Tuesday, January 5, 2010

Why a double-dip recession is extremely unlikely

It seems like every day I read about some economist or pundit predicting another recession, an economic slump, or another market crash. This undoubtedly sends chills up the spine of most investors, especially those who are "once burned, twice shy." The past year and a half have been so traumatic that it's only natural to worry that the future holds more nasty surprises. And for those who worry, there is no shortage of bad news. We've known for months that the unemployment rate is extremely high, that the housing market is facing another wave of foreclosure sales, that hotel occupancy rates are dismally low, that layoffs are continuing, that oil prices are rising again, that deflation threatens, that construction spending is very weak, that California is on the verge of bankruptcy, that the federal deficit is gargantuan, etc.

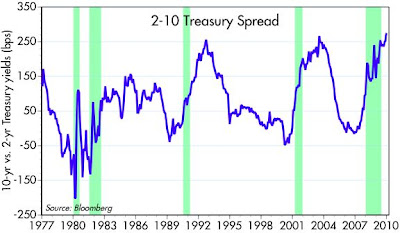

Fortunately, there is some very good news out there that doesn't get much air time. These two charts contain extremely valuable information about the future of the economy that is supplied in real-time, courtesy of the highly liquid U.S. bond market.

The top chart is the spread between the yield on 2- and 10-year Treasury bonds. When the spread is high, the yield curve is very steep, and a steep yield curve is a classic sign of easy money. When the spread is low or negative, the yield curve is flat or inverted, and that is a classic sign of very tight money. All of the post-war recessions in the U.S. have been preceded by one or more years of very tight monetary policy, and an inverted yield curve. All of the post-war recoveries from recessions have been accompanied by easy money, and a steep yield curve. Since the curve is steeper now than it has ever been, we can assume that monetary policy has never been so accommodative, and the likelihood of recovery has never been so high.

The second chart plots the spread on 5-year swaps. (See here for a basic primer on swap spreads.) This spread tells us a lot about how liquid the market is (low spreads = high liquidity), how risk-averse the market is (low spreads = low risk aversion), and what the generic risk of AA credit defaults is (low spreads = low default risk). Swap spreads have had an uncanny ability to foresee the economic health of the economy. They tend to rise well in advance of recessions, and they tend to decline well in advance of recoveries. (I first began forecasting an end to the recession in late 2008 because of the huge drop in swap spreads.) With swap spreads today trading at very low levels, the market is telling us that credit risk is very low, economic stress is very low, risk-aversion is very low, and default risk is very low. You couldn't ask for anything better.

Taken together, these two charts send a powerful and very reassuring message: the economic fundamentals have improved dramatically, and augur strongly for recovery.

Subscribe to:

Post Comments (Atom)

24 comments:

From your lips to G-d's ears.

Scott,

What exactly is the definition of a "double-dip" recession? Assume we have positive growth in the 4th quarter and thus we technically move out of recession having had two quarters of positive growth. Would we then have to have negative growth in the 1st quarter of this year or could it happen sometime in late 2010 to qualify? I've just never heard of a double dip in history unless you consider the depression of '29-'33 and then '37-'38 as double dip or the recession of '79-80 and '81-'82 as qualifying. I'd also like your take on Paul Krugman's article yesterday about facing a repeat of 1937 if we don't have another stimulus.

I doubt there is an official definition of what a "double-dip" recession is. But here's my guess: it would be similar to what happened in 1980-82, when we had two back-to-back recessions in a short period. In today's situation, where the recession apparently ended last June or July, a double-dip would involve at least one or two quarters of negative growth sometime this year or early next year.

Paul Krugman hardly warrants commentary these days, having discredited himself as a serious economist many times over the past several years. He went on record as saying that last year's stimulus was far too small. So he is forced to forecast something awful this year since Congress failed to up the stimulus ante.

That they do, that they do...

"Yield curve" arguments are very interesting. If you make a simple historical study about how yield curve flattened in observable history you will see that in ALL CASES without exception yield curve flattened via long-end and NOT via short-end as you suggest here. This is not to mention that central bank is very much in control of at least short-end rates and as we all know long-end as well. So how can you claim any outcome on this foundation?

I understand your desire to promote a no-double-dip argument but it is irrelevant. Double-dip depends solely on the government and 2nd stimulus. But then why should it matter if you are for capitalism? I would rather save pixels and spend time in a more productive way

Agree...an inverted yield has been

a good predictor of recessions....

as an aside the 2009 average of the ISM new orders minus inventories came in at 14.52. This is the highest annual number since 1994.

Does it concern you that the leading economic indicators (ex the stock market, which could turn at any moment) are in negative territory (also a very good predictor of recessions).

