Wednesday, May 19, 2010

Is the commodity selloff significant?

A friend asked me yesterday if I saw any signs of concern in the commodity markets. Could the broad-based decline in commodity prices in the past month be signaling an economic slump? Could the worries over Greek debt and the future of the euro be spilling over into another round of consumer and corporate retrenchment around the world?

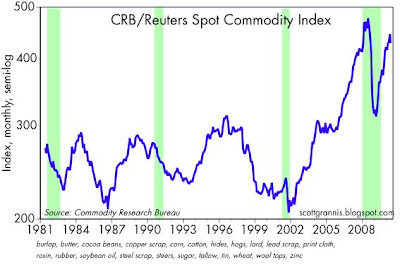

So I pulled together these charts of various commodity prices and indices and updated them with the latest figures. I think the message of every one is basically the same: yes, there's been a bit of a selloff, but it doesn't look particularly large from an historical perspective, and prices remain relatively elevated. In the case of gold (last chart), the recent decline is almost undetectable, and gold is the commodity most likely to be driven by speculative (and forward-looking) activity. The CRB spot commodity index is probably the one least influenced by speculative activity (since only a few of its components have futures markets attached to them), but it too has suffered only a minor correction of late.

Meanwhile, the dollar has experienced a pretty significant rally in the past month, coincident with the modest selloff in commodities. This is not unusual at all, since the value of the dollar and commodity prices have been inversely correlated for a long time.

Faced with the uncertainty of Greece and the euro, investors have retreated to the safety of the dollar and gold. Commodities have experienced a modest correction as the dollar has climbed, because commodity prices almost always respond that way to changes in the value of the dollar. If there's anything that stands out here, it is that the correction in commodity prices looks quite tame relative to the change in the dollar. And that, when combined with the very strong performance of gold, suggests that global liquidity is still in abundant supply.

Equity investors have been spooked as well. But note the big jump in the Vix Index, actually the biggest since those awful days of late 2008 when it seemed that the whole international banking system was on the verge of collapse. The biggest thing impacting the markets right now is that old familiar nemesis: fear, uncertainty and doubt. The rise in FUD is much bigger than any physical or financial sign of economic deterioration.

Bottom line: the most likely explanation for what is going on is this: the market is climbing one more in a series of "walls of worry." Today's concerns will eventually pass, to be replaced by a renewed focus on the many signs of renewed global growth.

Subscribe to:

Post Comments (Atom)

10 comments:

Scott:

What is your thoughts to the growing theme that China is on a verge of a major collapse...lead by an enormous property bubble collapse which will certainly due significant damage to the financial system (both within China and globally). Such an event would bring down the entire world economy in a way that could dwarf what we have been through to date. I'm curious as to your thoughts/concerns about this. The Chinese index is now down 20% from it's highs (in bear territory) and most expect a significant event in the near future. I appreciate your comments on this.

Jeff,

Scott will probably weigh in on your question when he has time. I share your concern and would appreciate his perspective also.

During times of market turbulence such as we are experiencing now there is a marked increase in the number and variety of 'apocolypse' scenarios that are put forth by 'analysts', 'strategists', and other 'experts'. While plausible, these are usually low probability outcomes and serve the purpose of bearishly positioned investors, traders, and speculators whose agenda is to freighten weak holders out of their positions. Many times it works and the purpose is served. The bulls use similar strategies on optimistic scenarios, but fear is a much stronger emotion than greed and it plays better in the media. Bad news and uncertainty gets more attention than good news. If you doubt this, watch the headlines.

Having said all that, I do believe China has an inherently unstable economy. Their GDP is based on exports and domestic investment (infrastructure, property development, etc.) with consumer consumption discouraged. The government directs much of this activity so its efficiency is less than optimal as most government spending is. This central planning makes it difficult to calibrate economic activity and could lead to imbalances that are unweildy. Their economy would be much more stable if domestic consumption was more equal to the other two factors.

It is quite possible that the 'China crash' could happen at some point. However the government holds massive reserves of US and other securities and definatly will have options if these imbalances occur. We saw an example of their reactions when our markets for their exports suddenly froze a few quarters ago. To keep their economy growing they significantly increased their domestic investment. They had plenty of cash to do so.

