The chart above is my way of interpreting what the level of 10-yr Treasury yields means. The recent four-month decline in yields is telling us that the market has become very pessimistic about the prospects for economic growth. It's a mini replay of the six-month decline in yields that occurred last year (April-October), which coincided with the widespread belief that the U.S. economy was headed for a double-dip recession.

Contrary to popular opinion, the level of 10-yr Treasury yields has very little to do with the Fed's quantitative easing initiatives. There are still many people who think that the Fed's QE2 program has helped the economy by lowering the level of long-term yields, and/or by pumping up the money supply, and this was precisely the justification advanced by the Fed for adopting QE2 in the first place. The evidence, however, does not support this contention.

To begin with, there is no evidence that 10-yr Treasury yields have been depressed by Fed purchases of notes and bonds. On the contrary. That became obvious when 10-yr yields started rising at almost the same time that the Fed began implementing its QE2 program early last November. If Fed purchases of significant amounts of Treasury notes and bonds had any impact on the market, it was the exact opposite of what one might have expected. Moreover, yields have been declining for the past four months, even as the end of QE2 approaches in a few weeks. If Fed purchases had depressed yields, you would have thought the market would now be bracing for rising yields, but that is clearly not the case.

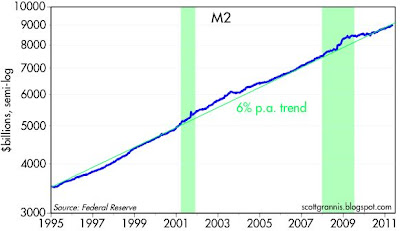

Second, there is no evidence that the Fed's QE2 program has had any impact on the amount of money in the economy. If QE2 hasn't favorably impacted yields, and has had no noticeable impact on the amount of money in the economy, how can it have had any impact on the economy?

As the above chart shows, there is no evidence whatsoever that the Fed's quantitative easing—which involved the purchase of $1.6 trillion worth of agency and Treasury debt—has had any impact on the amount or growth rate of M2, arguably the best measure of the money supply. The M2 money supply has grown on average by about 6% per year for the past 16 years. Despite the supposedly massive money-creating impact of QE2, M2 has grown at only a 4.9% annual rate over the period during which QE2 has been in effect. As I've explained before, the net effect of quantitative easing has been to swap T-bill equivalents for notes and bonds, thus effectively shortening the maturity of government debt and satisfying, in the process, the market's apparently voracious demand for safe-haven cash. There has been no unusual amount of money printing.

The reality is that yields are not determined by Fed purchases, they are driven by the market's expectation of growth and inflation fundamentals.

Stronger growth and higher inflation lead the market to expect more Fed tightening in the future, and the expectation of higher short-term rates in the future translates directly into higher 10-yr yields today. Conversely, when the market loses confidence in the economy's ability to grow, as it did from April '10 through October '10 (when a double-dip recession was widely anticipated), and from February '11 to this day, then 10-yr yields decline because the market expects the Fed to keep short-term rates low for longer.

You can see this dynamic clearly in the above chart. The white line is the yield on 10-yr Treasuries, and the orange line is the expected Fed funds rate one year in the future, and there is a strong correlation between the two (over 0.8). 10-yr yields rise when the market adjusts upward its expectation for the future path of short-term interest rates, and vice versa. (An efficient market sets 10-yr Treasury yields to equal the average expected return on cash invested at the Fed funds rate over the next 10 years.) Fed expectations, in turn, are driven by the market's perception of how weak or strong the economy is, since the Fed's Phillips Curve mentality has a strong tendency to want to tighten when the economy is strong and ease when the economy is weak.

The simple conclusion is that the recent decline in yields is a reflection of the market's increasingly pessimistic view of the prospects for economic growth. Pessimism has been fueled by the supply disruptions that have rippled outwards from the Japanese tsunami, and by the vagaries of seasonal adjustment factors for weekly unemployment claims, which have made it look like the labor market was deteriorating when in fact it was not. In addition, the market seems to have become overly concerned by what has amounted to only a minor correction in commodity prices.

With the market priced to a relatively high degree of pessimism, it is thus very vulnerable to any news which contradicts the expectation of deterioration. Bearing in mind that corporate profits remain very strong, that swap spreads remain very low, and that commodity prices remain very high, I think the market is going to be surprised to find out that the economy has not in fact deteriorated to the extent that is currently priced in. It's not that I'm wildly optimistic about the future, it's just that I am not as pessimistic as the market.

2 comments:

Events have been dimmed by the Japan events. Once stocks have finished selling off (about now) due to this, market will be a buy. Would not be a buyer of bonds. Growth will resume last half 2011 and early 2012.

You get 3 to 4 selloffs a year...

this is our second one,,,

Post a Comment