Krugman: American Economy Will Not Recover for a Long Time

da Washington's Blog di George Washington

Last week, Pimco's CEO said that he doesn't think we'll have a v-shaped recovery, and that economists, advisors and managers who have been counting on a v-shaped recovery are ignoring the economic fundamentals in our economy.

Now, Paul Krugman is agreeing:

Plunging prices of houses and CDOs ... don’t produce any corresponding macroeconomic silver lining. ... This suggests that we’re unlikely to see a phoenix-like recovery from the current slump. How long should recovery be expected to take?

Well, there aren’t many useful historical models. But the example that comes closest to the situation facing the United States today is that of Japan after its late-80s bubble burst, leaving serious debt problems behind. And a maximum-likelihood estimate of how long it will take to recover, based on the Japanese example, is ... forever. OK, strictly speaking it’s 18 years, since that’s how long it has been since the Japanese bubble burst, and Japan has never really escaped from its deflationary trap.

This line of thought explains why I’m skeptical about the optimism that’s widespread right now about recovery prospects. The main argument behind this optimism seems to be that in the past, big downturns in the world’s major economies have been followed by fast recoveries. But past downturns had very different causes, and there’s no good reason to regard them as good precedents

Игры рынка: Either you are miscommunicating or you have not done the research. Virtually every yield curve flattening has been driven mainly by a rise in short-term rates. Some have also seen falling long-term rates, but most of the action is always on the short end. This is a classic pattern that has been repeated many times.

The steepness of today's yield curve is in turn driven by the market's expectation that the Fed will be raising short-term rates significantly in coming years.

I don't see a second stimulus as helping the economy at all. I think government stimulus that fails to rely on reductions in marginal tax rates is almost always counterproductive.

Orange: I am not aware of leading indicators being in negative territory. Can you list some?

HOW ABOUT A SINGLE DIP DEPRESSION GUARANTEED?

Unless you maintain the belief that government has unlimited access to a printing press, than our current Obush continually growing deficit against declining tax receipts is simply unsustainable.....at some point extend and pretend must come to an end.....right?

But if you do belive in the magical printing press, than why do we pay taxes, why is there poverty, and why do we have a deficit?

Beatotrader: Recovery skeptics are the ones who haven't been paying much attention to the very significant changes on the margin in the U.S. economy over the past year. I have been highlight those for a long time, and the list is long: tighter credit and swap spreads, lower implied volatility, a big deceleration in weekly claims, rising commodity prices, etc.

Housing prices on average have been rising since March. The prices of asset-backed and commercial mortgage-backed securities have been rising for the past six months. The securities backing many CDOs have thus been rising. The news is getting better, but guys like Krugman are still fighting the last war.

alstry: The Fed kept the banking system from failing by supplying massive amounts of reserves to the system. That is not the same as printing money. Printing money can't create growth. But proper actions on the monetary front can avoid catastrophic failure in the banking system, and that is a precondition for a recovery.

Yes, at some point the federal deficit has to be brought under control. It may take an overthrow of Democratic control of Congress to do it, but it's not impossible.

This your last comment tells that you have no idea about how monetary system operates. But you are not alone there and can count FED being on your (wrong) side. Reserves are irrelevant for growth and are a fantasy of FED. Lending creates reserves. Ask any real and proper banker. And not the other way round like FED is dreaming.

And deficits are not a control variable but depend on private sector desire to save. Check your understanding of national accounting. Therefore the fate of any economy in this crisis depends on public deficits. As soon as they stop be sure to get 2nd, 3rd and so on dips. Krugman gets many things wrong but he is dang right on this one. So it is you who is fighting the last war. And you can throw out both houses of Congress because there are absolutely useless and even worse in doing anything good for american and global society.

Scott,

The problem now is the economy has become dependent on about $6.5 Trillion dollars of collective government spend......as tax receipts to government have evaporated, the deficits at ALL levels of government, have exploded.

Now cities, counties and states are facing unprecedented budget shortfalls and confront massive structural issues. Here is an exerpt from one facing Illinois:

This money is supposed to fund projects like school buses, special education, reading programs and early childhood development. But the money's not coming, instead getting added bill by bill to an already $4.5 billion IOU the state has for services from schools to homeless shelters.

But the same state that's no longer paying for these programs legally requires them.

Unlike the usual budget bellyaching when political pressure can make money appear, this time is different, said state Rep. Linda Chapa LaVia, D-Aurora. There is no money. "This is not a false alarm. This is not someone pulling a fire drill. This is a fire," Chapa LaVia said.

http://www.suburbanchicagonews.com/beaconnews/news/1971602,2_1_AU04_STATEMONEY_S1-100104.article

Since that past solution was basically borrow more and spend....won't cutting spending have an immediate braking effect to the economy as there will be no offsetting tax reduction to the reduced spending?

