-term Treasuries. Despite these massive and unprecedented purchases, 10-yr Treasury yields marched steadily higher, and didn't peak until the end of QE1 in late March, 2010. Yes, that's right: yields rose until the time the Fed stopped purchasing bonds.

The idea of QE2 was first floated by Bernanke in late August 2010, when 10-yr yields were around 2.65%. By the time QE 2 became official, with the FOMC announcement of Novermber 3, 2010, 10-yr yields had fallen by a about 15 bps, to 2.5%. As QE 2 was implemented over the next six months, with the Fed purchasing an additional $600 billion of Treasuries, not only did yields fail to decline, they actually rose by 100 bps.

In short, the anticipation and the reality of two major rounds of Fed purchases of MBS and Treasuries only served to depress yields temporarily. The major impact of QE1 and QE2 was to drive yields higher, even though the Fed justified its efforts by asserting that Quantitative Easing would drive yields lower, and that in turn would stimulate the economy. Furthermore, this short history of aggressive Fed intervention provides no evidence whatsoever to support the notion that the Fed has artificially depressed Treasury yields. If anything, two rounds of QE only pushed rates up.

So why did massive bond purchases not only fail to drive bond prices higher and yields lower, but produce exactly the opposite of the Fed's intended result?

The short explanation is that QE1 and QE2 pushed yields higher because they were just what the markets and the world needed. The first two rounds of quantitative easing helped address deep-seated issues that were creating a scarcity of dollar liquidity, which in turn was holding back the economy and threatening deflation. Note in the chart above how QE1 and QE2 followed periods in which core inflation fell to very low levels—a sign of a shortage of money—and the Fed was very determined to avoid the threat of deflation. The demand for money was intense, and the Fed's aggressive provision of bank reserves satisfied that demand. (Bank reserves, since they now pay interest, are functionally equivalent in the eyes of banks to 3-mo. T-bills, universally regarded as the world's safest and most liquid asset.) Quantitative easing provided much-needed liquidity to the economy and to the markets, and it was a stronger economy and the reduced risk of deflation that in turn boosted yields.

But will QE3 work the same way? 10-yr yields are down almost 150 bps since the end of QE2. Some of that decline could be due to Operation Twist (which involved the sale of short-term Treasuries and the purchase of longer-term Treasuries), but I think it's more likely that yields have declined because economic growth has slowed. However, today core inflation is not unusually low, and inflation expectations, such as the 5-yr, 5-yr forward breakeven rate embedded in TIPS and Treasury prices, have been rising for most of the past year, currently standing at 2.75%.

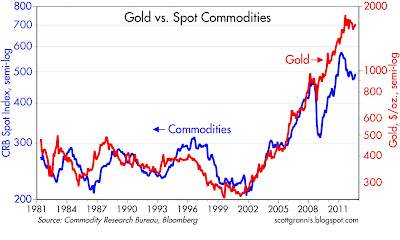

Conditions today are quite different from what they were leading into QE1 and QE2. The economy is weak, as before, but this time the threat of deflation is quite remote. Swap spreads are very low and credit spreads are relatively low, which suggests that the economy is not suffering from a shortage of liquidity. Although gold and commodity prices are off their highs of last year, they are still way above the levels of 10 years ago, when deflation fears first surfaced, and far above the lows of late 2008 when deflation was a again a real threat. If anything, commodity prices have risen so much more than the general price level in the past 10 years that they are probably contributing to inflation.

So if the Fed proceeds with QE3 later this year, it won't be because the economy is suffering from a shortage of liquidity, or because deflation is a real threat. It will simply be because the Fed thinks—or hopes—that additional purchases of bonds will help strengthen the economy. Long-time readers of this blog will know that I don't believe that monetary stimulus can result in stronger growth. Monetary policy can remove barriers to growth, as we have seen with QE1 and QE2, but it can't create growth out of thin air. So if we do see a QE3, then this time I think its effects will be mainly to push inflation higher. And of course, higher inflation is very likely to drive bond yields higher.

So if we do get QE3, don't expect bond yields to decline—expect them to rise.

