Wednesday, August 24, 2011

Speaking of negative correlations...

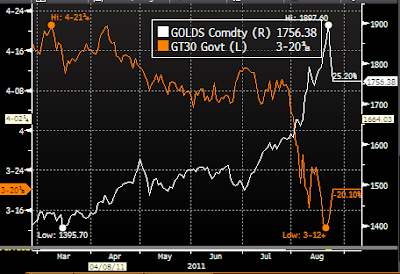

In my earlier post today, I noted the very strong negative correlation between the Vix index and the S&P 500. Here's an illustration of another very strong negative correlation (-0.92), between the price of gold (white) and the yield on 30-yr Treasuries (orange). Very low Treasury yields are symptomatic of a market that is terrified of the outlook for growth and the possibility of deflation. Very high gold prices are symptomatic of a market that is terrified of all sorts of things, and very weak growth accompanied by expansive monetary policy which could lead to high inflation is just one. The extreme volatility and relative weakness of equity prices is symptomatic of a market that is extremely worried about the outlook for growth.

When emotions run high and confidence is low, prices can reach levels which don't make much sense. Such is the case with the seemingly inexorable rise of gold prices (typically associated with rising inflation risk) and the seemingly relentless decline of long bond yields (typically associated with very low inflation or deflation). It should be easy to deduce that one or both of those markets was likely to be proved wrong. The big reversal we saw today, with gold prices falling 8.5% from yesterday's all-time high, and 30-yr Treasury yields rising 25 bps from yesterday's post-2008 low, is a perfect example of what happens when two trends which were inevitably and mutually unsustainable collide with even the slightest bit of reality: business investment continues to rise and inflation is by no means dead.

Subscribe to:

Post Comments (Atom)

29 comments:

People always seem to highlight these 'large' reversals in gold. However, if you push your chart out 10 years it is clearly evident there is no break in the trend.

Since 1970s, the nominal price of gold has risen almost 10 times higher relative to the S/P 500.

Food for thought...

Nicely written, Mr. Grannis.

You have a way with words.

Well, I have been wrong on gold for years. "All gold is fool's gold"--but not for last several years.

Still, gold is one asset category where bottom is way down there.

In terrible dumps, real estate seems to fall in half, and then buyers comes in. Stocks too.

Gold? What is gold worth? It is a bauble. It is worth what Chinese and Indian buyers will pay. That is likely higher than Americans--but not necessarily ever higher.

Anyways, gold is a sideshow. It tells us little anymore. Carnival-barkers and fear-mongers and Chinese holiday shoppers control the price of gold.

Good luck making sense of it.

The great bond bull market may be ending. There are quite a few institutions who have a required annual rates of return considerably above medium term bond yields and have been making it on bond price appreciation. If/when that game ends, there could be a huge shift of assets out of the bond market and into equities where generous yields await.

Being an equity investor has been a difficult experience over the last several years, but like our legal people like to remind us, past performance is not indicative of future results. With a bull market in bonds possibly ending, commodities a popular investment theme, real estate a popped bubble, it just might be that large, international corporations with proven managements, pristine balance sheets, good earnings prospects, and growing dividends above the yields on ten year US treasuries just might....MIGHT, mind you, find a few folks who find their shares interesting.

Food for thought.....

Another gem from Scott with a nugget provided by John. The fed keeps wanting to print, the consumer is strained (real estate prices high& unemployment high, and government regulations are hurting business. Could we have slow growth with a stagnant market along with inflation? Also, do you trust the price of gold as a predictor of inflation more than a rating agency? Perhaps your excellent chart then is predicting inflation (gold) and slow growth (bonds). I do know that if we do have inflation the interest rate on 30 year bond rate will go way up

I hate to say it, but sell Apple?

I like dividend stocks now.

Benj,

Re AAPL:

If you were to look in the dictionary for a definition of a destructive technology, you just might find a picture of Apple Computer. The recent collapse of tech titan Hewlett Packard is, in the opinion of some, the result of competition with Apple. In 2009, AAPL earned $6.29 per share. In 2010 they earned $15.15. In 2011 earnings are expected to be $24.20and that number will likely be exceeded. Most estimates have EPS north of $27 in 2012. At $376 per share, AAPL is selling for ~15X earnings. However, AAPL has $25 per share in NET cash on the balance sheet. Deducting that from the share price leaves a PE of 14X. Interest rates are ~ 0%. If you sell, where do you go with the money? Gold? At $1700+ per oz? Be my guest. Treasuries? At < 1% unless yo go out beyond 7 years? Not me. Corporate bonds? Maybe a case can be made for high yield, but IMO AAPL can withstand a slow growth economy better than a bunch of companies with weak balance sheets.

Bottom line, if I had APPL I'd keep it (unfortunatly I do not). I'll probably buy higher. (sigh)

Benj,

My apologies. Iwas out and did not see the news of SJ's resignation 'till after I posted the above.

Still goes however. I should use a pullback to get a few shares.

My daughter is a high school senior. The public school she attends distributed new iPads to all juniors and seniors first day of school. Amazon now offers a Kindle app for the iPad/iPod - why buy the Kindle? Retail stores like Nordstrom now completing sales on the floor with an iPod Touch ( like in Apple stores ), bypassing traditional POS systems. The list is already very long... I think we are just beginning to see how the portable, multipurpose apple devices will be used to replace existing systems.

john-

I think Apple is a wonderful company. They did seem to rise and fall with the direct involvement of SJ. The guy must be a genius, the type we are lucky to have.

What great wealth is created by the private sector!