Now that we are facing a $2 trillion dollar and growin deficit, there simply seems to be no way to cover such a massive amount, twice the federal tax receipts, without dramatically slowing the economy.

Based on recent calculations, over 50% of WalMarts revenues comes simply from government sources such as food stamps, unemployment, welfare, government employees, and medicare and medicaid.

Wouldn't any cuts to those programs have a material impact on WalMart's revenues and a significant effect on GDP?

alstry, tax receipts do not fund budget spending. It is a fiction which is programmed into collective minds of people by neo-liberals. Government does not need any income to run any spending. Even more, the idea that government has to "finance" its deficits by issuing debt is ridiculous in the fiat money system. We are not in the gold standard and there is no need to debt-finance deficits. Government can simply run deficits because government is THE issuer of money. Full point here. It is issuing bonds to keep short term rates from falling to zero and this is the whole idea of the so-called "monetary" policy. You need to understand that the natural rate of interest is zero as long as private sector wants to save. Monetary policy prevents this from happening in order to bring "market" interest rate in line with target interest rate.

Scott,

Is Игры рынка correct on this....if so it could have incredible implications. For example, if government can simply create money, and give it to whoever it chooses......

By bailing out the banks, than one could argue under the Equal Protection Clause of the Constitution, that the people/businesses should also be able to get interest free loans to pay off their bank debt.

If we bailed out the citizens, we would also be baling out the bank debt....do you think this could be in the works and that is why spreads are contracting?

Игры рынка's assertions are beyond my comprehension.

it is not me who is correct on this but basic principles of national accounting. The same principles that are rejected by neo-liberals. Read: all those smart people arguing for earlier than later return to budget proficits. Economy with budget proficit can be sustainable only and only if it runs sufficiently enough positive net export position. This is as simple as national accounting. What happens when private sector run big deficits we all know. But again this topic is (deliberately/completely) ignored by mainstream economists.

If you want to know more about it google for MMT - modern monetary theory

Is it sufficient to say that tax receipts do not fund anything but rather disappear on the tax-collecting account of the government at the central bank? And when government needs to spend money it simply credits accounts of commercial banks? Noone in the treasury (banks for the same sake) asks where they have enough tax receipts or reserves/deposits to spend/lend money. The difference between the two though is that the latter has to balance its accounts by the day end while the former can run overnight deficits without any issues and forever. The idea of "debt-financing" is a self-imposed constraint left from gold standard because government is the ultimate and monopolistic issuer of money in the fiat money system with flexible exchange rates

what do you make of this mr grannis from the cleveland fed re the steepness of the yield curve and its predictive ability for recovery?:

Of course, it might not be advisable to take these number quite so literally, for two reasons. (Not even counting Paul Krugman’s concerns.) First, this probability is itself subject to error, as is the case with all statistical estimates. Second, other researchers have postulated that the underlying determinants of the yield spread today are materially different from the determinants that generated yield spreads during prior decades. Differences could arise from changes in international capital flows and inflation expectations, for example. The bottom line is that yield curves contain important information for business cycle analysis, but, like other indicators, should be interpreted with caution.

septizoniom: I'm always wary of arguments that say "this time it's different." To be sure, no two recoveries are alike, and neither are recessions. But the yield curve is the yield curve. I've been working in the bond market for more than two decades, and I can't find any evidence to suggest that things are being distorted. The yield curve is largely driven by mathematics and expectations of where the Fed funds rate will be in the future. Those expectations and the breakeven inflation rates that fall out of the combination of Treasury and TIPS yields all tie together. MBS and corporate bonds trade at spread over the Treasury yield curve that has been behaving in a rational manner.

The components of LEI trending down recently (last 6 mos) are money supply and consumer expectations. On a y/y basis, you have manufacturers orders (consumer goods/materials & nondefense capital goods) down, along with building permits. I believe the financial indicators (stock market & bond yields) are the strongest weights pushing the LEI index upwards and indicating a strong recovery, while the non-financial indicators paint a less clear picture I think...

Orange: The Leading Economic Indicators on average have increased hugely since March: from 98 to 105. They are up 6% year over year through November. Building permits are up (albeit modestly) from their April lows and new orders for manufactured goods are also up modestly. Consumer expectations in November were way up from their June lows. The average workweek is well above its March lows. In short, I don't think there is any way you can spin the leading index numbers in a negative fashion. True, the non-financial numbers are a lot less strong than the financial numbers, but virtually everything is better. And wasn't this past recession all about the collapse of the financial sector? A strong financial recovery is essential to an economic recovery.

Post a Comment