Smart investors always keep a sharp eye out for what might go wrong, and they build their portfolios accordingly, by not putting all their eggs in one basket.

Today, there are all sorts of things that might go wrong, and there is plenty of bad news to be found everywhere you look. Investors are right to be very worried.

In fact, sovereign bond markets are proof that investors everywhere are extremely concerned, because yields on most sovereign debt are extremely low. 10-yr Treasury yields are a paltry 1.6%; German 10-yr yields are 1.4%; and Japanese 10-yr yields are a mere 0.8%. It's simply amazing that 2-yr German and Swiss yields are now negative. You only buy bonds with extremely low yields like these if you are terribly worried about the risks of other investments. Bottom line, markets everywhere are beset by predictions of doom and gloom.

That's because it's no secret that the Eurozone is in a recession, and that some Eurozone countries seem utterly incapable of coming to terms with their bloated public sector spending, and so the risk of major sovereign debt defaults remains relatively high. It's because the whole world has seen China's economy slow meaningfully, and we know that many developing economies are struggling. Who is unaware that almost every major central bank in the world is up against the "zero boundary," unable to stimulate further by reducing interest rates, and therefore forced to resort to quantitative easing which could potentially threaten a big increase in inflation if not reversed in timely fashion? Iran is getting close to having atomic weapons, and Israel is not the only country worried about the consequences.

Everyone knows that the U.S. unemployment rate, which is still very high at 8.3%, nevertheless severely understates the effective unemployment rate, which is much higher. Nearly everyone bemoans the fact that the U.S. economy has been growing at a very slow rate ever since the recovery started, and that this is the most miserable recovery in our lifetimes.

Pundits remind us every day that there are millions of homeowners who are underwater with their mortgages, and that banks are still holding millions of foreclosed properties (REO) on their balance sheets; thus the "shadow inventory" of properties that could get dumped on the market is huge, and prices could suffer another collapse. So it's no wonder that mortgage rates are extremely low—it's because there is a relative shortage of people willing to borrow to buy homes, even though homes are more affordable now then ever before.

The stock market is studiously ignoring today's extremely strong level of corporate profits, focusing instead on how much profits are likely to decline, which is why PE ratios are below average.

Meanwhile, the U.S. government continues to run trillion-dollar deficits, while the unfunded obligations of social security and medicare are staggeringly large. It's dismaying that there don't seem to be any politicians—with the exception of that right-wing whacko Paul Ryan—willing or able to tackle this challenge. And of course, the "fiscal cliff" looms at year end.

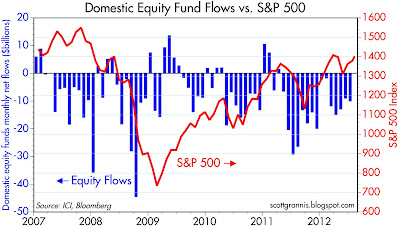

In short, if you don't know that the world is beset with problems and threats of mega proportions, then you just haven't been paying attention. And if you have been paying attention, you're extremely worried about all the things that could wrong, and it's a good bet that your portfolio is extremely conservative. The charts above tell the story: for the past three years, investors have been pulling money out of equity funds and stuffing it into the relatively safety of bond funds, despite the ongoing rise in equity prices. Markets everywhere are depressed because of all the concerns over all the things that might go wrong. Forecasts for future growth range from a depression to, at best, 2.5-3% real growth. Contrarians take note: no one is forecasting growth in excess of 3-4%.

Ok, fine, lots of things could go wrong, but what if something goes right? That, I would submit, is the key risk you face today. Is your portfolio positioned to take advantage of an economy that continues to grow? of a housing market that doesn't collapse again, and in which prices begin to recover, albeit modestly? of corporate profits that fail to collapse?

Markets have actually been grappling with these sorts of questions for some time now. As the chart above shows, equities appear to be rising reluctantly, because the economic fundamentals (using first-time claims for unemployment as a proxy) continue to improve instead of deteriorating. When markets are braced for the worst, if the worst doesn't happen, then prices almost have to rise.

Eurozone swap spreads have improved significantly this year, and 5-yr credit default swaps have declined substantially. Both developments suggest that the risk of a Eurozone collapse has declined meaningfully. Not surprisingly, Eurozone equity markets are up over 16% in the past two months. Not because the future is looking brighter, but because the future is looking less grim.