In summary, the 'collapse' of China's economy is a possibility, but no one can know when. When reading these stories, also keep in mind the probable agendas of those telling them.

Well said and appreciated. My concern lays in the fact that China's growth has been a huge impact in the global growth story in the economy and commodoties as Scott likes to reference, if they collapse, it's going to hurt and I'm concerned about it. I do think the cosumer is becoming a bigger part of their economy (look at the number of cars on the street vs. 10 years ago), but its still on a pretty small scale. Thus...all of this building/development looks fishy and concerning. I appreciate your thoughts/comments.

Jeff-

I ditto everything John said but I can add that I live in Thailand part-time, and watch Chinese TV (44.8 in Los Angeles) a lot when stateside.

I think the short story is that mainland China has so much money nothing matters.

As a somewhat centralized economy, they misallocate resources. On the other hand, in the USA we misallocated a couple trillion into our domestic property markets, so maybe this is a case of the kettle calling the pot black. We are getting close to spending $1 trillion a year on national defense, homeland security and the VA. That's one trillion every year--parasitic spending they do not have in China.

The upshot: China will boom for generations, thanks to their work ethic and strong culture and lack of militarism (heavy defense spending contributed to the Soviet Union's collapse).

Jeff, John, and Ben,

The Global economy is out of whack so you should expect the pump priming by central banks the world over to spring a leak at some point.

China is in a bear market, the US is in zirp mode for eternity (see Japan), and the eurozone is a bundle of laughs.

We are still in a solvency crisis no matter how you divvy up the pie. Until someone in a place of authority acknowledges it, expect more vol and a calamity of affairs.

Noe of this should be of any surprise.

Benj,

That's "the pot calling the KETTLE black". Just kidding..

You are so correct about our own problems with government spending. However keep in mind that as much as our government spends, it is still dwarfed by private GDP. Also, we have a dynamic consumer economy that China does not have (yet...I hope its coming). It provides a much more balanced economy and thus can weather the economic storms better.

Just my cheap opinion. China still has a lot going for it, but it is still a young, developing economy.

John-

I am fascinated by China, as you can probably tell. I am saddened by their inability to free up their country, in terms of speech and politcal dissent, and that does not bode well. They seem to be freeing up parts of their economy, with much success. I believe that free enterprise and democracy are the best ways to make a good society.

China is failing the test so far.

But, as an economy, they may continue to boom for generations, and I think they will.

BTW, nothing I write should be construed to mean I have anything but admiration for the individuals in our armed services.

I am only pointing out about 5 percent of our GDP (military, VA, homeland security) is poured into a black hole, economically speaking, a drag they do not have in China.

Benj,

I share your fascination with China. They have come a long long way in a relatively short time (measuring from the days of Mao) and are evolving nicely. I think you are correct in your estimation of their potential. All asians are highly industrious people and given a decent chance will prosper through hard work, determination, and strong family values. Asia as an investment theme is an exciting long term vision that will create many fortunes for those willing to ride what I call 'the wooly beast' of those markets.

John.

Ditto again.

I guess you gotta think in 10- and 20-year chunks.

Well, making predictions is hard especially about the future.

BTW, BP yielding well more than 7 percent now. You get paid to wait, and they might be getting that blowout fixed.

Jeff: Re China. I'm not a China expert, but as a contrarian I'm impressed by the number of people out there calling for a collapse in the Chinese housing market. If there is an investor alive in the world who has not heard of the Chinese housing bubble I would be surprised.

Whether the bubble pops or not, my sense is that the Chinese economy is dynamic enough (9% average annual growth for the past 16 years!) to absorb a big slowdown in construction without seriously impacting the rest of the world.

The Chinese economy is much less leveraged than ours, and they suffer not at all from the complicated web of MBS and derivatives that we had. Their finances are relatively straightforward, and the central bank has gigantic reserves. Releasing just a fraction of those reserves, should the economy begin to shrink, would virtually assure a big increase in foreign demand for US goods, services, and assets, and that could conceivably replace whatever decline in local consumption that might occur.

Post a Comment