Wednesday, August 22, 2012

Subscribe to:

Post Comments (Atom)

10 comments:

This was almost sickening reading both the FOMC minutes, and market reaction to it. Bernanke himself has said twice in testimonies to congress the past year, that even he admits the effects of QE2 were up for debate. If Bernanke himself has said QE2's effects were debatable, why does anyone think QE3 will arrive at the drop of a hat? And the markets are dumb enough to think the mere changing of wording from "some" to "many" means anything? If they had really wanted to do anything, they would have done it at the last meeting while this "many" though more easing might be needed.

What will be the reaction if the data continues to improve, and the Fed does not do a QE3? The problem with the Fed doing things so often, is that after a while market participants come to expect it at the slightest suggestion, even if that suggestion turns out to be just idle talk. It would be great if the markets could focus on things like, say ... projected forward earnings, no? It's disappointing, to put it mildly, to see the markets become little more than people trying to game the Fed. The Fed should be a side-show, not the central focus.

If Dr Bernanke and the Fed undertake some form of QEIII, the effort will be limited to checking deflation in order to hold inflation at around 2% or lower -- the Fed fears deflation and depression, and the Fed will only undertake sufficient monetary actions to ensure that deflation does not go wild -- the chances of the Fed undertaking monetary expansion in order to spawn growth or raise employment is none -- none at all...

Here's my fantasy FOMC statement for their September meeting. They would start out with the first couple paragraphs of background discussion, and then:

"To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided that in the best interests of stable market and economic functioning, no further easing measures beyond the pledge for exceptionally low interest rates through 2014 will be enacted. The Committee decided it is unhealthy for markets and the economy to pay undue attention to the actions of the Committee, so to inject a degree of certainty and predictability into FOMC actions, we have decided to introduce a mention of actions the Committee will not undertake."

But as the Billy Joel song said, "It's just a fantasy. It's not the real thing."

If the effects of QE2 are debatable, then we should definitely go ahead with QE3.

Why?

Are you kidding? We can monetize national debt without any consequences? We know inflation is dead, and the movements int he bond market are microscopic.

Andy shrewd, or even mediocre business guy with this opportunity--wipe out debt without consequence--would seize it.

But, we don't have even mediocre business guys running the federal government.

Has anyone noticed? Taxpayers now own $2 trillion in bonds, that can be used to offset taxes. Oh, gee, how terrible this is.

Maybe Romney would seize this chance. Somehow i doubt it.

Orthodoxy often trumps initiative.

Brillian analysis as always. If they implement QE3 and the Bush tax cuts are allowed to expire look out below.

Scott, thanks for that very clear, convincingly argued post. If the Fed does anything more than a token QE3 in the face of the facts you cited, they would be not only be hurting the economy, but damaging the reputation of the Federal Reserve as an independent institution possibly putting its very survival at risk.

Scott-

I seems that growth and/or inflation is what is going to send treasuries higher, not any concern over creditworthiness. With the recent CBO announcement of a fourth straight year of $1+ trillion deficit and Obama even in the polls, do you have any thoughts as to if or when a bond market vigilante mentality could creep into the treasury market? Will the bond market ever penalize us for our fiscal policy? What might trigger that? Thanks.

Inflation or even hyper-inflation cannoy last long enough to make a dent in the unfunded liabilities in this country. The government does not have the luxury of retiring debt early. Therefore, inflation or hyper-inflation only mitigates the interest costs for as long as the public is willing to endure the pain. After the collapse from such an egregious effort, deflation will resume with the liabilities unchanged.

Similar situations all around the globe. At some point, governments will start defaulting on promises. There is no way around it. The debts are too large to ever payoff.

Bernanke understands this but it is generally human nature to intervene. Some times the best trade is the one never made. However, Bernanke is not a trader and he has proven to be a terrible forecaster. It is anyones guess as to what he willl do and why...

Donny: re "will the bond market ever penalize us for our fiscal profligacy." Japan has had a much worse fiscal deficit than we have had for a long time without being penalized. Our situation is not all that terrible in any event, with the deficit as a percent of GDP falling.

Post a Comment