If just a few things go right, then it is likely that risk assets (in particular equities, real estate, and commodities) could continue to rise in price. And economies could do a little better than expected, even if sovereign yields rise. Indeed, rising sovereign yields would be a sure sign of an improved outlook.

Whereas owning sovereign debt has traditionally been a good way to hedge against the risk of something going wrong with the economy, these days you should consider that being short sovereign debt (or just not holding any, or borrowing at fixed rates) is a good way to hedge against the risk of something going right.

16 comments:

Excellent Commentary. Thank you for sharing your expertise and investment experience!!

William

2012 US Federal Budget:

Department of Defense including Overseas Contingency Operations

Discretionary $683.0 billion Mandatory $5.3 billion

Department of Health and Human Services including Medicare and Medicaid

Discretionary $84.2 billion

Mandatory $787.8 billion

Department of Education

Discretionary $79.1 billion

Mandatory $19.4 billion

Department of Veterans Affairs

Discretionary $58.8 billion

Mandatory $70.4 billion

Department of Housing and Urban Development

Discretionary $47.9 billion

Mandatory $8.9 billion

Department of State and Other International Programs

Discretionary $53.4 billion

Mandatory $2.6 billion

Department of Homeland Security Discretionary $58.8 billion

Mandatory $1.6 billion

Department of Energy

Discretionary $42.3 billion

Mandatory $–1.7 billion

Department of Justice

Discretionary $28.8 billion

Mandatory $5.8 billion

Department of Agriculture

Discretionary $28.8 billion

Mandatory $121.9 billion

National Aeronautics and Space Administration

Discretionary $17.7 billion

Mandatory $–0.02 billion

Department of Transportation Discretionary $25.6 billion Mandatory $58.6 billion

Department of the Treasury Discretionary $13.5 billion Mandatory $148.7 billion

Department of the Interior Discretionary $12.4 billion

Mandatory $–1.1 billion

Department of Labor

Discretionary $14.0 billion Mandatory $113.1 billion

Social Security Administration Discretionary $11.7 billion Mandatory $817.5 billion

Department of Commerce

Discretionary $10.9 billion Mandatory $0.5 billion

Army Corps of Engineers Civil Works Discretionary $9.3 billion

Mandatory $–0.06 billion

Environmental Protection Agency

Discretionary $9.5 billion

Mandatory $–0.1 billion

National Science Foundation

Discretionary $8.0 billion

Mandatory $0.2 billion

Small Business Administration

Discretionary $1.4 billion

Mandatory $1.8 billion

Corporation for National and Community Service

Discretionary $0.8 billion

Mandatory $0.007 billion

Net interest

Discretionary N/A

Mandatory $0.2 billion

Disaster costs

Discretionary $<0.005 billion

Other spending

Discretionary $19.3 billion

Mandatory $88.0 billion

Total Budget

Discretionary $1.338 trillion

Mandatory $2.252 trillion

In markets, there is no "right" and "wrong" -- only what is -- no matter what the market does, you have to figure out how to make money -- up or down -- left or right -- it's all a money making opportunity -- the market is always right...

In order to get it right we need to liquidate the failed institutions and companies requiring government support.

Until then, we are looking at a Japanese style slog. 'Capitalism without bankruptcy is like religion without sin.'

It simply does not work in the long run and until you get that right, the rest seems fairly predictable.

Wow. What a convincing thesis.

The market (S&P 500) had downers in ’10 and ’11. But the highs in ’11 were higher than the highs in ’10. And the lows in ’11 were higher than the lows in ’10. (Look at weekly charts to easily see this).

2012 has had a higher high than 2011’s and the low in 2012 was shallow. The market is challenging the March 2012 higher high. If it breaks above in the absence of a negative shock (from the Middle East) and in the presence of “something good happening” like, like, something, we shall see a magnanimous rally.

Really, look at the weekly chart. There is nothing to complain about a market working its way higher over time.

We are almost smack right at the point of making a new recovery high. Each day is tense and exciting. At 1:45 am Tuesday East Coast time, Asia is up some and U.S. index futures are up a fraction.

A subsequent negative shock may take a big rally here down a lot, but may not break the pattern of higher highs and higher lows.

While coporate profits are doing extremely well, it seems to me that its being built on an inverse pyramid. Corporate profits are doing well because there is less and less competion in the economy. While it's good for corporate profits, it can't be good for the future of the economy.

You may call Ryan a wacko. At least he has an idea to negotiate around.

My use of "whacko" to describe Ryan was facetious. In earlier posts I have given him very high marks. I think he is outstandingly good.

