Tuesday, June 7, 2011

Healthy financial market conditions point to a stronger economy

This chart illustrates swap spreads' ability to forecast financial and economic conditions. Swap spreads (see my primer on swaps here) are excellent barometers of systemic and financial makret risk. They rise when financial market participants see rising counterparty risk, and that risk in turn is a function of general liquidity conditions, monetary policy, and the health of the economy. Swaps represent a highly liquid market which is extremely sensitive to underlying fundamentals, and as such they can and do tend to lead developments in other markets, such as corporate bonds and equities. For example, when financial conditions deteriorate, sources of funding become more expensive and/or dry up, investment declines, and economic growth eventually suffers.

Swap spreads started rising in mid-2007, well before the economy entered a recession, and well before the financial market crisis of late 2008. They peaked in early October '08, and then fell precipitously in late 2008/early 2009, thanks largely to the Fed's quantitative easing program, which (belatedly) succeeded in meeting the world's intense demand for safety and liquidity that followed in the wake of the collapse of Lehman Bros. With financial market conditions vastly improved going into 2009, it didn't take long for the equity market to reach a low in early March, and for the economy to begin to recover in July '09.

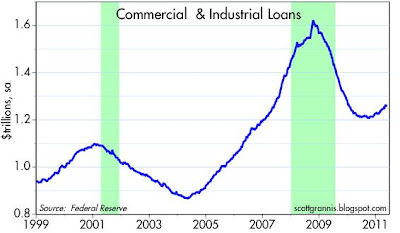

Swap spreads have now been low and stable since last August, signaling the complete normalization of financial market conditions. This normalization can also be seen in the above chart, which plots Bloomberg's index of a variety of financial indicators. I would also note that there has been a noticeable improvement in Commercial & Industrial Loans (bank loans to small and medium-sized companies) since the end of last year, and this is yet another example of how a normalization of financial market conditions eventually translates into an improved economy. When financial conditions are healthy, this opens the door to increased investment, and that is what fuels economic growth.

All of this suggests that we are likely to see continued improvement in the economy as the year unfolds. That improvement, in turn, should provide strong support for a continued rally in the equity and corporate bond markets. The "soft patch" of the last few months is thus most likely related to bad weather and the disruptive impact of the Japanese tsunami. Brian Wesbury fleshes out that story here.

Subscribe to:

Post Comments (Atom)

1 comment:

Interesting that swap spreads and treasury spreads all suggest a very healthy economy. Amazing that everybody fears a double dip in the stock market when nobody is investing like that. This is clearly a buy the dip market.

Post a Comment