Tuesday, December 1, 2009

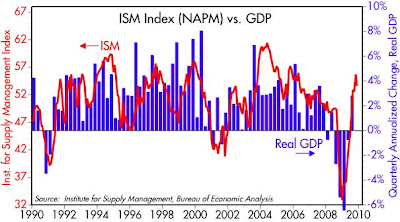

ISM index another V-sign

Although the November reading was a bit lower than October's, the ISM index is still quite consistent with the 3-4% real GDP growth I've been calling for quite many months. This is yet another indicator that we are in a V-shaped recovery, even though 3-4% growth isn't all that strong given how far the economy slumped during the recession. The market continues to be very nervous about growth going forward, but I see no sign of deterioration.

Subscribe to:

Post Comments (Atom)

3 comments:

Scott,

There seem to be more new cars in my neighborhood....but the AP doesn't seem to agree with the V:

DETROIT (AP) -- U.S. auto sales struggled to gain ground in November and big improvements aren't expected until people stop worrying about losing their jobs.

Sales were flat compared to last November, according to Autodata Corp. Even higher incentives couldn't push the needle much beyond the dismal lows seen a year ago, when a credit freeze and the financial meltdown kept car buyers at home.

"This is yet another indicator that we are in a V-shaped recovery, even though 3-4% growth isn't all that strong given how far the economy slumped during the recession."

That seems contradictory to me. Either we're in a V-shaped (strong) recovery or we're not. Right?

I suppose it depends on what your definition of "V-shaped recovery" is. I take it to mean a clear reversal of the path of the economy, from decline to growth. That contrasts to the U-shaped recovery that most seem to be calling for, where growth is meager and suffers setbacks along the way. Then there is the W-shaped recovery, where we have a "double-dip" recession after a brief period of growth.

Post a Comment