I see competition as a good thing. Take Apple, which is outcompeting almost everyone and raking in huge profits. Competition leads to superior products and services, and profits follow in their wake. Ask Apple's competitors if they think a lack of competition in the market is leading to Apple's profits.

But I would concede that there may be a lack of competition overall, and if there is, it is mainly due to the very high and rising barriers to entry: e.g., very high corporate tax rates and very high regulatory burdens. This has the effect of retarding growth.

Maybe a silly point but your graph title of, "U.S vs. German 2-yr Yields" should read U.S and German 2-yr Yields". They would be 'vs' if one was on the x-axis and one on the y-axis. Versus means 'against' and since they are both on the same axis they are not 'against' each other.

Why didn't Ryan vote for Simpson-Bowles?

John said...

"Why didn't Ryan vote for Simpson-Bowles?"

Ryan said that he didn't vote for it because it had too high tax increases.

Excellent overview by Grannis.

I can remember the 1970s, and the gloomy stagflation rising crime in the streets, the Vietnam debacle fresh, and oil skyrocketing due to OPEC actions. Carter became President and emblematic of the time (he had bad luck in many regards, and it is forgotten he appointed Paul Volcker).

Nobody asked, "What can go right?" The next two decades we're great, especially for investors.

We may see some sort of replay of that.

But, Grannis has to ask himself: "What are the ramifications of 20-year secular downtrends in interest rates? What will this mean for monetary policy? What policy tool is now useless (hint: Lowering interest rates). "

Unless rates go back up towards historical ranges, we are in a new era for monetary policy. What was unconventional--QE--will have to become conventional, if only by default.

BTW, Romney has posted his plan for economic growth, here :

http://www.docstoc.com/docs/125714335/Romney-Tax-Reform-White-Paper

Most of it I agree with, though it little mentions paring of federal agency spending, pretty much a GOP sacred cow (yes, Defense, Homeland Security, VA, and USDA make up the bulk of agency outlays, a fact never, ever discussed in GOP circles)).

What is interesting is that the Romney plan mentions not monetary policy, despite the fact that John Taylor crafted part of it, he of the famed Taylor Rule.

This is interesting. I am hoping that Romney wins, and that he plans to usher in a more-bullish, growth-oriented monetary policy.

But he cannot say so; the GOP right-wing is hysterical about gold and inflation. It is interesting that the document does not pander to those sentiments.

A slender reed upon which to hope, I am sure, but one must hope.

Add on:

Some quick online research confirms that Romney has been all but mute on monetary policy for many months. Meanwhile, Paul Ryan is something of a crank on monetary policy wanting to go to a gold standard, or commodities-based basket.

Is there another party I can vote for?

Bloomberg reports the following:

The Treasury also said it is “in the process of building the operational capabilities to allow for negative-rate bidding in Treasury bill auctions, should we make the determination to allow such bidding in the future.”

--30--

This is not the hyperinflation I was told to expect. Really? Negative yields on Treasuries?

How does negative yields on Treasuries after $2 trillion in QE square with anybody's economic theories?

You think maybe the theorizers got it wrong?

A long tine ago, I was taught that you plan for the worse and hope for the best. That has always been my investment philosophy, and it has paid off (I've also been very lucky).

Although I buy your argument that things could turn out better, the odds are poor. P/Es are low because profits as a percentage of GDP are historically high levels (not seen in 70 years), you can say that the housing market will recover but you assume that willing buyers can finance the purchase!

Bond yields on AAA sovereigns are low because reich people have a fundamental perspective on investing -- don't lose your capital.

Europe has been kicking the can down the road for 3 years now (lurching from crisis to crisis) in the hope of "devine" intervention.

Japan's savings rate are about to turn negative -- as older japanese now withdraw more than younger ones are investing.

China's export miracle is being challenged by difficult export market -- ending of demographic boom (countryside to city mouvement), and already excessive levels of unproductive over-investment.

America has political gridlock that is unlikely to change even if Romney wins -- and worse under a second Obama administration.

Add to the mix drought in America and Russia and you have a volatile mix.

Sure the upside senario is appealing, but the most likely outcome is either more muddling economic growth. In these circumstances the prudent investors takes to the hills

Frozen: you have simply repeated my main thesis, that the market is priced to terrible expectations. Everyone has taken to the hills. No sign of optimism anywhere. Which means that if anything good happens, even if things turn out to be bad instead of terrible, the market is very vulnerable on the upside.

Post a Comment