SJ seemed to have the knack. Let's see if another SJ is in the wings--but those types seem to not follow in the footsteps.

"What great wealth is created by the private sector!"

Yes, when companies use their profits and investor capital to create goods and services people want to buy.

When the private sector sits on its cash, and investors buy useless gold instead of great ideas, then, not so much.

The reason the government prints money is to compensate for reduced velocity caused by hording.

AAPL is down only 2% in Pre-Market.

I have owned some shares of Apple since 2005. I will not sell because I think Job has had 5 or 6 years to plan for this transition and has the right people in key position for the next few years. He's smart enough to have planned for this important day.

But as we have recently seen with Hewitt Packard, things can change for the worse over time. HPQ has had a poorly functioning board for a number of years.

And exchanges increased margin requirements again on gold contracts.

The negative correlation looks only to be a current phenomenon.

John--

"Hording"??

It's called fear!

Obama has taken over banks, auto makers, student loans, health care, he has demonized wall street, banks, oil companies, pharmas, telecoms, he has blasted corporate luxury trips and corporate jets, and has that there are some companies who make too much in profit!!!!!

In addition, he wants to take money out of my pocket and give it to those who haven't worked for 2 years. His Commerce Sec said that every dollar of food stamps creates $1.84 in economic activity. Pure insanity.

There is still much FEAR of this man and his administration. Freeze taxes, freeze spending, freeze regulation, roll back health care, Dodd Frank, and let people buy the light bulbs they want and people would stop "hording".

John--

And government is printing money to give even more away than what they are able to take!

Benji--

Gold has been a store of value for all recorded history. Gold has been the basis for coinage for most of history (recent history being an exception!).

It is more than just jewlery worn by Indian women. Way more. It WAS the basis of our currency!

See this image:

http://en.wikipedia.org/wiki/File:Series1934_100gold_obverse.jpg

Article I, Section 8, Clause 5 of the United States Constitution grants Congress the power "To coin Money"; and Article I, Section 10, Clause 1 provides that "No State shall... make any Thing but gold and silver Coin a Tender in Payment of Debts".

Gold is more than jewlery my friend.

Seen in the Daily Telegraph:

Insurance on the debt of several major European banks has now hit historic levels, higher even than those recorded during financial crisis caused by the US financial group's implosion nearly three years ago.

Credit default swaps on the bonds of Royal Bank of Scotland, BNP Paribas, Deutsche Bank and Intesa Sanpaolo, among others, flashed warning signals on Wednesday. Credit default swaps (CDS) on RBS were trading at 343.54 basis points, meaning the annual cost to insure £10m of the state-backed lender's bonds against default is now £343,540.

The cost of insuring RBS bonds is now higher than before the taxpayer was forced to step in and rescue the bank in October 2008, and shows the recent dramatic downturn in sentiment among credit investors towards banks.

"The problem is a shortage of liquidity – that is what is causing the problems with the banks. It feels exactly as it felt in 2008," said one senior London-based bank executive.

"I think we are heading for a market shock in September or October that will match anything we have ever seen before," said a senior credit banker at a major European bank.

What do you think the odds are of a major market shock as a result of the above?

Jeff:

Such FEAR is irrational, but, so what, markets aren't so rational, either. The only way Obama could do any of the things you list, is if he actually wanted to (which he doesn't) and Congress wanted it too, (which it doesn't).

Plus, if the government had broad confiscatory power, would it make sense to sit on a big pile of cash? Hell, you may as well spend or invest it before Obama "steals" it.

He has ALREADY done the things on the list!

And his big "jobs" announcement coming up will be more of the same.

John and Jeff:

The latest news about a "refinance program to allow more homeowners to benefit from lower interest rates" is another great example of this administration taking money out of one persons pocket and giving it to someone else. Seems like Obama advisors think this is just magic, that the benefit has no cost. Well, it costs the investors holding the existing mortgage backed bonds plenty as the duration is suddenly dramatically shortened. More silent theft. To make matters worse, just like all the other "programs", it's likely that most of the people who would have defaulted still will eventually, and a huge number of mortgagees will benefit when they would have survived anyway. Investing is a crap shoot when you don't know what the government will do next.

"Investing is a crap shoot when you don't know what the government will do next."

How do you feel about having national elections every 2 years? Should we cancel them and go to one-party rule? That way there won't be so much fear uncertainty?

Investing is a crap shoot when speculators and HFT wreak havoc on the markets.

<>

Agreed! It's fair to add though that speculation has been encouraged by fed policies that have kept interest rates abnormally low, and the havoc greatly magnified because of the extreme leverage thereby created.

"the havoc greatly magnified because of the extreme leverage thereby created"

It wasn't just the Fed that created extreme leveraging. De-regulation had a hand in that.

Jeff said:

"Obama has taken over banks, auto makers, student loans, health care, he has demonized wall street, banks, oil companies, pharmas, telecoms....

There is still much FEAR of this man and his administration. Freeze taxes, freeze spending, freeze regulation, roll back health care...."

Why don't we just roll the clock back to 9 October 2008 when George W. Bush was President, Dick Cheney was Vice President and Hank Poulsen was Sec. of the Treasury AND DO NOTHING ;~)

@William

Actually,that's not a bad idea. Then real estate might find its rightful price and the excess inventory would clear and we would some certainty and direction. Might have to nationalize a few banks along the way,

I agree with The Dude. Roll back everything to that date. Skip TARP (which never was used to buy "T"oxic assets), skip stimulas, skip shovel ready, skip home buyers credit, skip cash for clunkers for Goodness Sake!! Skip it ALL...we'd be much better off today by far. No contest.

Post a Comment